Link: https://www.governing.com/finance/public-pensions-new-quandary-coping-with-geopolitical-turmoil

Excerpt:

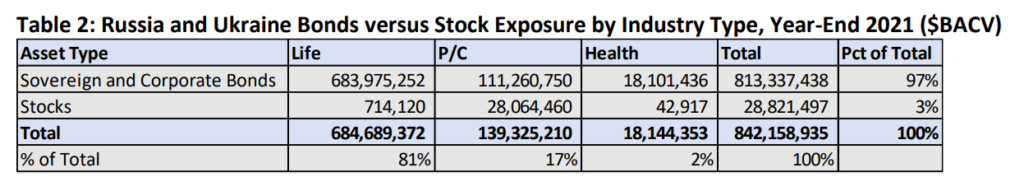

Arguably, trustees and investment teams need a serious conversation with portfolio managers who are overweight in companies and countries that could foreseeably lose favor and stock exchange value. To ground that dialog, some form of risk analysis is required. One protocol could be as primitive as routinely identifying which major corporate equity and debt holdings in a system’s portfolio have cost and revenue exposure of more than 10 or 15 percent in such potentially at-risk regimes, and prodding managers to trim down those geopolitically vulnerable positions unless there is a clearly compelling undervaluation thesis. Another sensible approach would be to require underweighting of major companies relative to a benchmark index, based on their percentages of autocrat-nation revenues.

Ultimately at a fiduciary level, if a pension fund’s total worst-case exposure to all earnings and income derived from autocratic nations is an insignificant fraction of its total portfolio, the composite risk is probably not worth losing sleep over, on purely financial grounds. But politics could still enter the theater stage for pension boards that ignore this issue.

Pension consultants and risk advisers have a new role to play in this dialog. ESG investing is now under fire, so a healthy ESG+G discussion is especially timely. If nothing else, informed advisers can help investment teams and trustees identify where their portfolios might contain a blind-side risk that hasn’t received enough attention.

Author(s): Girard Miller

Publication Date: 10 May 2022

Publication Site: Governing