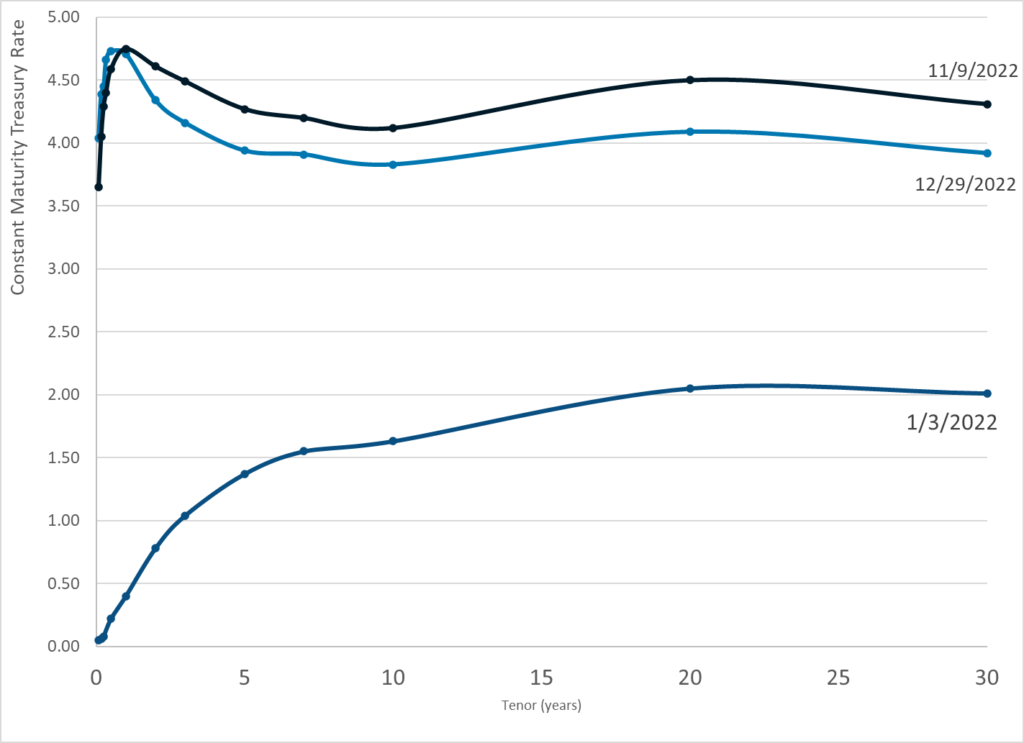

Graphic:

Publication Date: 29 Dec 2022

Publication Site: Treasury Dept

All about risk

Graphic:

Publication Date: 29 Dec 2022

Publication Site: Treasury Dept

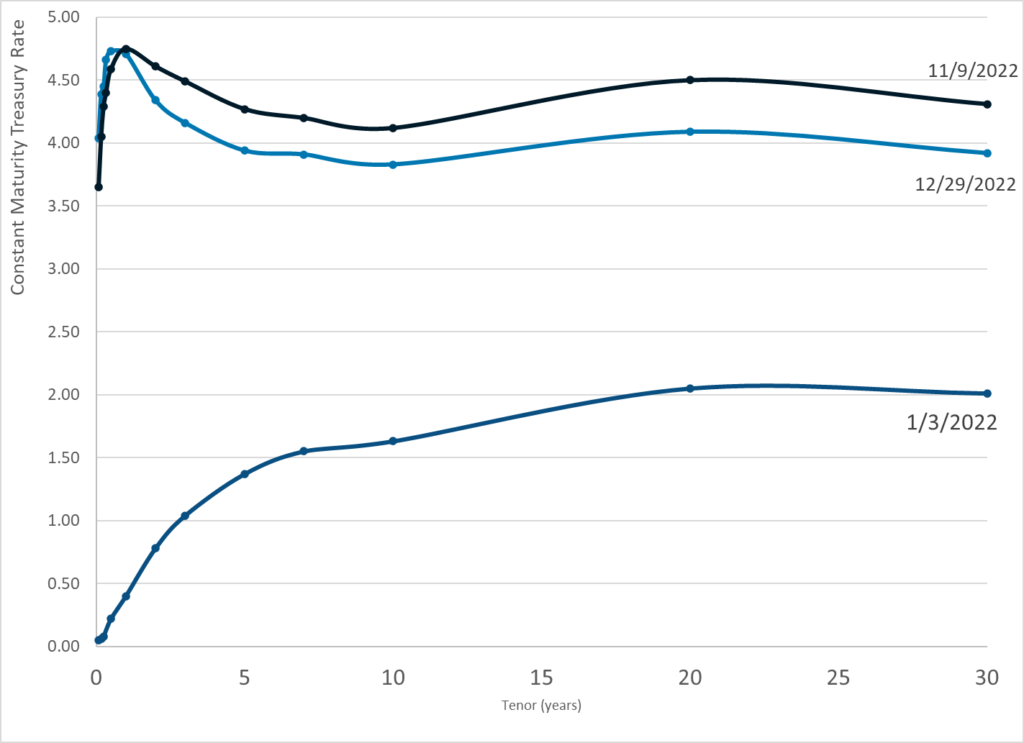

Graphic:

Excerpt:

Every year, thousands of claimants like Heard find themselves blocked at this crucial last step in the arduous process of applying for disability benefits, thanks to labor market data that was last updated 45 years ago.

The jobs are spelled out in an exhaustive publication known as the Dictionary of Occupational Titles. The vast majority of the 12,700 entries were last updated in 1977. The Department of Labor, which originally compiled the index, abandoned it 31 years ago in a sign of the economy’s shift from blue-collar manufacturing to information and services.

Social Security, though, still relies on it at the final stage when a claim is reviewed. The government, using strict vocational rules, assesses someone’s capacity to work and if jobs exist “in significant numbers” that they could still do. The dictionary remains the backbone of a $200 billion disability system that provides benefits to 15 million people.

It lists 137 unskilled, sedentary jobs — jobs that most closely match the skills and limitations of those who apply for disability benefits. But in reality, most of these occupations were offshored, outsourced, and shifted to skilled work decades ago. Many have disappeared altogether.

Author(s): Lisa Rein

Publication Date: 27 Dec 2022

Publication Site: Washington Post

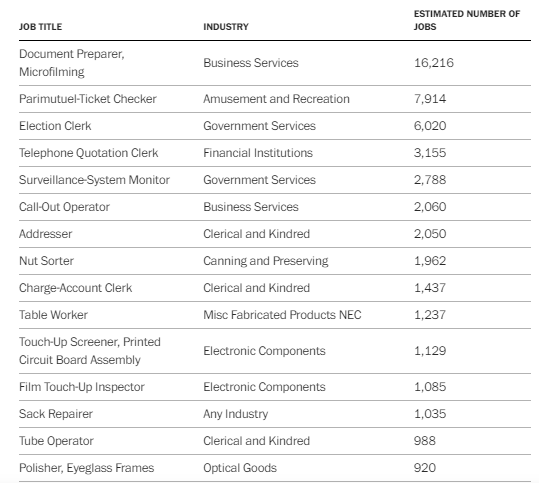

Link: https://cepr.org/voxeu/columns/cultural-stereotypes-multinational-banks

Graphic:

Excerpt:

Previous studies (e.g. Guiso et al. 2006, 2009) have used aggregate survey data from Eurobarometer to show that the volume of flows between pairs of countries is importantly affected by bilateral trust. A limitation of such country-level evidence is that average levels of trust are almost certainly correlated with unobserved characteristics of country pairs. To rule out confounding factors, we therefore develop a bank-specific measure of trust.

For this purpose, we model banks as hierarchies (as illustrated by Figure 1). Strategic decisions such as whether or not a bank should invest in a country are generally taken at bank headquarters. Portfolio managers working in the headquarters country or elsewhere are then responsible for implementing those decisions. Because we are concerned with investment decisions undertaken by headquarters, we focus our analysis on the extensive margin of sovereign exposures – whether or not a bank invests in the bonds of a country, as opposed to exactly how much it invests.

Given this framework, cultural stereotypes in subsidiaries can shape the soft information that subordinates transmit up the hierarchy to headquarters, where the broad parameters guiding portfolio investment decisions are set. They can affect how that soft information is received by directors, because the latter share the same stereotypes, reflecting the extent to which banks hire and promote internally across borders, such that the composition of bank boards and officers reflects the geography of the bank’s branch network. We provide empirical support for this framework by showing that multinational branch networks help predict the national composition of high-level managerial teams at bank headquarters.

Author(s): Orkun Saka, Barry Eichengreen

Publication Date: 23 Dec 2022

Publication Site: VoxEU

Graphic:

Excerpt:

Philadelphia has recorded more than 500 homicides this year as the city’s gun violence crisis continues to rise dramatically.

The city has only ever recorded this large loss of human life twice in its history, matching the record of 500 deaths during the crack cocaine epidemic in 1990.

Since Tuesday, the total has risen to 502, a 7% reduction from 2021, per the city’s dashboard .

The total in 2022 only pales slightly in comparison to last year’s record-breaking total. In 2021, Philadelphia recorded 562 homicides, with 501 of the deaths due to gun violence alone, per Axios.

Homicide victims in Philadelphia for 2022 spanned across all ages, from as young as 9 to as old as 78. The 500th homicide was a man, 35, shot in the city’s Ogontz section on Sunday afternoon, and he died hours later from his injuries, police confirmed to multiple outlets.

The demographics surrounding the homicides reflect the extent to which gun violence plagues the city. Of the 500 homicides, 30 victims were juveniles, with seven being 14 years old or younger. According to police, 84% of people killed or injured in shootings this year were black.

Author(s): Rachel Schilke

Publication Date: 21 Dec 2022

Publication Site: Washington Examiner

Link: https://thespectator.com/topic/great-anti-esg-backlash/

Excerpt:

The ESG story starts in 2004, when the three-letter acronym appeared in a UN report arguing for environmental, social and governance considerations to be hardwired into financial systems. Since then the term has been on a long but rapidly accelerating journey from NGO-world obscurity into the financial mainstream and subsequently the political limelight, prompting strong reactions from a chorus of prominent figures. Elon Musk calls it “a scam.” Peter Thiel says it’s a “hate factory.” Warren Buffett describes it as “asinine.”

Unsurprisingly for a piece of UN jargon that has become part of the political cut and thrust, “ESG” is often used to mean different things. Properly defined, it refers to an investment strategy that factors in environmental, social and corporate governance considerations. That might mean not investing in oil and gas companies, for example. Or it might mean only investing in companies that have a stated commitment to diversity, equity and inclusion. As it has grown in infamy, the acronym has also come to refer not only to investment products billed as ESG, but to other practices through which investment firms use their customers’ money to push political ends. For example, your pension may not be invested in an ESG fund, but the manager of that money may still be using stocks owned on your behalf to pursue political goals. A third, even broader, meaning is as a synonym for woke capitalism: a broad catch-all for big business’s embrace of bien pensant opinion, particularly on the environment.

….

This win-win rhetoric has been the rallying cry of the ESG crowd on what has looked like an unstoppable march. Make money and do good: who could possibly object? Millions have bought into this seductive logic. Globally, more than $35 trillion of assets are invested according to ESG considerations, an increase of more than 50 percent since 2016. From 2020 to 2022, the size of ESG assets in the United States grew by 40 percent. According to an analysis by the asset manager Pimco, ESG was mentioned on just 1 percent of earnings calls between 2005 and 2018. By 2021, that figure had risen to 20 percent.

….

If the anti-ESG movement has the wind in its sails, that’s in large part thanks to last year’s tumultuous geopolitical events and economic trends, foremost among them the war in Ukraine. The Russian invasion has transformed the ESG debate in two ways.

First, it has underscored the ethical dilemmas ESG champions would rather ignore. For example, many ESG funds rule out investment in weapons manufacturers. Is it really ethical to deny capital to the firms producing the material Ukraine needs to survive? Indeed, the socially responsible position is arguably the exact opposite.

Second, it has transformed the energy conversation in a way that has made many more of us acutely aware of the importance of cheap, abundant and reliable energy — and conscious that it cannot be taken for granted. In other words, each of us is a little more like Riley Moore’s West Virginia constituents, who don’t have much time for net-zero grandstanding given that they will be the ones who pay a heavy price for someone else’s pursuit of feel-good goals. What has always been true is becoming clearer: a financial system that starves domestic energy producers of capital not only hurts those whose savings are being used to pursue political ends, but ends up as a de facto tax on US consumers in the form of higher energy costs. ESG, says Goldman Sachs’s Michele Della Vigna, “creates affordability problems which could generate political backlash. That is the risk — political instability and the consumer effectively suffering from this cost inflation.”

Author(s): Oliver Wiseman

Publication Date: 22 Dec 2022

Publication Site: The Spectator

Graphic:

Publication Date: 27 Dec 2022

Publication Site: Treasury Department

Graphic:

Publication Date: 23 Dec 2022

Publication Site: Treasury Dept

Excerpt:

A group of emergency physicians and consumer advocates in multiple states are pushing for stiffer enforcement of decades-old statutes that prohibit the ownership of medical practices by corporations not owned by licensed doctors.

Thirty-three states plus the District of Columbia have rules on their books against the so-called corporate practice of medicine. But over the years, critics say, companies have successfully sidestepped bans on owning medical practices by buying or establishing local staffing groups that are nominally owned by doctors and restricting the physicians’ authority so they have no direct control.

These laws and regulations, which started appearing nearly a century ago, were meant to fight the commercialization of medicine, maintain the independence and authority of physicians, and prioritize the doctor-patient relationship over the interests of investors and shareholders.

Those campaigning for stiffer enforcement of the laws say that physician-staffing firms owned by private equity investors are the most egregious offenders. Private equity-backed staffing companies manage a quarter of the nation’s emergency rooms, according to a Raleigh, North Carolina-based doctor who runs a job site for ER physicians. The two largest are Nashville, Tennessee-based Envision Healthcare, owned by investment giant KKR & Co., and Knoxville, Tennessee-based TeamHealth, owned by Blackstone.

Author(s): Bernard J. Wolfson

Publication Date: 22 Dec 2022

Publication Site: Kaiser Health News, California HEalthline

Graphic:

Publication Date: 21 Dec 2022

Publication Site: Treasury Department

Link: https://khn.org/news/article/coroners-medical-examiners-doctor-or-not-death-investigations/

Excerpt:

When a group of physicians gathered in Washington state for an annual meeting, one made a startling revelation: If you ever want to know when, how — and where — to kill someone, I can tell you, and you’ll get away with it. No problem.

That’s because the expertise and availability of coroners, who determine cause of death in criminal and unexplained cases, vary widely across Washington, as they do in many other parts of the country.

….

Each state has its own laws governing the investigation of violent and unexplained deaths, and most delegate the task to cities, counties, and regional districts. The job can be held by an elected coroner as young as 18 or a highly trained physician appointed as medical examiner. Some death investigators work for elected sheriffs who try to avoid controversy or owe political favors. Others own funeral homes and direct bodies to their private businesses.

Overall, it’s a disjointed and chronically underfunded system — with more than 2,000 offices across the country that determine the cause of death in about 600,000 cases a year.

…..

Belcher’s crusade succeeded in changing some aspects of Washington’s coroner system when state lawmakers approved a new law last year, but efforts to reform death investigations in California, Georgia, and Illinois have recently failed.

Rulings on causes of death are often not cut-and-dried and can be controversial, especially in police-involved deaths such as the 2020 killing of George Floyd. In that case, Minnesota’s Hennepin County medical examiner ruled Floyd’s death a homicide but indicated a heart condition and the presence of fentanyl in his system may have been factors. Pathologists hired by Floyd’s family said he died from lack of oxygen when a police officer kneeled on his neck and back.

….

In 2009, the National Research Council recommended that states replace coroners with medical examiners, describing a system “in need of significant improvement.”

Massachusetts was the first state to replace coroners with medical examiners statewide in 1877. As of 2019, 22 states and the District of Columbia had only medical examiners, 14 states had only coroners, and 14 had a mix, according to the Centers for Disease Control and Prevention.

Author(s): Samantha Young

Publication Date: 20 Dec 2022

Publication Site: Kaiser Health News

Excerpt:

Hedge fund billionaire Ken Griffin, who founded and helms trading powerhouse Citadel, has sued the Internal Revenue Service and Treasury Department for alleged negligence in maintaining safeguards for confidential tax returns after a bombshell report last year cited a trove of IRS data in a series of articles detailing the incomes and taxes paid by some of the world’s richest people.

KEY FACTS

In a federal suit filed with the Southern District of Florida, Griffin alleged the IRS has “willfully and intentionally” failed to establish adequate safeguards to protect confidential tax return information after nonprofit news outlet ProPublica published an article citing the data in June 2021 and then followed up with several pieces, including some targeting Griffin’s political lobbying.

The suit, first reported by Wall Street Journal, claims the disclosure of Griffin’s tax return information to ProPublica was not “requested by the taxpayer,” and as a result entitles the billionaire to punitive damages totaling at least $1,000 per unlawful disclosure and attorneys’ fees, according to a section of the tax code.

It is a felony for a federal employee to leak a tax return or information about a tax return, but the source of the data remains unknown despite some lawmakers claiming there “is little doubt” the confidential information “came from inside the IRS;” the IRS and Justice Department have stated they are investigating the leak, but no formal charges have been filed.

Author(s): Jonathan Ponciano

Publication Date: 13 Dec 2022

Publication Site: The Wealth Advisor, Forbes

Link: https://reason.com/2022/12/13/inflation-cools-to-7-1-percent-but-still-has-a-long-way-to-fall/

Excerpt:

Inflation finally slowed to a near halt in November, possibly signaling a winding down of the prices crisis that has gripped American households this year.

Prices rose just 0.1 percent on average during November, the Department of Labor reported on Tuesday morning. The year-over-year inflation rate fell as well, to 7.1 percent for the 12 months ending in November. That’s the lowest annualized rate since December 2021, and is significantly lower than the 7.8 percent annualized rate reported a month ago.

This also marks the fifth consecutive month in which the annualized inflation rate has held steady or fallen, after peaking in July at an astounding 9.0 percent.

That trend suggests that the Federal Reserve has finally gotten a collar on rising prices. The central bank’s board is expected to hike interest rates for the seventh time this year when it meets on Wednesday. That means it will continue getting more expensive to obtain a mortgage or a car loan, and credit card interest rates will continue to rise—but also that savings accounts and other interest-based investment vehicles are paying larger returns.

Author(s): Eric Boehm

Publication Date: 13 Dec 2022

Publication Site: Reason