Link: https://www.thinkadvisor.com/2022/09/12/insurers-must-reach-millennials-and-gen-zers-heres-how/

Excerpt:

Based on the widely used Pew Research definitions, the millennials are turning 26 through 41 this year, and Gen Zers are turning 10 through 25.

More than half of Gen Zers ages 16 through 24 are already in the workforce.

It’s time for carriers to innovate rapidly to respond to the buying preferences of members of these generations.

…..

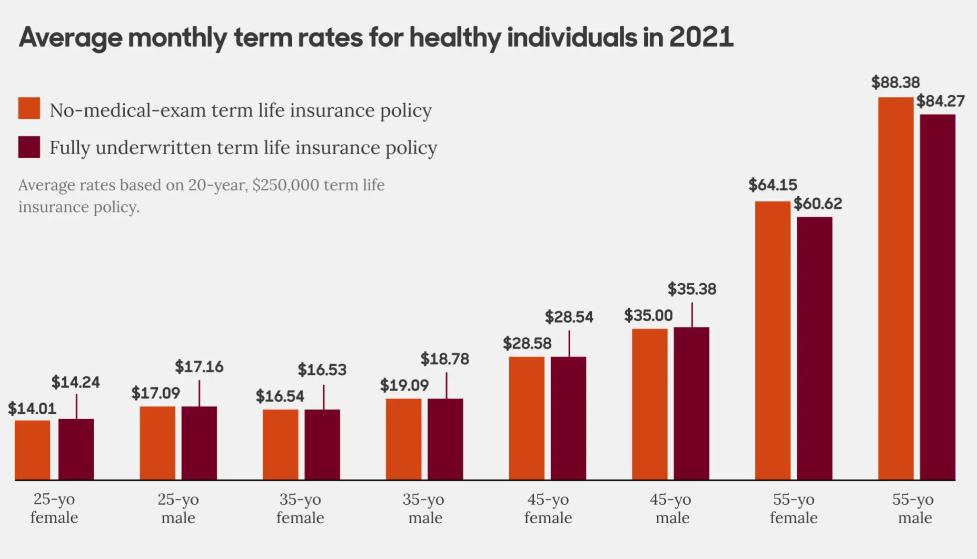

As an example, if the target customers are millennials and Gen Zers who need a simple term life insurance solution, you may want to focus on instant decision underwriting and lower face amounts to meet the most basic needs.

This approach could mean that many historical riders and features are actually not necessary.

It likely also means that the tools used in underwriting need to focus on information that is available instantly as opposed to traditional methods that could take weeks or even months.

Author(s): Jeremy Bill

Publication Date: 12 Sept 2022

Publication Site: Think Advisor