Graphic:

Excerpt:

Amendment 1 would grant government unions unprecedented bargaining powers as a “fundamental right,” including the power to override voters and state lawmakers. Proponents are selling it as a constitutional ban on passing right-to-work laws – laws that protect employees’ rights to keep their jobs without having to pay fees to a union. Illinois is not among the 28 states that currently have right-to-work laws, so that aspect has little meaning.

The amendment does include three other provisions that together would severely weaken taxpayers’ voices in state government and make it easier for government union bosses to make unaffordable demands in collective bargaining contracts. First, virtually anyone would have a fundamental right to collective bargaining if they could be considered an employee in any context, including even prisoners. Second, bargaining would be expanded beyond just wages, hours and working conditions to include broad new subjects covering public policy decisions or how to run a businesses. Third, the amendment prevents lawmakers from ever limiting or scaling back on these rights in any way.

Even without these provisions, powerful government unions helped public sector wages grow 60% faster than the private sector in Illinois from 1998 to 2019.

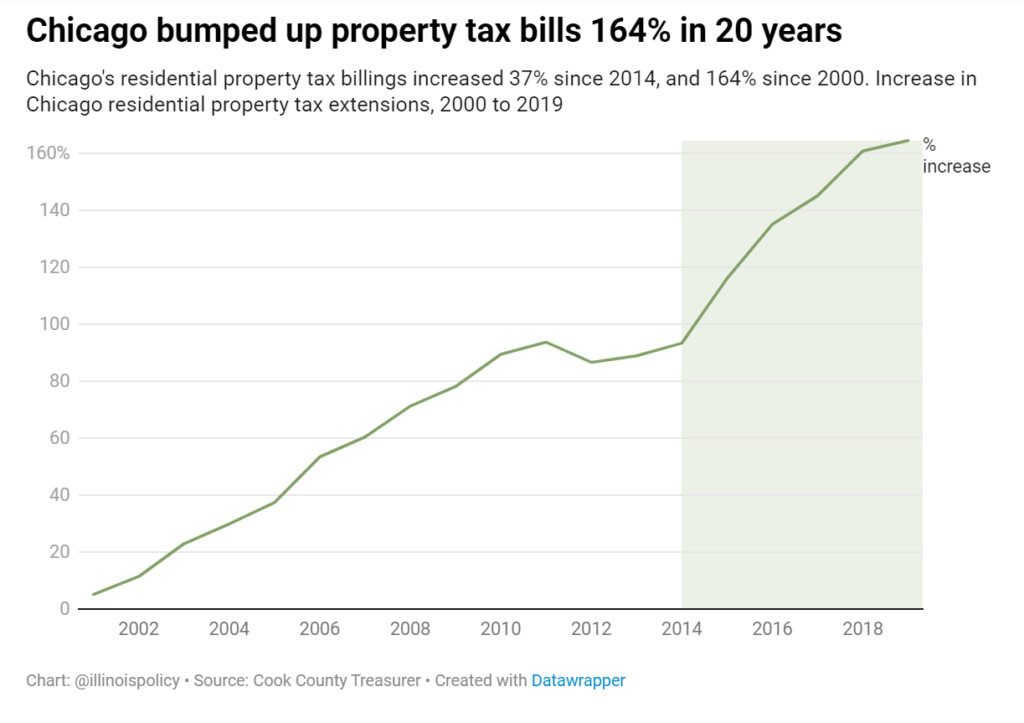

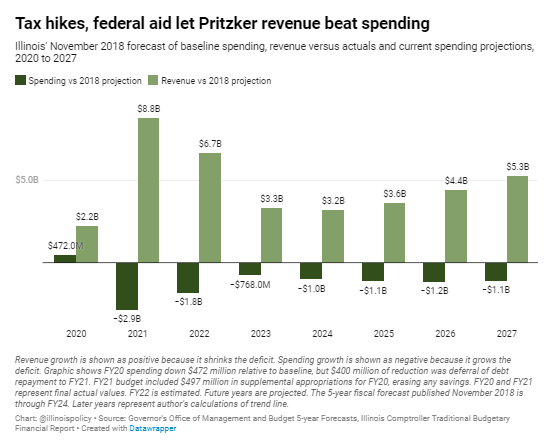

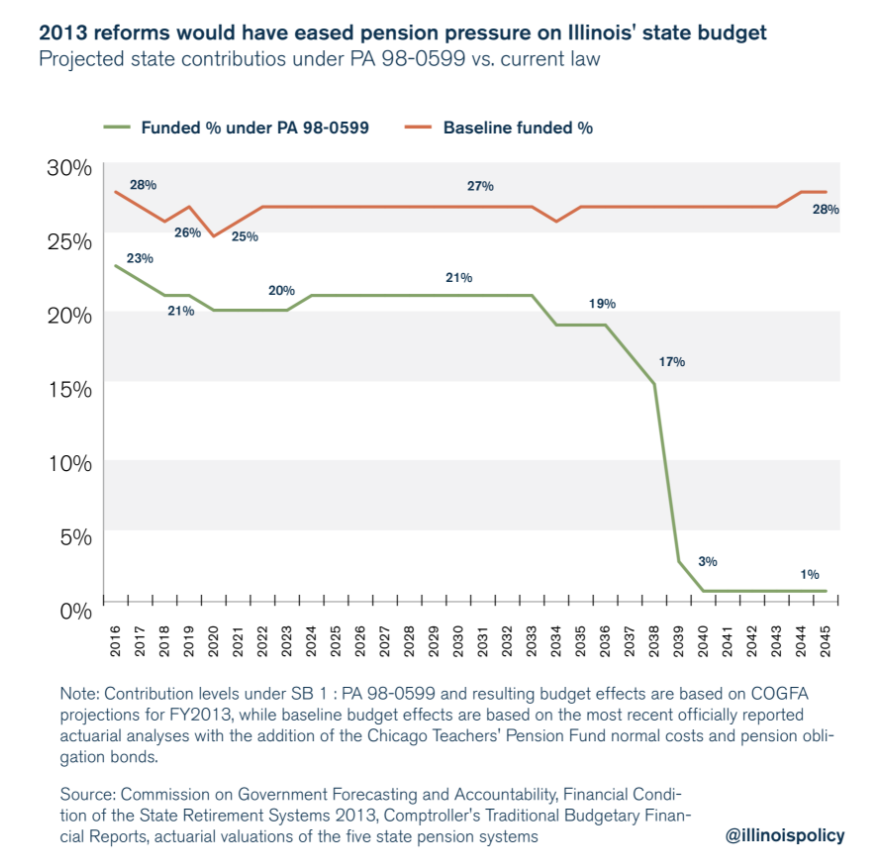

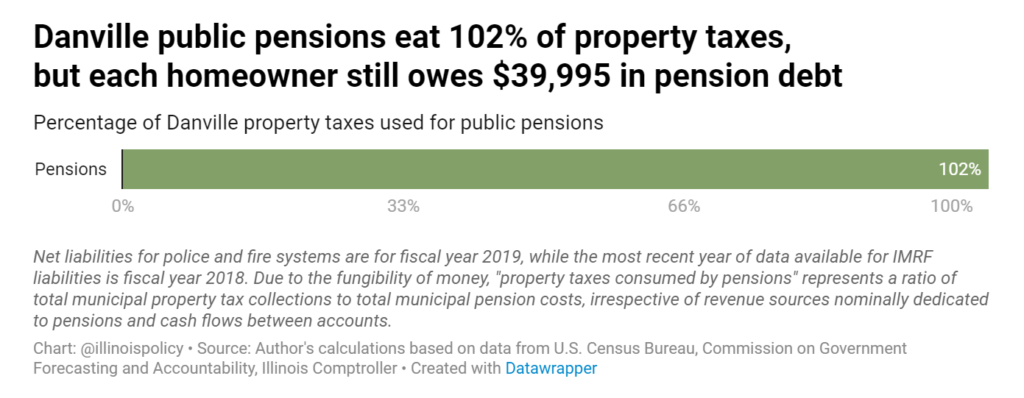

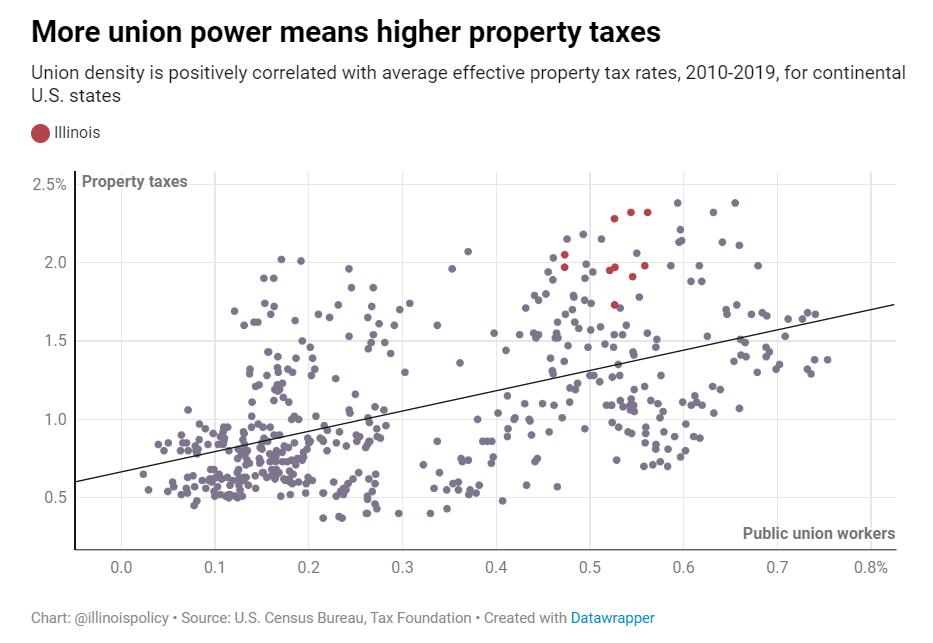

Peer-reviewed research shows stronger government worker unions cause the cost of government to increase, with powerful unions putting even more upward pressure on benefits than on wages. Government worker retirement benefits, which flow mostly to government union workers, have left Illinois local governments with $75 billion in pension debt and are already the primary cause of rising property taxes. Government unions helped Illinois politicians build the state and local pension crisis by supporting both unaffordable benefits as well as irresponsible funding games that pushed costs into the future.

Nationwide data from 2010 to 2019 show a significant statistical association between the percentage of government workers who are members of a government worker union and each state’s average effective property tax rate.

Author(s): Adam Schuster

Publication Date: 15 Jun 2022

Publication Site: Illinois Policy Institute