Graphic:

Excerpt:

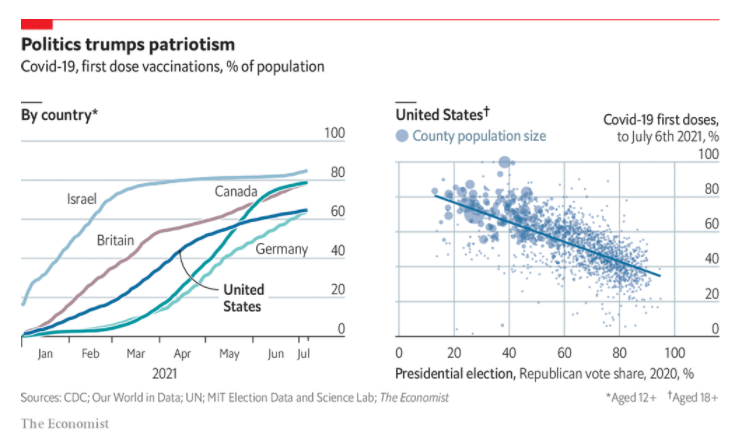

ON JULY 4TH President Joe Biden stood on the White House lawn to declare that America was nearing independence from the coronavirus. But with covid-19 not fully “vanquished”, he called upon his fellow citizens to get vaccinated, telling them that “it’s the most patriotic thing you can do.” About 55% of Americans over the age of 12 have now been fully vaccinated, and a further 10% have had the first of two doses. But in recent weeks America’s vaccination rate has slowed markedly. In April 3m doses were administered each day; since June that figure has fallen to an average of 1m per day.

There are three possible explanations for this slow-down. The first is that it is typical for vaccination rates to fall as more people are jabbed, since those in cities and other easy-to-reach areas are likely to have been targeted already. Yet America does not appear to have reached such a threshold. Other rich countries, such as sparsely populated Canada, continued to vaccinate at a decent clip until about 75% of their populations had received their first dose (see left-hand chart). Germany, which has vaccinated a similar proportion of its citizens as America, is currently vaccinating at nearly three times the rate.

Publication Date: 8 July 2021

Publication Site: The Economist