Excerpt:

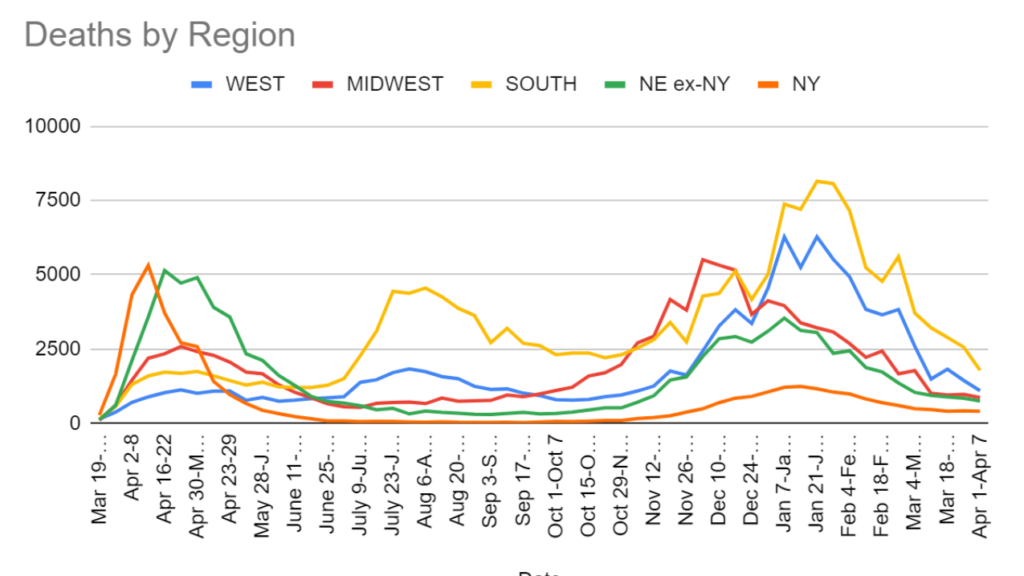

By June, most US adults get vaccinated. The shots halt the spread of SARS-CoV-2, even the more transmissible variants. And people feel safe shopping, traveling, and visiting each other, almost like they did before the pandemic.

This is the best outcome — and it isn’t completely far-fetched. Half of US adults have received at least one shot. Even with Johnson & Johnson’s vaccine paused, more than 3 million shots are being administered a day; at that rate, every adult American could receive one by late June.

Israel offers a glimpse of this future. There, a fast-paced campaign had immunized more than half of the population by mid-April. The results have been striking in the country of 9 million, with new cases falling to around 200 a day, 2% of the January peak. Starting this weekend, an outdoor mask mandate will be lifted.

Author(s): Dan Vergano

Publication Date: 21 April 2021

Publication Site: Buzzfeed News