Link:https://burypensions.wordpress.com/2021/12/14/the-looming-tipping-point-of-new-jerseys-pension-system/

Excerpt:

Andrew Biggs prepared a report for The Garden State Initiative that focused on the impact of more retirees than employees.

Notable excerpts:

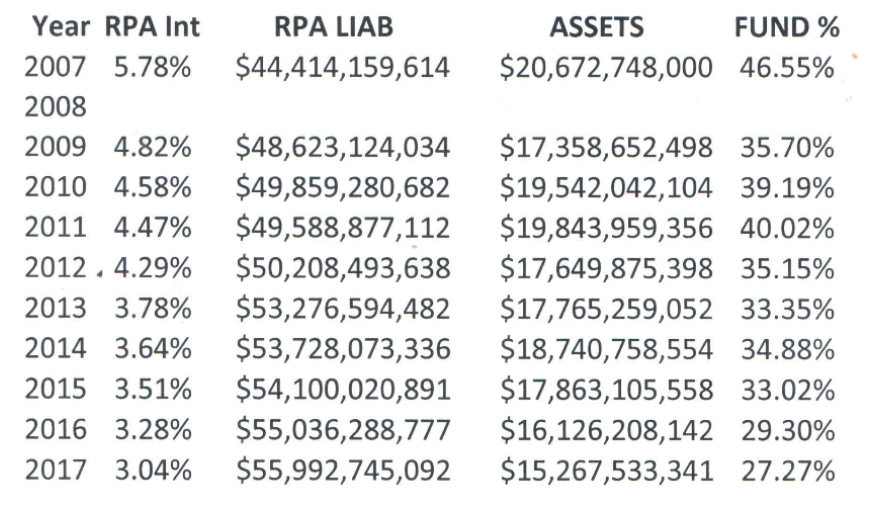

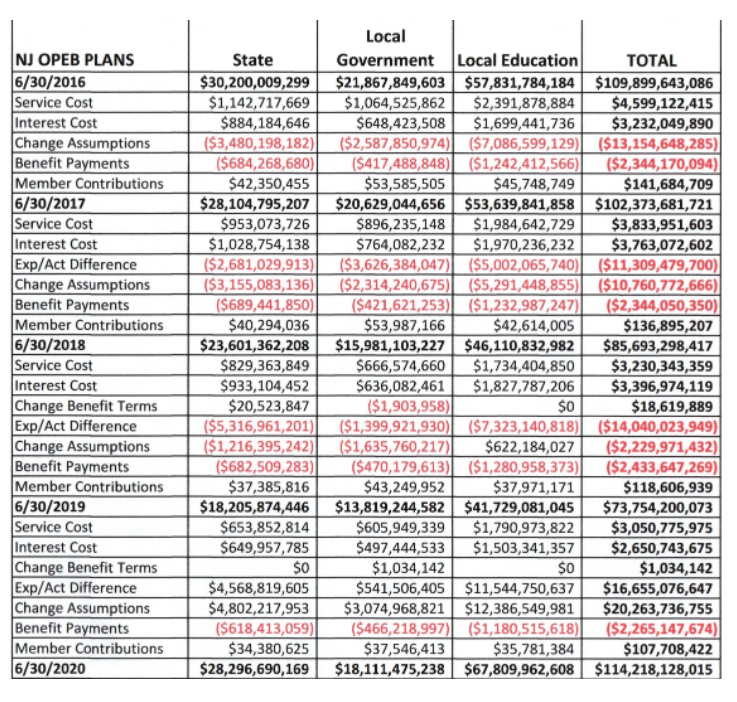

Nationally, unfunded state and local government pension liabilities remained roughly stable at about $1 billion from 1975 through 1999, but accelerated rapidly in the following two decades, reaching $4.0 trillion in 2020. The combined unfunded liabilities of New Jersey public plans have increased significantly as well, from $58 billion in 2000 to $186 billion in 2019. (page 4)

….

In summary, federal government figures demonstrate that New Jersey lawmakers promised benefits to employees that were larger than lawmakers were willing or able to fully fund. The New Jersey pension systems instead relied upon returns on risky investments to make up the gap. But, as New Jersey’s investment experience shows, risky investments pay higher expected returns than safe investments precisely because they are risky, even over long periods of time. This leaves only more conventional solutions available, which are both financially and political difficult. All New Jersey pension stakeholders — including lawmakers, public employees and retirees, and taxpayers — must carefully consider how the costs and benefits of pension reforms will be borne. (page 33)

Author(s): John Bury

Publication Date: 14 Dec 2021

Publication Site: Burypensions