Link: https://www.illinoispolicy.org/biden-promises-nearly-36-billion-for-national-pension-bailouts/

Excerpt:

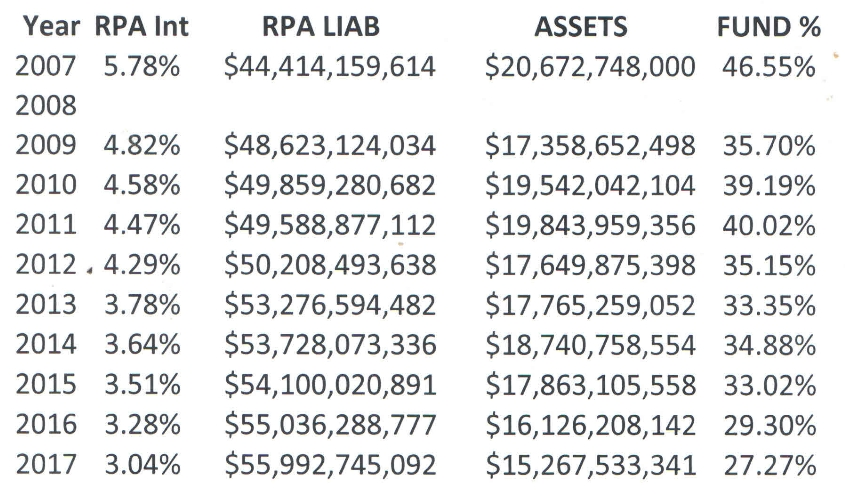

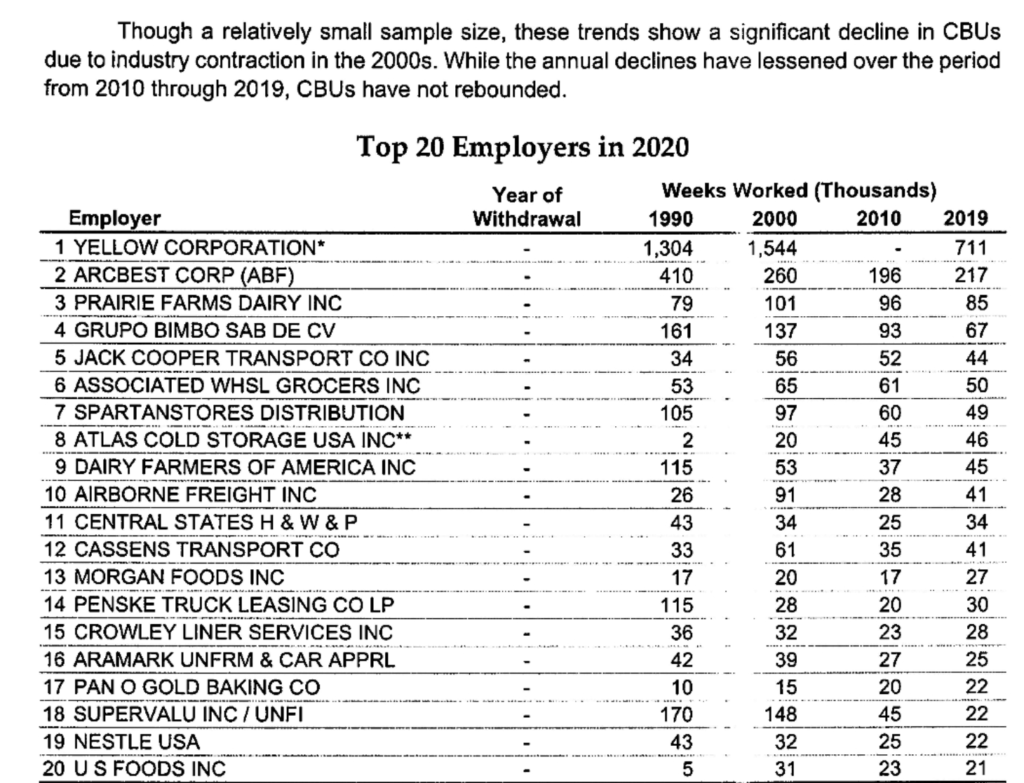

The Biden administration promised nearly $36 billion to stabilize pension plans for Teamsters nationwide after forecasts predicted the system’s default by 2026. Union members would have seen their retirement benefits slashed by 60% if the system defaulted.

President Joe Biden announced Dec. 8 the federal government will use nearly $36 billion to stabilize failing Teamsters union pension plans nationwide, preventing severe benefits cuts for more than 350,000 union workers.

….

Illinois is home to more than 20 Teamster’s chapters and the nation’s worst pension debt, estimated at nearly $140 billion by state authorities in 2022. Private investor services projected that debt as high as $313 billion, using more realistic assumptions on returns.

In September these state pension funds had just 47 cents for every dollar in promised pension benefits.

Springfield lawmakers cannot routinely rely on federal authorities to bail out overly generous and underfunded state and local pensions. Illinois public servants deserve to receive the retirements they’ve been promised in full – not the 40% that would remain after default.

Author(s): Patrick Andriesen

Publication Date: 12 Dec 2022

Publication Site: Illinois Policy Institute