Link: https://www.thinkadvisor.com/2022/09/27/5-worst-states-for-working-age-deaths-in-august/

Graphic:

Excerpt:

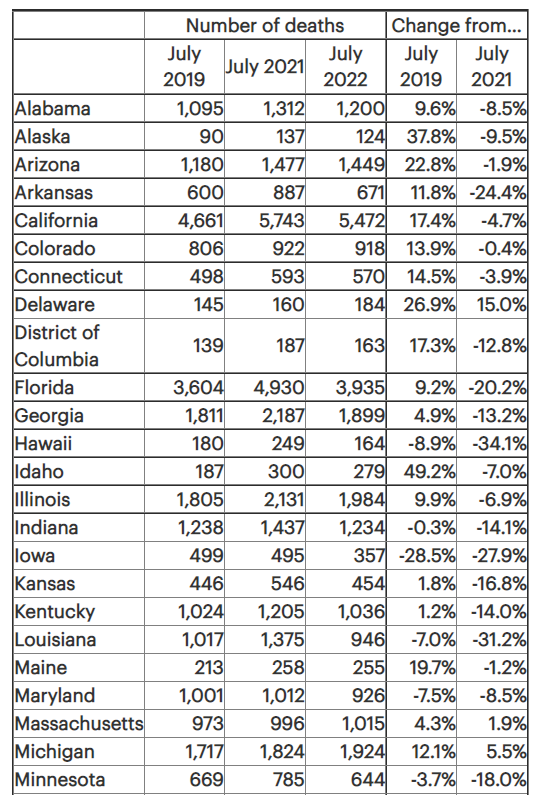

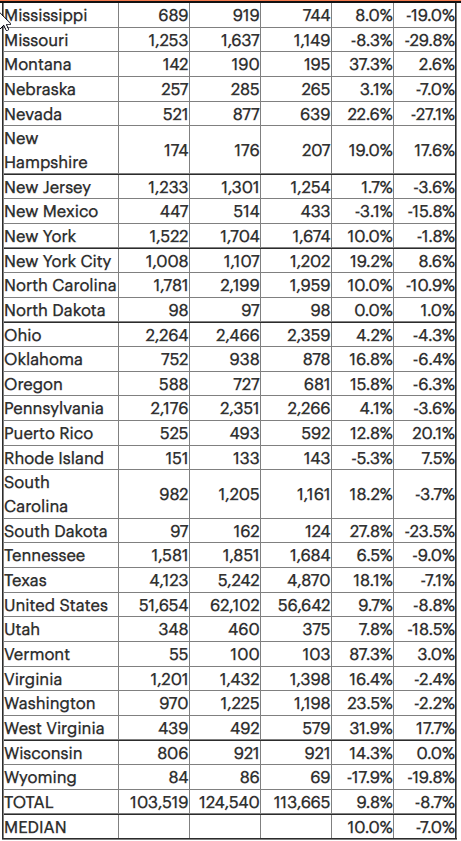

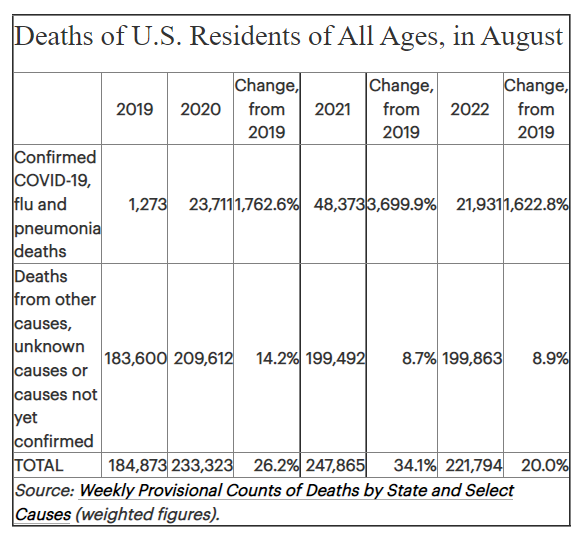

The number of deaths of working-age Americans was lower in August than in August 2021, but it was still much higher than it was in August 2019, before the COVID-19 pandemic began.

Death figures for the period from July 31 through Aug. 27 are just starting to firm up. But very early figures show that at least 53,655 U.S. residents ages 25 through 64 died from COVID-19 and all other causes during that four-week period.

The number of deaths was down sharply from 77,847 in August 2021, but it was still up 6.1% from the total of 50,590 for August 2019.

Author(s): Allison Bell

Publication Date: 27 Sept 2022

Publication Site: Think Advisor