Excerpt:

“Too few” public pension funds are addressing climate-related financial risk when it comes to proxy voting, according to a report released Jan. 23 by nonprofit organizations Sierra Club, Stand.earth and Stop the Money Pipeline.

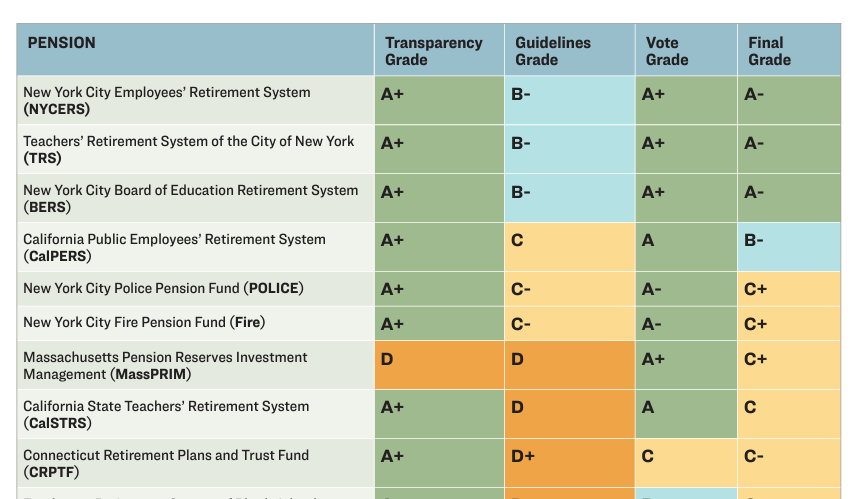

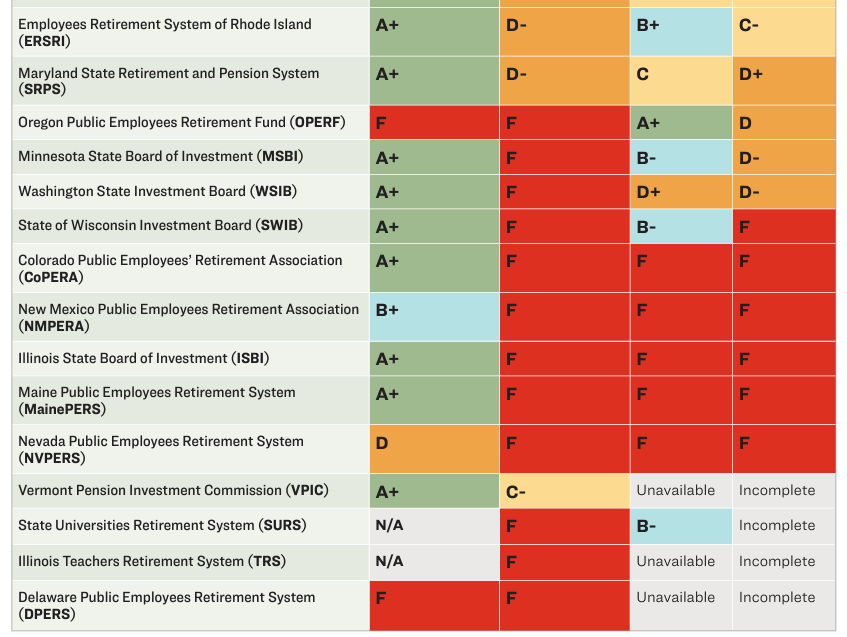

The report, “The Hidden Risk in State Pensions: Analyzing State Pensions’ Responses to the Climate Crisis in Proxy Voting,” looked at 24 public pension funds with a collective $2 trillion in assets, including the $241.7 billion New York City Retirement Systems and state pension funds in California, Colorado, Connecticut, Delaware, Illinois, Maine, Maryland, Massachusetts, Minnesota, Nevada, New Mexico, Oregon, Rhode Island, Vermont, Washington and Wisconsin.

The pension funds were graded on their proxy-voting guidelines, proxy-voting records, and data transparency.

On proxy-voting guidelines, no pension system received an A grade, but three of the five New York City pension funds covering city employees, the Board of Education and teachers, earned a B for addressing systemic risk and climate resolutions. Half of the 24 pension funds studied earned an F.

….

“The findings of this analysis are clear: Far too few state pensions are taking adequate steps to address climate-related financial risks and protect their members’ hard-earned savings, raising serious concerns about their execution of fiduciary duty,” the report’s executive summary said.

….

Amy Gray, associate director of climate finance for Stand.earth, said it is disappointing to see many funds not using proxy-voting strategies to address the financial risks of climate change. “This report is a stark reminder that pension funds can — and must — do so much more to wield their massive investor power,” Gray said in the news release.

Author(s): Hazel Bradford

Publication Date: 23 Jan 2024

Publication Site: P&I