Link: https://cepr.net/report/beware-of-private-equity-gobbling-up-life-insurance-and-annuity-companies/

Graphic:

Excerpt:

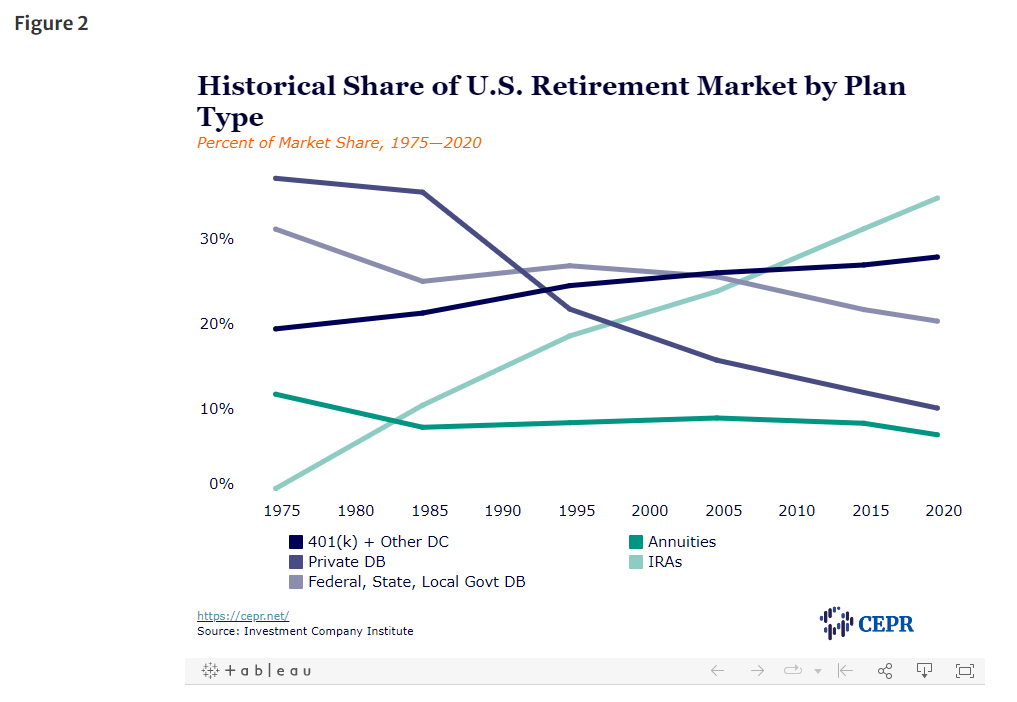

Private equity (PE) firms have had their eye on individual retirement savings since 2013 when they were first allowed to market directly to individuals. Pension funds already allocate workers’ retirement savings to PE firms, which use these assets to fund a range of risky equity and debt investments. Access to personal retirement savings, including IRAs and 401(k)s, would open up a huge new source of capital for PE.

PE firms’ first attempts to get a piece of these very sizable direct contribution assets were largely unsuccessful. More recently, however, they have turned to acquiring and/or managing life insurance and annuity assets. Some PE firms buy out life insurance and annuity companies, acquiring their assets. Others take a minority stake in a life insurance or annuity company in exchange for the right to manage all of the company’s assets. In both cases, the PE firm substantially increases assets under its management. They have also stepped-up efforts to recruit near-wealthy as well as wealthy investors, so-called retail investors, to allow PE firms to manage their assets. These activities have been a game changer for the largest PE firms. As Blackstone CEO Stephen Schwarzman put it as he lauded the firm’s third quarter 2021 performance, this quarter has been “the most consequential quarter [in history] . . . a defining moment in terms of our expansion into the vast retail and insurance markets.”1

Meanwhile, policyholders find that a PE firm now manages their retirement savings. This raises a major concern for individuals and government regulators: Given PE firms’ track record of failing to observe their duty of care as owners of Main Street companies as well as their poor fund performance in recent years,2 can they be trusted to protect the retirement savings of millions of Americans?

Author(s): EILEEN APPELBAUM

Publication Date: 13 January 2022

Publication Site: CEPR (Center for Economic and Policy Research)