Link:https://www.rstreet.org/2022/01/24/insurance-companies-heels-or-heroes/

Excerpt:

The insurance industry is far from the economy’s most-admired sector. A Forbes survey found insurance ranking low in popularity in the public eye. Three main reasons are responsible for insurers’ relatively poor rating. First is the intangible nature of the insurance product. Unlike a car one can drive home from the dealership, or a chocolate bar whose taste can be savored, purchase of an insurance policy does not lead to immediate physical gratification. To be sure, if there is no loss, one may never get a flavor of its value. Second, insurance is associated with life’s tragedies, its most physically, emotionally and financially distressing experiences—a home damaged by a storm, a car totaled, being sued, a death or dread disease, or a crippling workplace accident. Insurance payments can take away the sting with financial recovery, but loss remains painful, especially if one discovers the loss is not 100 percent covered. And third, the insurance industry has become an easy target for critics who regularly vilify it.

…..

Why do we maintain that insurance, R Street’s inaugural research program, is fundamentally exciting? Three reasons.

First, insurance is the economy’s financial first responder. When the wind blows, the earth shakes and large-class action lawsuits are decided in plaintiffs’ favor, the insurance industry pays.

….

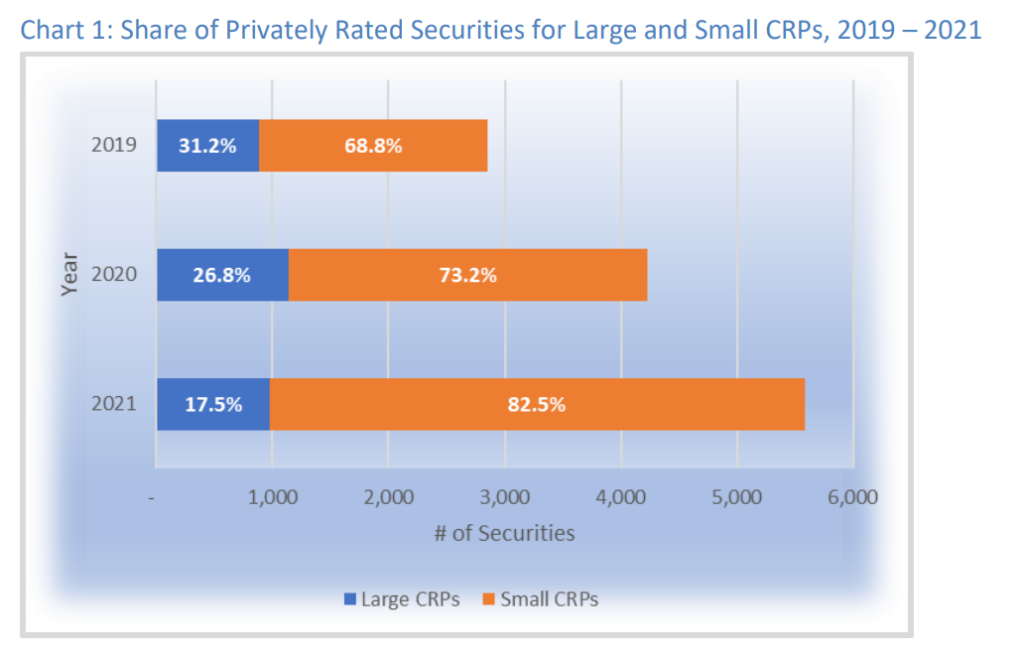

Second, insurers are significant investors in the capital markets. They provide much of the financial muscle to power the economy. Property-casualty insurers hold $1.1 trillion in bonds, and life and health insurers hold another $3.6 trillion. Collectively, insurers hold $4.7 trillion in bonds, 10 percent of the U.S. bond market of $47 trillion.

….

Third, insurance is the grease in the engine of the economy. Without clinical trials insurance, pharmaceutical companies would not take the risk of developing vaccines. Without ocean marine or inland marine insurance, ships would not sail and trucks would not take the risk to carry loads. Airplanes would not fly, people would be afraid to drive, and inventors would not create new products for fear of lawsuits.

Author(s): Jerry Theodorou

Publication Date: 22 Jan 2022

Publication Site: R Street