Link: https://www.nortonrosefulbright.com/en-us/knowledge/publications/e91814ee/canadian-legislation-aimed-at-protecting-pension-plans-may-mean-significant-changes

Excerpt:

On February 3, 2022, Bill C-228 was introduced as a private members bill and has now made its way to the third reading in Canada’s Senate. The purpose of Bill C-228 is to greatly expand the pension liabilities that are afforded super priority status by amending bankruptcy and insolvency legislation. As currently drafted, the Bill will grant priority for a pension plan’s unfunded liability or solvency deficiency claims over the claims of the majority of creditors — including secured creditors — unless specifically enumerated otherwise in the statutes.

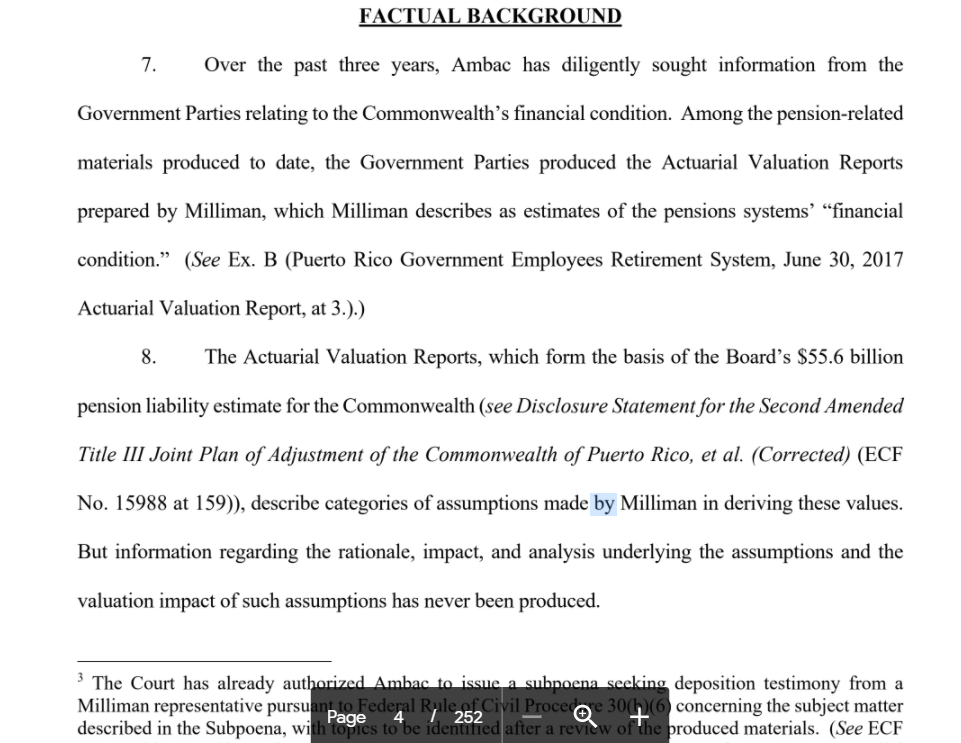

The “unfunded liability” is the amount necessary to enable the fund to continuously pay member benefits as they come due, on the assumption that the fund will operate for an indefinite period of time. The “solvency deficiency” includes the amount necessary to ensure the fund meets its obligations if wound up. As these amounts are constantly fluctuating, a fixed value cannot be ascribed to either of these requirements other than through a single point in time calculation by an actuary.

What does this mean for borrowers with pension plans?

Clearly, Bill C-228 would substantially increase the opportunity for recovery of pension entitlements within insolvency proceedings by way of super priority. The issue is whether it remains viable for lenders to provide capital to borrowers with defined benefit pension plans given the increased risk profile that may be created by Bill C-228 expanding the pension claims that take priority over a secured creditor in an insolvency case.

In all likelihood, Bill C-228 will minimally effect borrowers that have defined-contribution pension plans as the employer’s liability is restricted to predefined contributions. As this type of plan is subject only to ordinary course known contribution requirements, and given that the employer does not guarantee a certain amount of income in retirement, the liability afforded super priority in insolvency proceedings should be predictable in most circumstances.

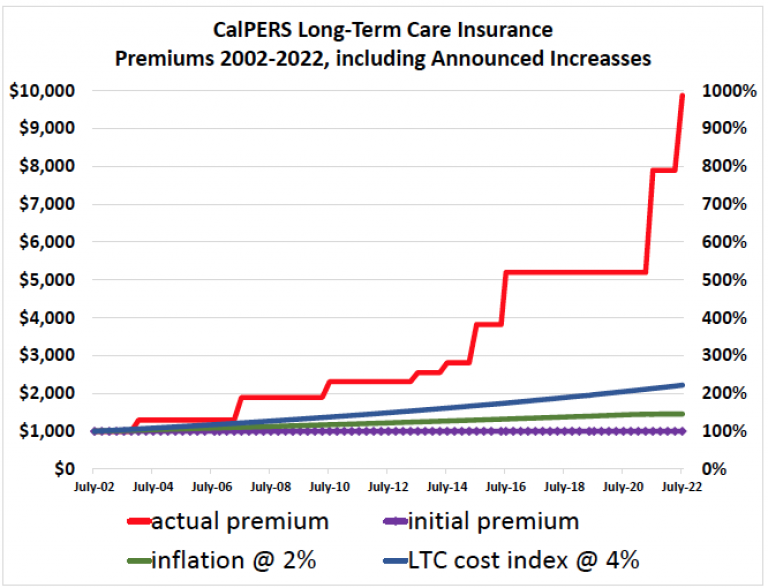

Conversely, Bill C-228 will significantly impact defined-benefit pension plans. These types of plans commit to providing a specified level of income in retirement based on a variety of factors. As such, an employer must diligently manage the pension fund to ensure it is in a position to pay the benefit to the employee for the remainder of their life, once retired. The inherent challenge with these plans is the uncertainty of the liability of the employer at any given time and the potentially large scope of that liability based in part on external factors such as interest rate fluctuations.

Bill C-228 has therefore created a conundrum. Although the intention of the Bill is to protect pension plans, it may potentially cause a shift that results in even more employers moving from a defined-benefit pension plan to a defined-contribution pension plan. Plainly, this shift may be caused by lenders’ concerns regarding the uncertainty surrounding the amount necessary to liquidate an unfunded liability or solvency deficiency at any given time. In other words, a lender will not be able to determine prior to the lending decision, with any great certainty, the amount of the unfunded liability or solvency deficiency in a future insolvency proceeding. At a minimum, a secured creditor wants to know the quantum of obligations that will take priority over their interests. This is essential information in deciding the quantum of a loan, the terms of such loan, any reserves and whether the creditor will agree to loan any money to the borrower.

Author(s): Candace Formosa

Publication Date: 2023Q2

Publication Site: Norton Rose Fulbright