Link: https://www.chicagofed.org/publications/chicago-fed-letter/2022/469

Graphic:

Excerpt:

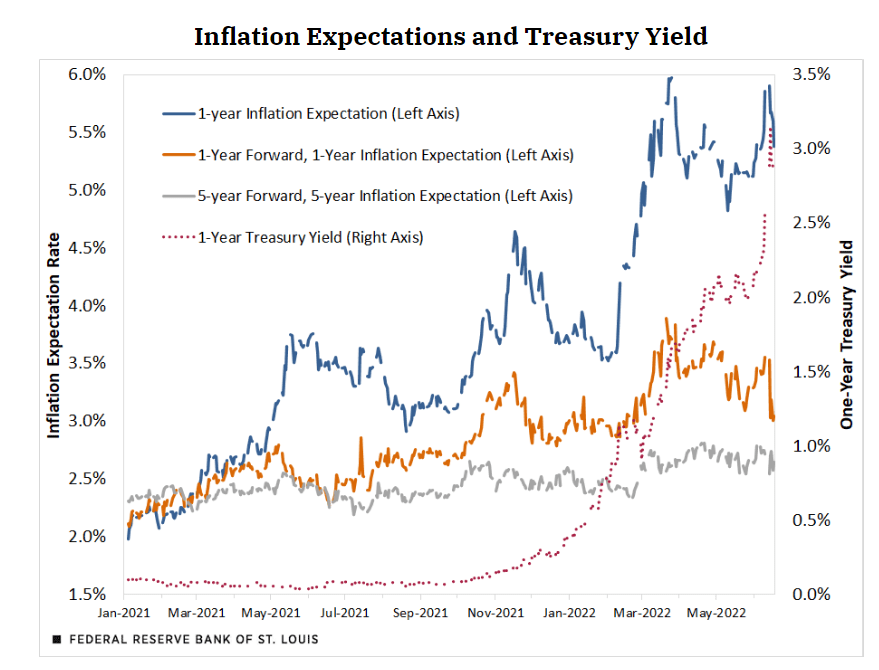

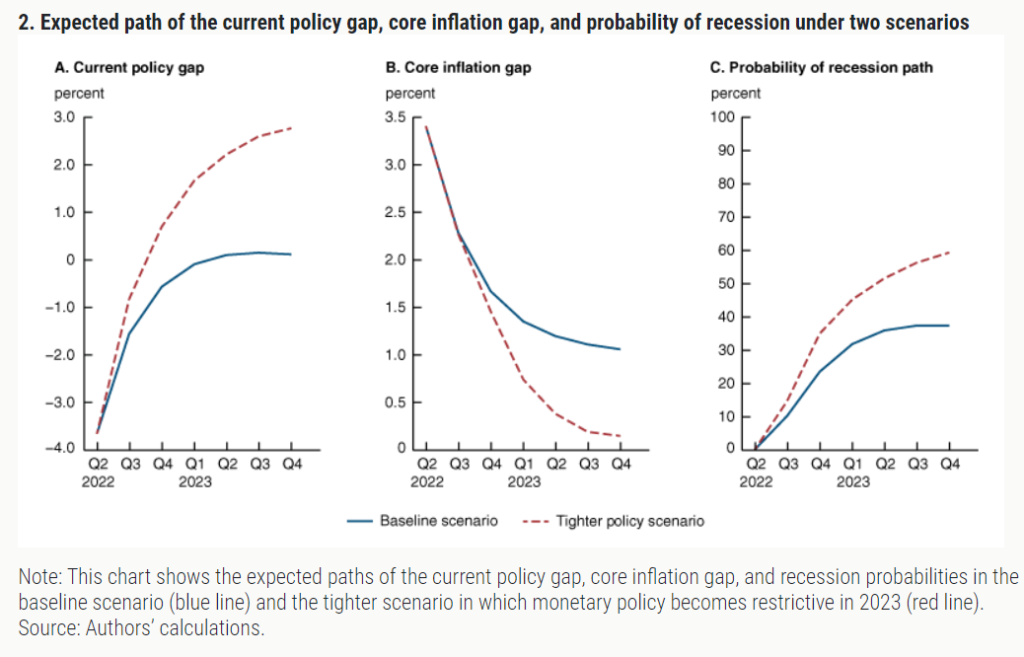

We simulate future realizations of the policy gap and the slope of inflation forecasts from the 2022:Q2 initial conditions through 2023:Q4 using the ABC model. We then evaluate the recession probability predicted by our preferred probit model for each of these simulated paths. Through this analysis, we show that future inflation outcomes and the odds of a recession depend critically on both the pace of removal of monetary policy accommodation and on how restrictive the monetary policy stance will become over the medium term. In particular, we highlight two scenarios: The first one, which we refer to as the “baseline case,” reflects the ABC model forecasts or, equivalently, the average of all simulated paths. The second one, which we label the “tighter-policy scenario,” is characterized by a faster removal of monetary policy accommodation; it is identified by the average of the simulated paths in which policy becomes restrictive by the end of 2022.11

1. Baseline case: As of early June 2022, the ABC model predicts that nominal and real yields will rise over the next six quarters, the current policy gap will narrow and become mildly restrictive in mid-2023, while core inflation will fall and remain around one percentage point above its model-implied longer-run expectations through 2023 (figure 2, blue lines in panels A and B). The expected tightening of the policy gap and a downward-sloping expected inflation path combine to increase the one-year-ahead recession probability to about 35% by 2023 (figure 2, blue line panel C). Such a level is comparable to the one estimated ahead of the 1994 monetary policy tightening cycle that was followed by a soft-landing scenario.

2. Tighter-policy scenario: In this alternative scenario, monetary policy becomes more restrictive than in the baseline case, in that the policy gap is markedly restrictive over 2023. In this case we find that core inflation declines more rapidly than under the baseline, closing the gap with its model-implied longer-run expectations almost completely by the end of 2023. By that date, in this scenario the likelihood of a recession approaches 60%, a level that, based on our historical estimates, is generally followed by a recession in our sample (figure 2, red lines).

Author(s): Andrea Ajello , Luca Benzoni , Makena Schwinn , Yannick Timmer , Francisco Vazquez-Grande

Publication Date: August 2022

Publication Site: Federal Reserve Bank of Chicago