Link: https://www.bloomberg.com/opinion/articles/2022-09-29/uk-pensions-got-margin-calls

Excerpt:

I said above that pension funds are unusually insensitive to short-term market moves: Nobody in the pension can ask for their money back for 30 years, so if the pension fund has a bad year it won’t face withdrawals and have to dump assets. Still, pension managers are sensitive to accounting. If your job is to manage a pension, you want to go to your bosses at the end of the year and say “this pension is now 5% less underfunded than it was last year.” And if you have to instead say “this pension is now 5% more underfunded than it was last year,” you are sad and maybe fired; if the pension gets too underfunded your regulator will step in. You want to avoid that.

And so the way you will approach your job is something like:

- You will try to beat your benchmark, buying stocks and higher-yielding bonds to try to grow the value of your assets.

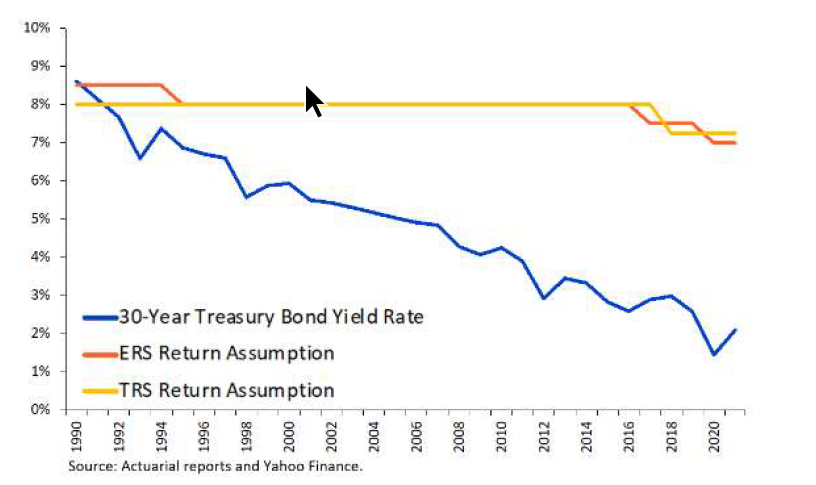

- You will hedge the risk of rates going down. If rates go down, your liabilities will rise (faster than your assets); you are short gilts. You want to do something to minimize this risk.

The way to do that hedging is basically to get really long gilts in a leveraged way. If you have £29 of assets, you might invest them like this:

- £24 in gilts,

- £5 in stocks, and

- borrow another £24 and put that in gilts too.[5] [5] No science to this number, and you’d probably do a bit less if your stocks are correlated with rates.

That way, if rates go down, the value of your portfolio goes up to match the increasing value of your liabilities. So you are hedged. You were short gilts, as an accounting matter, and you’ve solved that by borrowing money to buy more gilts. In practice, the way you have borrowed this money is probably not by actually getting a loan and buying gilts but by doing some sort of derivative (interest-rate swap, etc.) with a bank, where the bank pays you if rates go down and you pay the bank if rates go up. And you have posted some collateral with the bank, and as interest rates move up or down you post more or less collateral.

This all makes total sense, in its way. But notice that you now have borrowed short-term money to buy volatile financial assets. The thing that was so good about pension funds — their structural long-termism, the fact that you can’t have a run on a pension fund: You’ve ruined that! Now, if interest rates go up (gilts go down), your bank will call you up and say “you used our money to buy assets, and the assets went down, so you need to give us some money back.” And then you have to sell a bunch of your assets — the gilts and stocks that you own — to pay off those margin calls. Through the magic of derivatives you have transformed your safe boring long-term pension fund into a risky leveraged vehicle that could get blown up by market moves.

I know this is bad but I find something aesthetically beautiful about it. If you have a pot of money that is immune to bank runs, over time, modern finance will find a way to make it vulnerable to bank runs. That is an emergent property of modern finance. No one sits down and says “let’s make pension funds vulnerable to bank runs!” Finance, as an abstract entity, just sort of does that on its own.

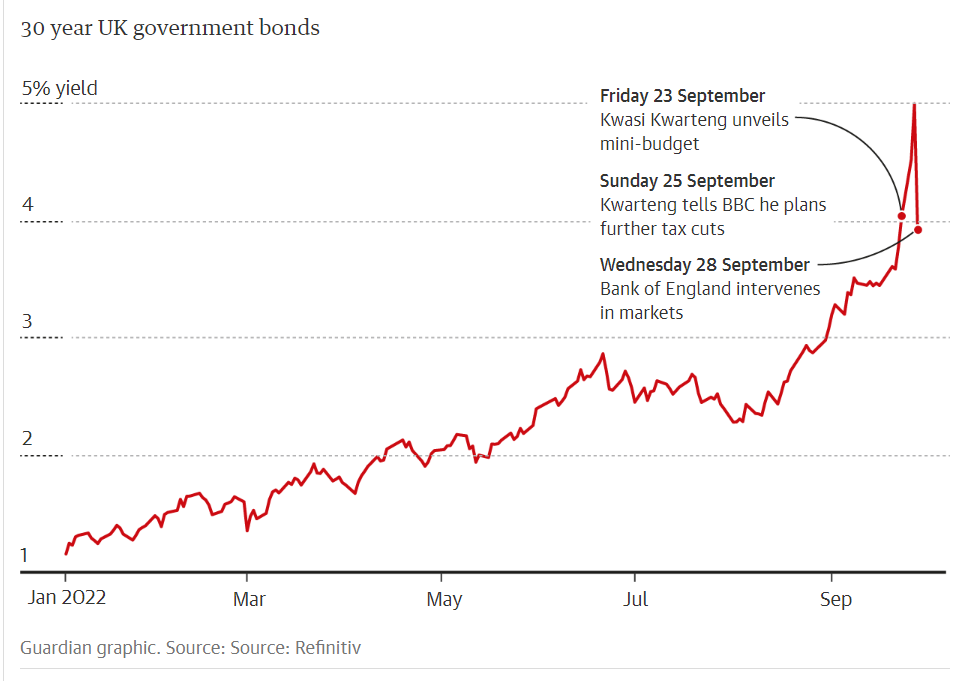

Anyway, as I said above, 30-year UK gilt rates were about 2.5% this summer. They got to nearly 5% this week, and were at about 3.9% at 9 a.m. New York time today. You can fill in the rest.

Author(s): Matt Levine

Publication Date: 29 Sept 2022

Publication Site: Bloomberg