Graphic:

Excerpt:

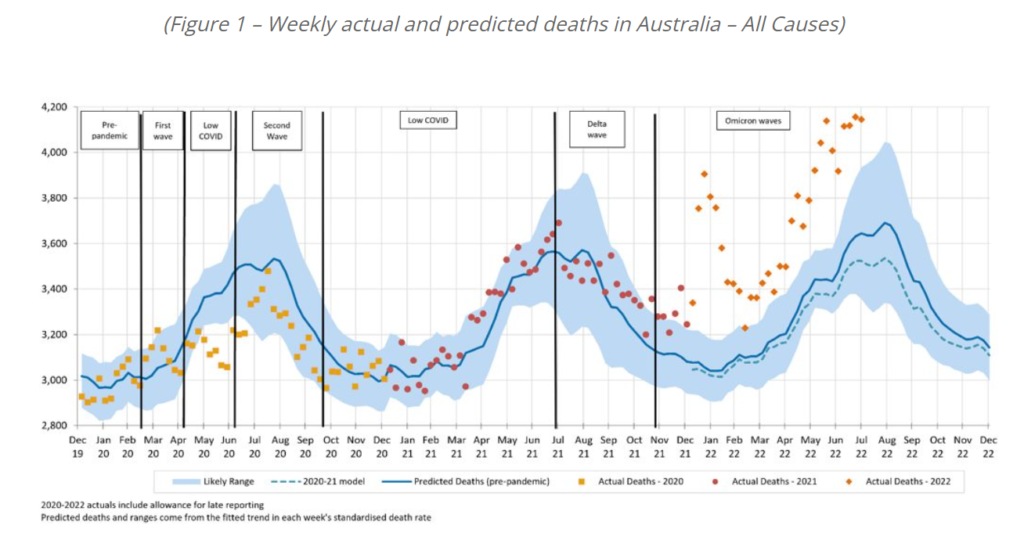

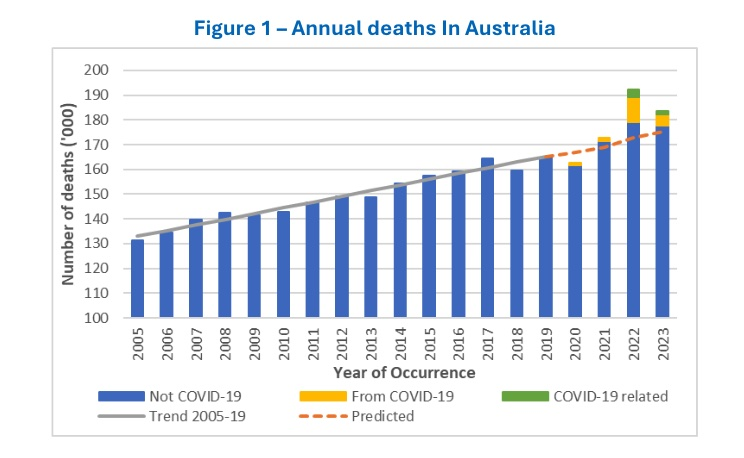

There were 8,400 more deaths in Australia in 2023 than predicted had the pandemic not occurred – less than half of the almost 20,000 excess deaths estimated for 2022.

The new Research Paper from the Mortality Working Group explores how COVID-19 affected mortality in Australia from 2020 to 2023 and how Australia’s experience compares with the rest of the world.

In brief:

- The steep decline in excess deaths in 2023 was primarily due to the number of people dying from COVID-19 falling to 4,600 in 2023 from 10,300 in 2022.

- While Australia’s excess mortality rate had dropped substantially, it remains significantly higher than the 1-2% excess observed in years of high flu deaths prior to the pandemic.

- When analysing the excess mortality of 40 countries from 2020 to 2023, Australia’s excess mortality over the four-year period (5%) was low by global standards (11%).

Author(s): Mortality Working Group. Members Karen Cutter, Ronald Lai, Jennifer Lang, Han Li, Richard

Lyon, Matt Ralph, Amitoze Singh, Michael Seymour, Zhan Wang.

Publication Date: July 2024

Publication Site: Actuaries Institute