Graphic:

Excerpt:

The Financial Times made its interview with departing CalSTRS’ Chief Investment Officer Chris Ailman its lead story yesterday: Private equity should share more wealth with workers, says US pension giant. The Financial Times was too polite to say so, but Ailman could lay claim to being the best large public pension fund chief investment officer. CalSTRS, which manages the pensions of California teachers, is in the same general size league as its Sacramento sister CalPERS, and regularly outperforms CalPERS by a meaningful margin.

….

It’s hard to know where to begin with this. Limited partners like CalSTRS, who are, in Wall Street parlance, the money, have not even been able to get basic disclosures from the general partners like how much in total the private equity firms hoover out in fees and expenses, despite many years of pleading. Mind you, it’s a requirement for a fiduciary to evaluate the costs and risks of any investment, yet these investors have accepted this abuse.

Limited partners don’t get P&Ls of portfolio companies. They don’t get independent valuations even though that is considered to be essential for every other type of investment. So it’s ludicrous to think that general partners will share money with one of the very weakest parties in the picture, mere workers, when they won’t give information to the limited partners.

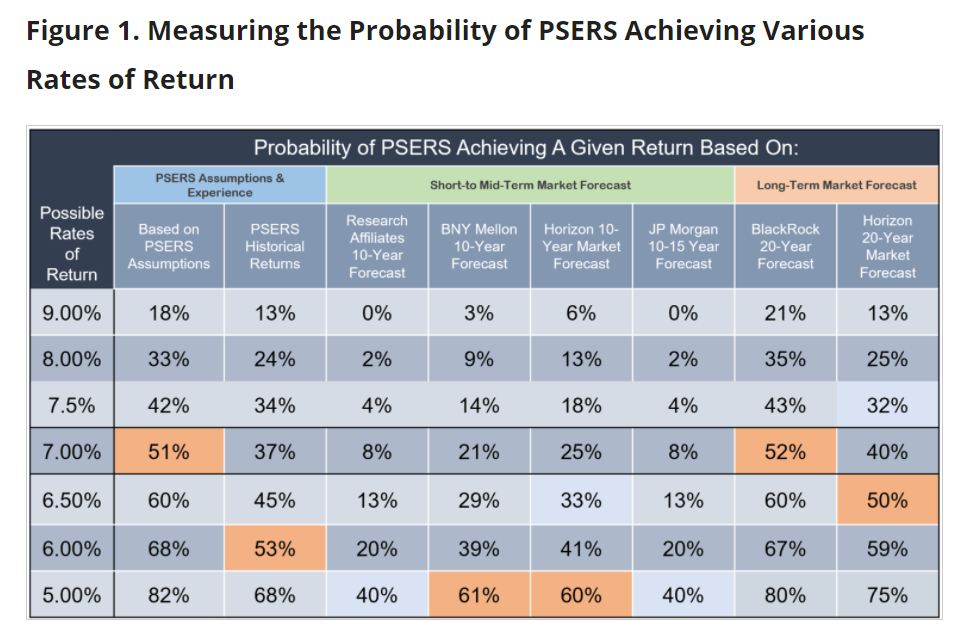

Someone new to this topic might wonder why limited partners don’t say “no”. The reason is they perceive private equity to be necessary for them to earn enough to reduce their level of underfunding, which in the public pension fund world is typically pretty bad. To make up for the shortfalls, pension funds like CalPERS and CalSTRS have also been increasing the amount they charge to cities, counties, and other local government entities. These pension costs are taking up larger and larger proportions of these budgets, creating concern and anger.

Author(s): Yves Smith

Publication Date: 16 Feb 2024

Publication Site: naked capitalism