Link: https://www.kff.org/health-costs/issue-brief/americans-challenges-with-health-care-costs/

Graphic:

Excerpt:

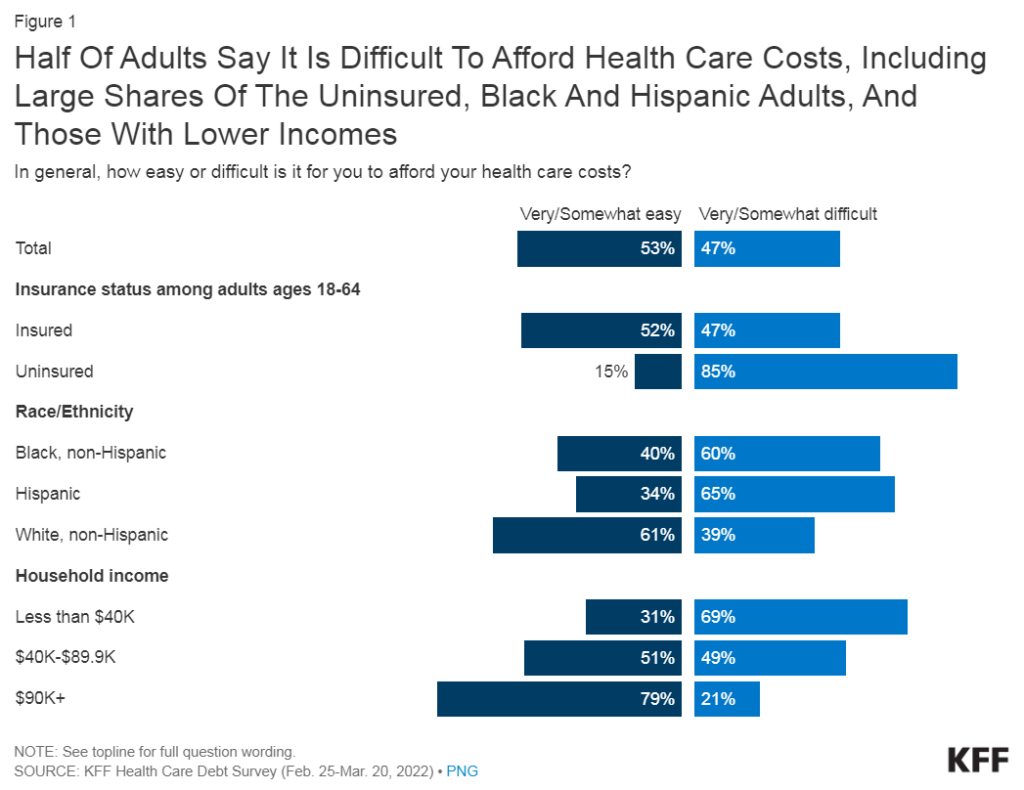

- About half of U.S. adults say it is difficult to afford health care costs, and one in four say they or a family member in their household had problems paying for health care in the past 12 months. Younger adults, those with lower incomes, adults in fair or poor health, and the uninsured are particularly likely to report problems affording health care in the past year.

- The cost of health care can lead some to put off needed care. One in four adults say that in the past 12 months they have skipped or postponed getting health care they needed because of the cost. Notably six in ten uninsured adults (61%) say they went without needed care because of the cost.

- The cost of prescription drugs prevents some people from filling prescriptions. About one in five adults (21%) say they have not filled a prescription because of the cost while a similar share say they have instead opted for over-the-counter alternatives. About one in ten adults say they have cut pills in half or skipped doses of medicine in the last year because of the cost.

- Those who are covered by health insurance are not immune to the burden of health care costs. About four in ten insured adults worry about affording their monthly health insurance premium, and 48% worry about affording their deductible before health insurance kicks in. Indeed, large shares of adults with employer-sponsored insurance (ESI) and those with Marketplace coverage rate their insurance as “fair” or “poor” when it comes to their monthly premium and to out-of-pocket costs to see a doctor.

- Health care debt is a burden for a large share of Americans. About four in ten adults (41%) report having debt due to medical or dental bills including debts owed to credit cards, collections agencies, family and friends, banks, and other lenders to pay for their health care costs, with disproportionate shares of Black and Hispanic adults, women, parents, those with low incomes, and uninsured adults saying they have health care debt.

- Notable shares of adults still say they are worried about affording medical costs such as unexpected bills, deductibles, and long-term care services for themselves or a family member. Additionally, about half of adults would be unable to pay an unexpected medical bill of $500 in full without going into debt.

Author(s): Lunna Lopes, Marley Presiado, and Liz Hamel

Publication Date: 21 Dec 2023

Publication Site: Kaiser Family Foundation