Graphic:

Excerpt:

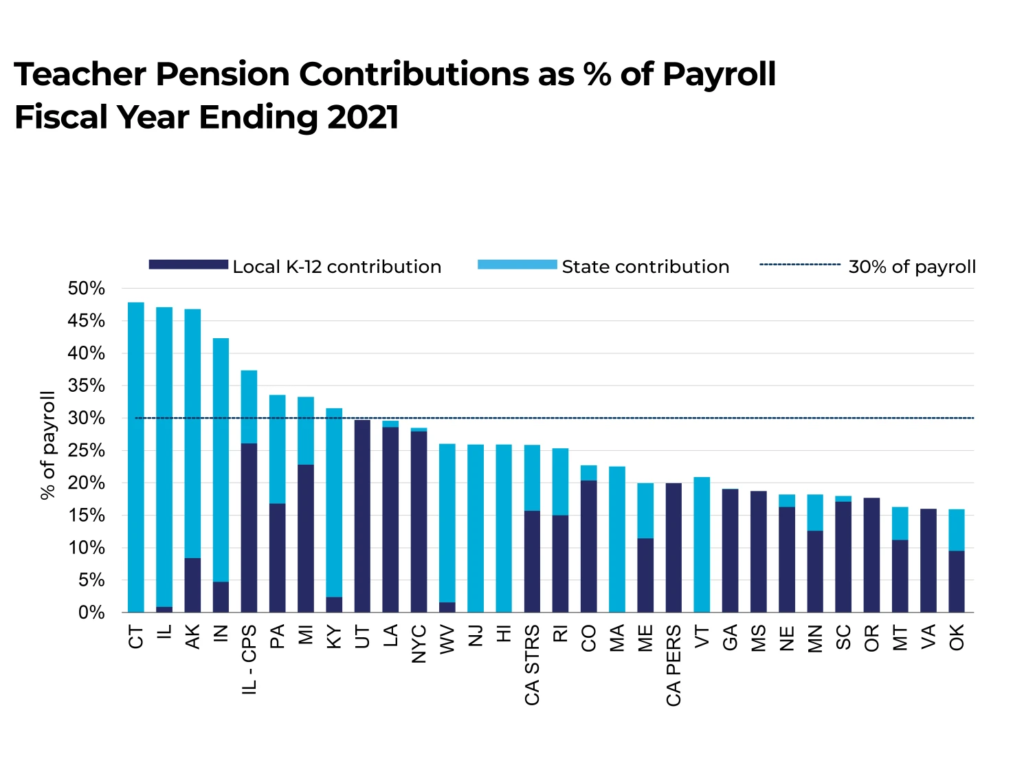

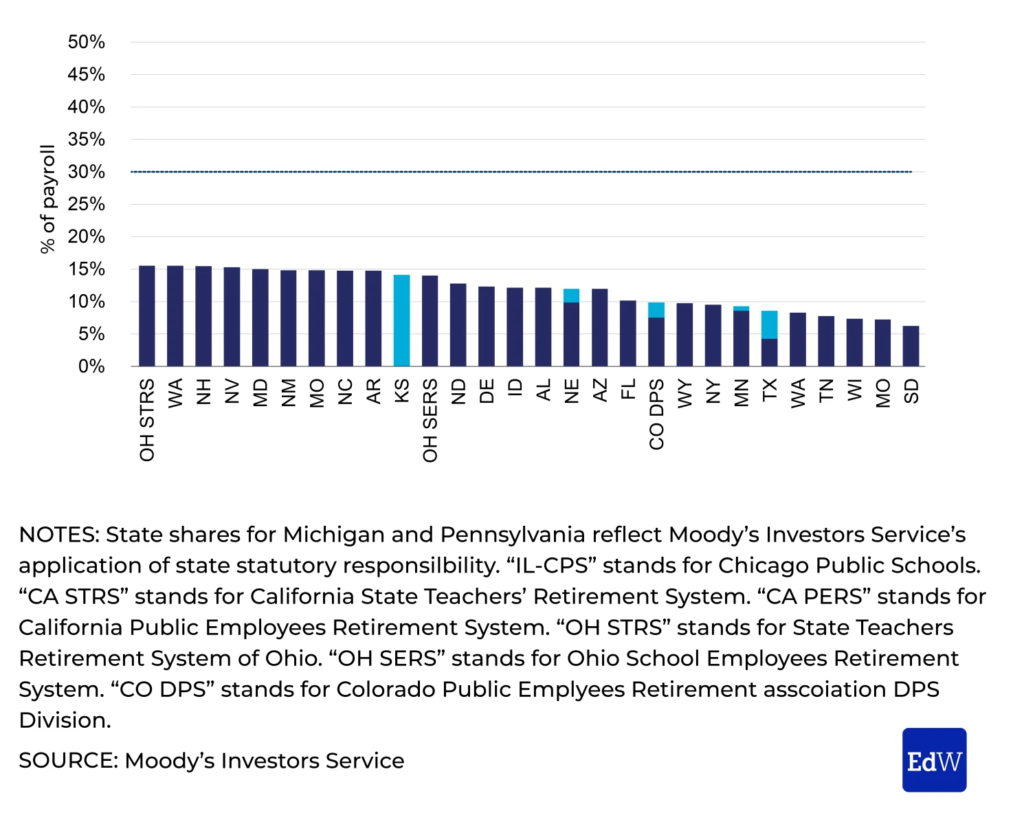

In at least some states and school districts, the share of pension costs now amounts to nearly a third of payroll, concludes a new analysis from Moody’s Investors Service, a credit-rating firm.

The gradually increasing burden of retirement costs on districts isn’t a new phenomenon. But the latest analysis is a good reminder of how pensions act as the third rail of district and state school finance—even if the average educator, parent, and principal doesn’t know a ton about their complexities.

Retirements don’t directly have much to do with the instructional quality students receive, but indirectly, they have a lot of impact. Cash going into these systems generally means it’s not going toward building improvements, teacher pay, learning materials, or programs.

Author(s): Stephen Sawchuk

Publication Date: 12 Sept 2022

Publication Site: Education Week