Graphic:

Excerpt:

The goal of this paper is to equip actuaries to proactively participate in

discussions and actions related to potential racial biases in insurance

practices. This paper uses the following definition of racial bias:

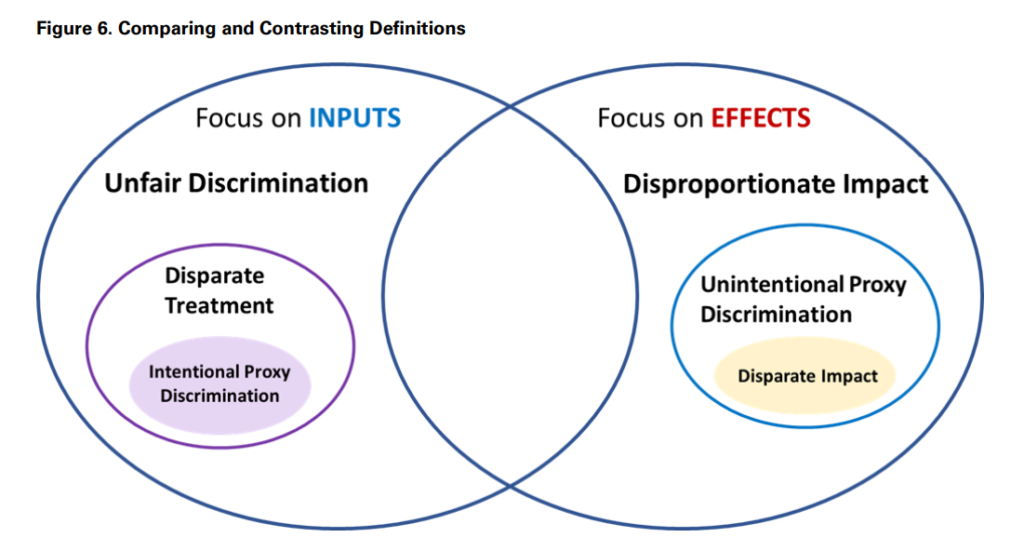

Racial bias refers to a system that is inherently skewed along racial lines.

Racial bias can be intentional or unintentional and can be present in the

inputs, design, implementation, interpretation or outcomes of any system.

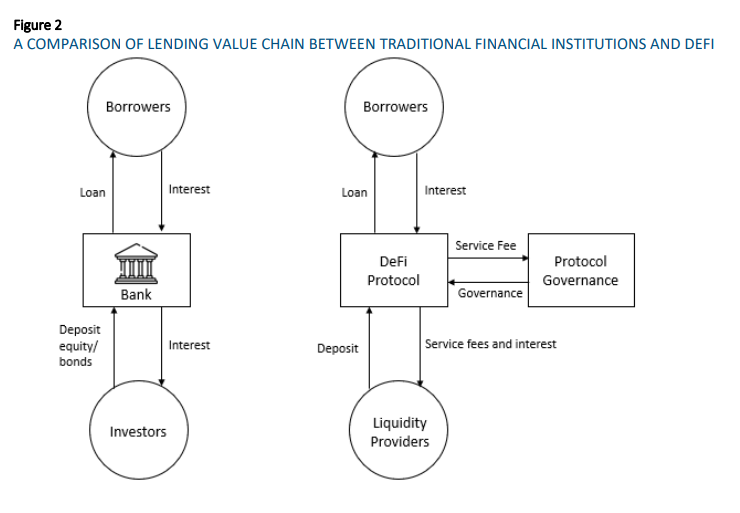

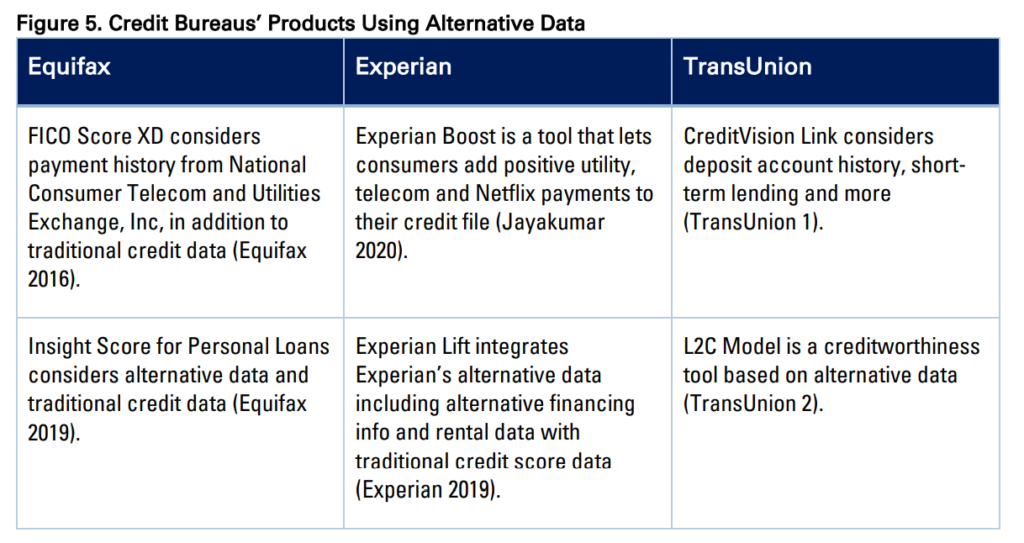

To support actuaries and the insurance industry in these efforts, this paper

examines issues of racial bias that have impacted four areas of noninsurance financial services — mortgage lending, personal lending,

commercial lending and the underlying credit-scoring systems — as well

as the solutions that have been implemented in these sectors to address

this bias. Actuaries are encouraged to combine this information on

solutions and gaps in other industries with expertise in their practice areas

to determine how, if at all, this information could be applied to identify

potential racial biases impacting insurance or other industries in which

actuaries work.

Parallels can be drawn between the issues noted here in financial services

and those being discussed within the insurance industry. While many

states have long considered race to be a protected class which cannot be

used for insurance business decisions, regulators and consumer groups

have brought forth concerns about potential racial bias implicit in existing

practices or apparent in insurance outcomes. State regulators are taking

individual actions to address potential issues through prohibition of

certain rating factors, and even some insurers are proactively calling for

the industry to move away from using information thought to be

correlated with race. However, this research suggests that government

prohibition of specific practices may not be a silver-bullet solution.

Actuaries can play a key role as the insurance industry develops

approaches to test for, measure and address potential racial bias, and

increase fairness and equality in insurance, while still maintaining riskbased pricing, company competitiveness and solvency.

Author(s): Members of the 2021 CAS Race and Insurance Research Task Force

Publication Date: March 2022

Publication Site: CAS