Link: https://netinterest.substack.com/p/the-policy-triangle

Graphic:

Excerpt:

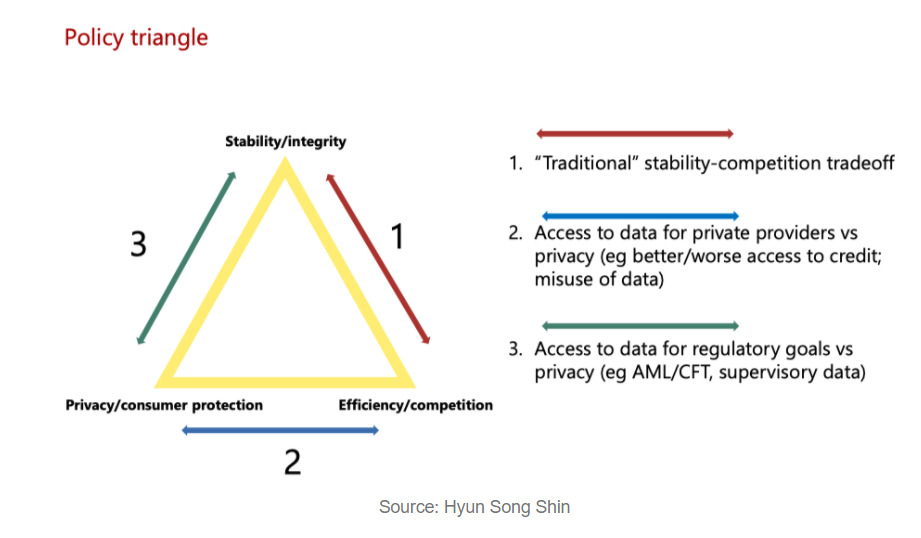

Policymakers are increasingly confronting a new problem, though: the entry of technology companies into financial services throws their trade-off framework off-kilter. There are two issues.

First, financial regulators don’t have jurisdiction over technology companies. They have jurisdiction over their financial activities but not over the companies themselves. At the entry level, this works fine. When a company wants to do payments, they need to get a payments license and when they want to do credit underwriting, they need a credit license.

Sometimes, new entrants skate round these rules. Afterpay in Australia is not regulated as a credit provider since it doesn’t impose a charge for the ability to pay; nor as a payment system since it conducts relationships bilaterally between consumers on the one hand and merchants on the other. In response to impending regulatory scrutiny, the company points out that the major card providers got away with it for 20 years. “The dominant international card payment systems…were launched in Australia in 1984 and were not subject to RBA [Reserve Bank of Australia] regulation until 2004.”

Author(s): Marc Rubinstein

Publication Date: 12 February 2021

Publication Site: Net Interest on Substack