Graphic:

Excerpt:

A flood of money pouring in? Check: Muni bond funds added about $2 billion in the week ended Feb. 17, according to Refinitiv Lipper US Fund Flows data, building upon a $2.6 billion inflow in the prior period that was the fourth-largest on record. Scarce supply? You bet: Some analysts estimate that states and cities in 2021 will bring to market the smallest amount of tax-exempt bonds in 21 years. Fiscal stimulus supporting its case? Indeed: The prospect of $350 billion in aid to state and local governments should help stave off any widespread credit stress.

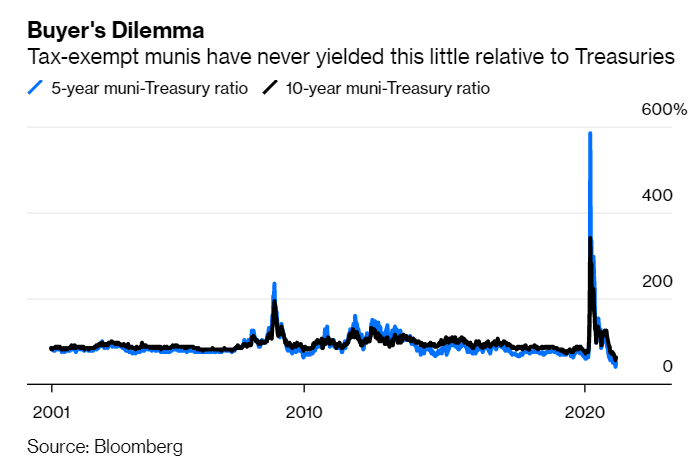

Perhaps most remarkably, though, muni investors appear to have fully embraced the “HODL” mentality of the crypto crowd. In typical times, February’s sharp selloff in U.S. Treasuries, which has sent the benchmark 10-year yield up almost 30 basis points to 1.35% (for a monthly loss of almost 2%), would have reverberated by now across the market for state and local bonds. Instead, tax-exempt yields have been borderline immovable; they only finally started to budge toward the end of last week.

By that time, municipal bonds became arguably the most expensive asset class anywhere. As Bloomberg News’s Danielle Moran noted, yields had fallen so low on top-rated tax-free debt that even after accounting for the exemption from federal taxes, it still made more sense for investors to purchase Treasuries instead. It’s certainly fair to argue that Bitcoin isn’t worth more than $50,000, or that shares of Tesla Inc. shouldn’t be trading at more than 1,000 times earnings. But it’s at least possible to make the case that they should. It’s not every day that a corner of the bond market rallies to such an extent that it’s objectively a bad deal.

Author(s): Brian Chappatta

Publication Date: 22 February 2021

Publication Site: Bloomberg