Link: https://www.cato.org/blog/more-federal-aid-states-not-needed

Graphic:

Excerpt:

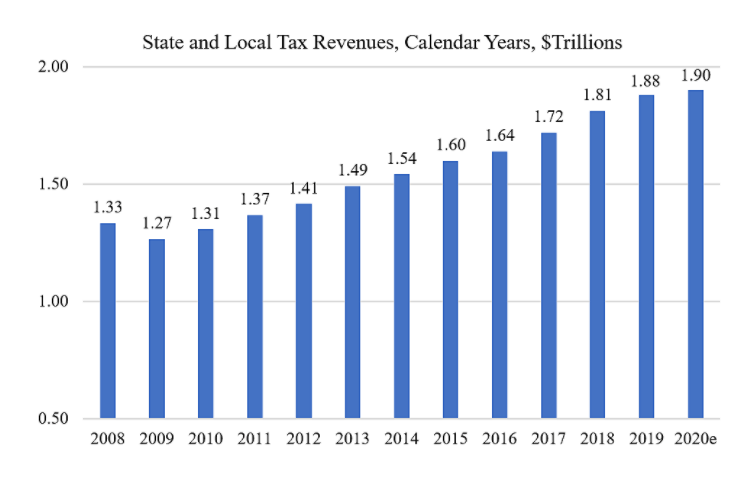

Spending advocacy groups are still claiming that state and local budget “shortfalls” are hundreds of billions of dollars. It is true that tax revenue growth in 2020 was slower than projected before the pandemic, but that is only a “shortfall” if you assume that budgets must always grow at the strong pre‐pandemic rates. Yet states should know that booms do not last forever. If revenues are growing slower, then states should slow spending growth to match.

Perhaps tax revenues will fall in 2021, as they did in 2009. But that seems unlikely. CBO projected yesterday that real GDP will rise a strong 4.6 percent in calendar 2021. Private forecasters are also projecting solid growth. As incomes rise, state tax revenues should grow. Meanwhile, local governments are gaining from rising house prices because property taxes account for 70 percent of local tax revenues. U.S. house prices in the fourth quarter were up 14.9 percent on the year and are expected to remain strong in 2021.

Author(s): Chris Edwards

Publication Date: 12 February 2021

Publication Site: Cato Institute