Link: https://marypatcampbell.substack.com/p/multiemployer-pensions-will-the-recent

Graphic:

Excerpt:

I think it unlikely that Congress, at least this Congress, will pass any MEP reforms. The bill allowing for MEP benefit cuts passed under Obama, during his second term – with a Republican House and a Democratic Senate.

There may eventually be MEP reforms, but with a big cash injection into Central States Teamsters, the reckoning day has been pushed off.

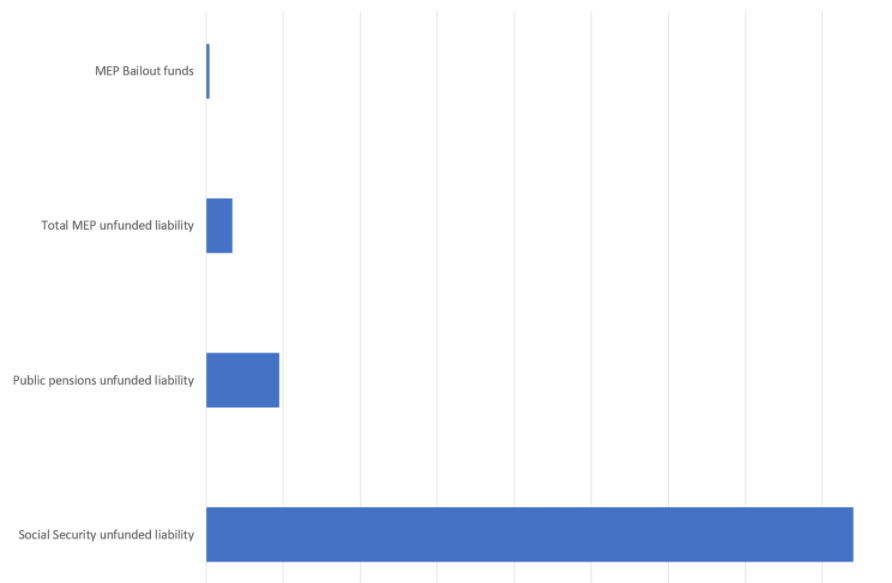

The real crisis was Central States Teamsters going under. It would have taken down the PBGC. The puny plans like Warehouse Employees Union Local No. 730 Pension Trust (total liability amount: $474,757,777) are drops in the bucket compared with Central States (total liability amount: $56,790,308,499).

Author(s): Mary Pat Campbell

Publication Date: 5 April 2021

Publication Site: STUMP at substack