Excerpt:

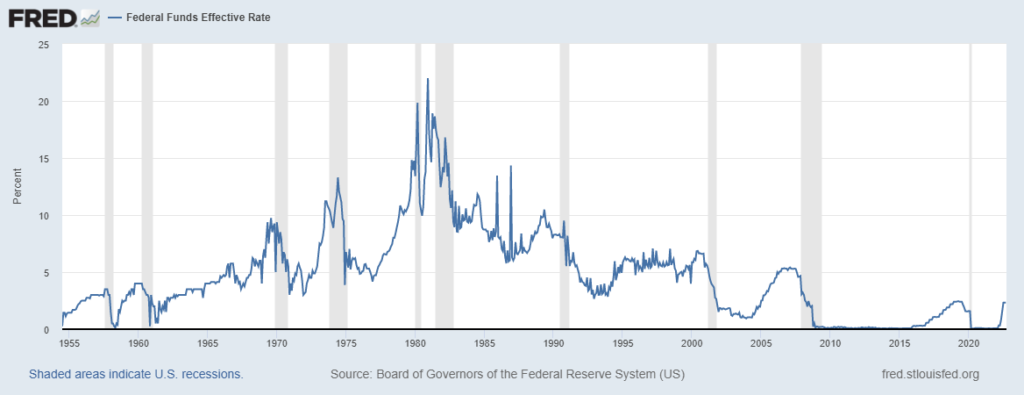

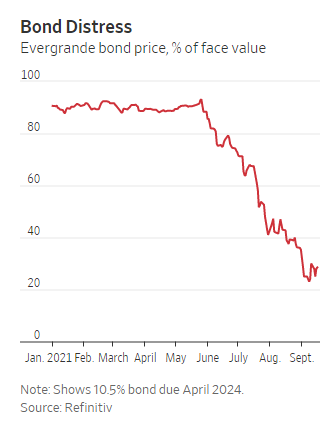

On day one of Fixed Income School, you learn that bond prices mean-revert. While a stock or a house’s price can continue to increase as the company or land becomes more valuable, yields can only go so low. Nobody will pay to lend someone else money, or at least, they won’t pay much to do that. Bond prices can only climb so high before they fall. While some evidence shows that yields trended downward slightly as the world became less risky, they still tended to revert to a mean greater than zero.

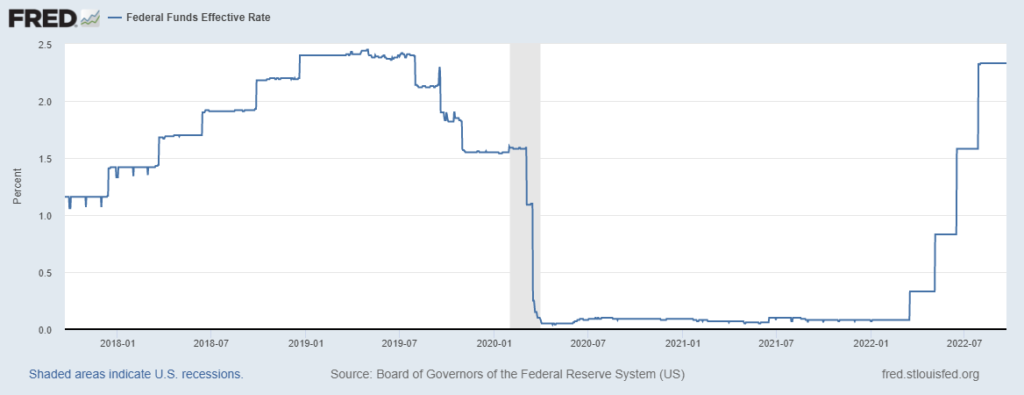

It’s easy to blame Silicon Valley Bank for being blissfully ignorant of such details. They purchased long-term bonds and mortgage-backed securities when the Fed was doing QE on steroids! Did they expect that to last forever? Well, maybe that was a reasonable assumption, based on the last 15 years, but I digress.

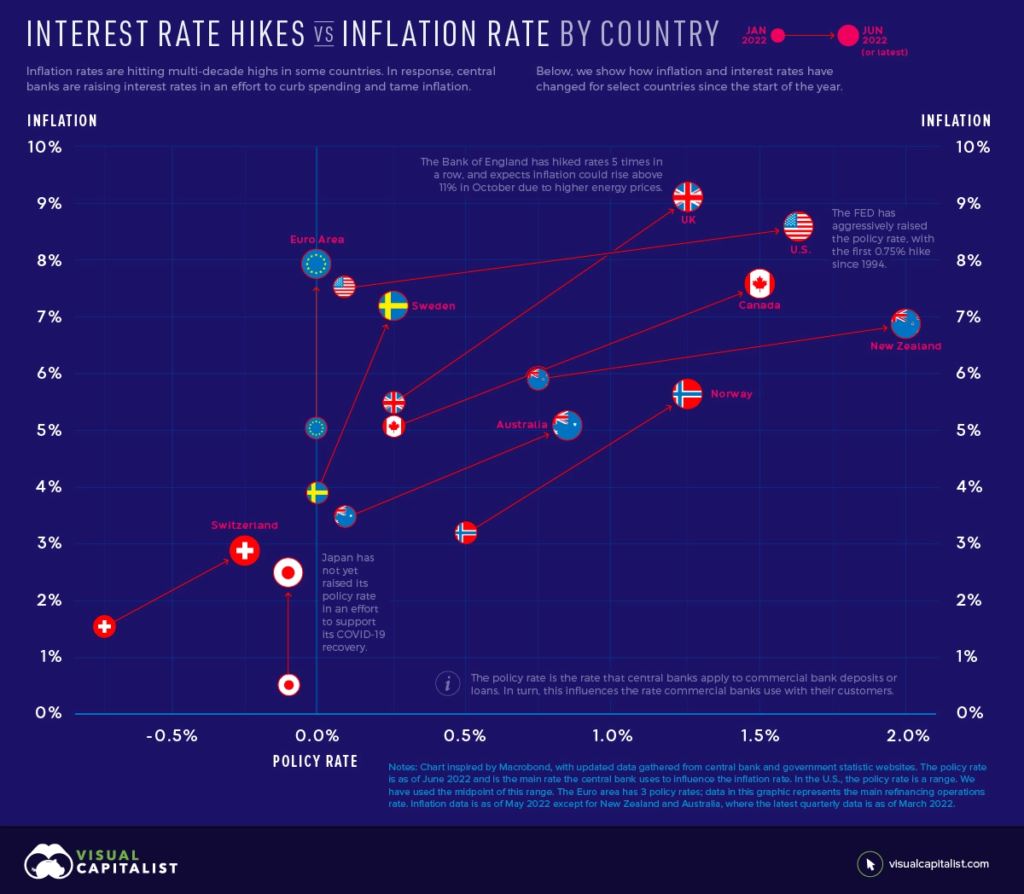

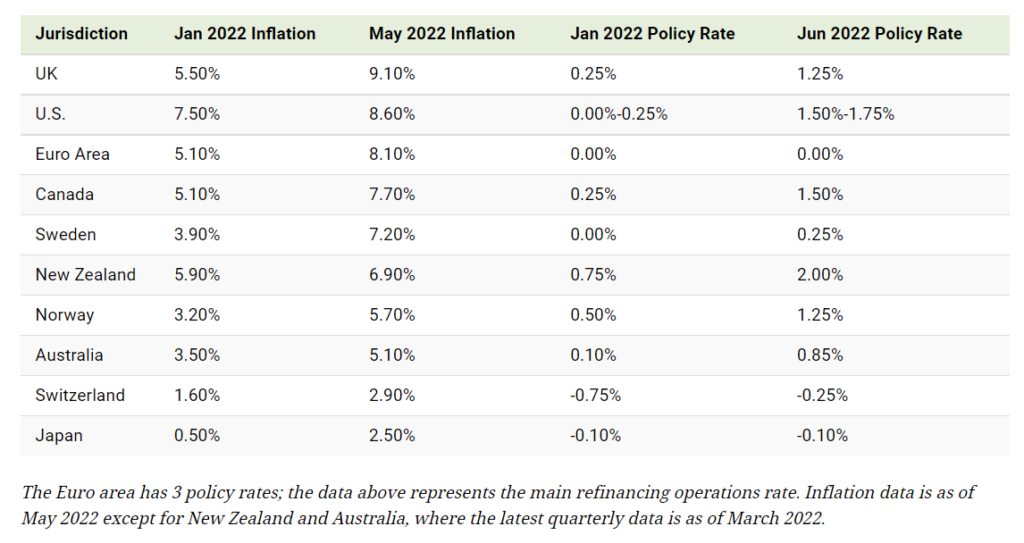

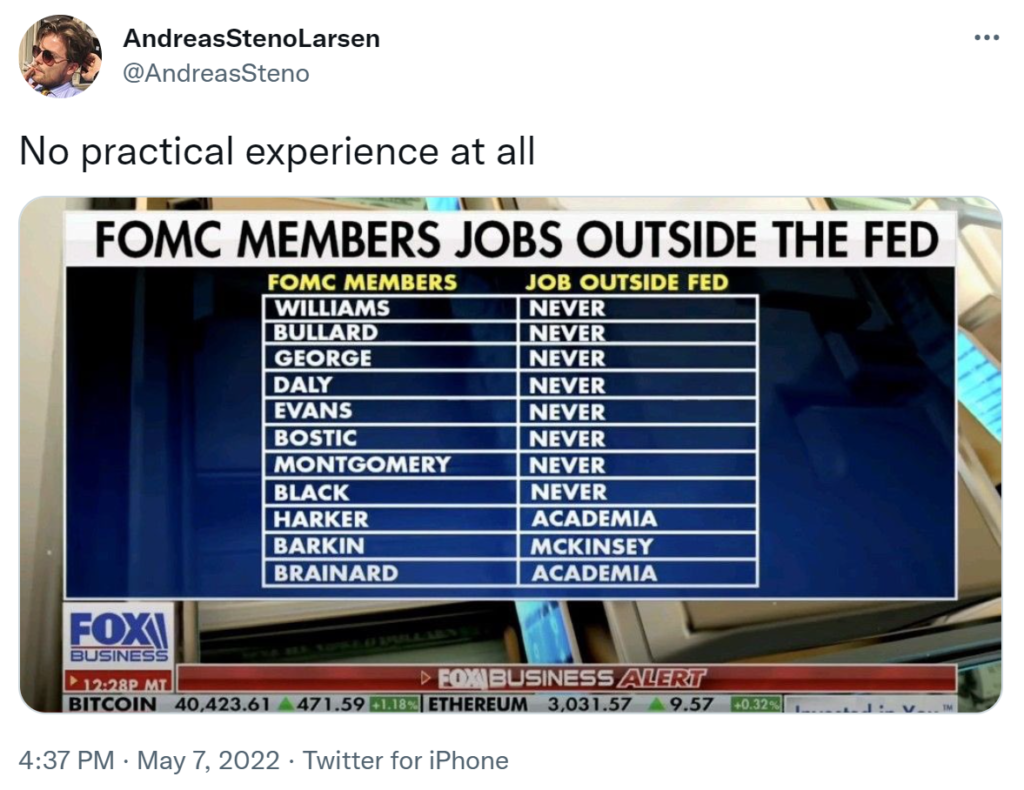

Many of these smaller banks, particularly Silicon Valley, are in trouble because they were particularly exposed to rate risk since their depositors’ profit model relied on low rates. So, when rates increased, they needed their money—precisely when their asset values would also plummet. It’s terrible risk management. But, to be fair, even the Fed (the FED!) did not anticipate a significant rate rise. Stress tests didn’t even consider such a scenario, even as rates were already climbing. Why would we expect bankers in California to be smarter than all-knowing bank regulators?

According to the New York Times, Central Bankers still expect rates to fall back to 2.5%. Why? Because of inequality and an aging population. But how does that work, and what’s the mechanism behind it? No good answer, or not one that squares with data before 1985, but we can hope. Sometimes we just want something to be true and for it to be true for politically convenient reasons.

Author(s): Allison Schrager

Publication Date: 20 Mar 2023

Publication Site: Known Unknowns at Substack