Excerpt:

Illinois State Senator Robert Martwick (D-Chicago) is pushing ahead with legislation that, according to a Bloomberg report, could increase Chicago’s police pension obligations by another $3 billion in total through 2055. An earlier city estimate put the cost at $2.1 billion. Senate Bill 2105 would do that by removing a birthdate restriction on eligibility at age 55 for a 3% automatic annual increase in retirement annuity.

Where would Chicago get money to cover the additional liability? No answers.

….

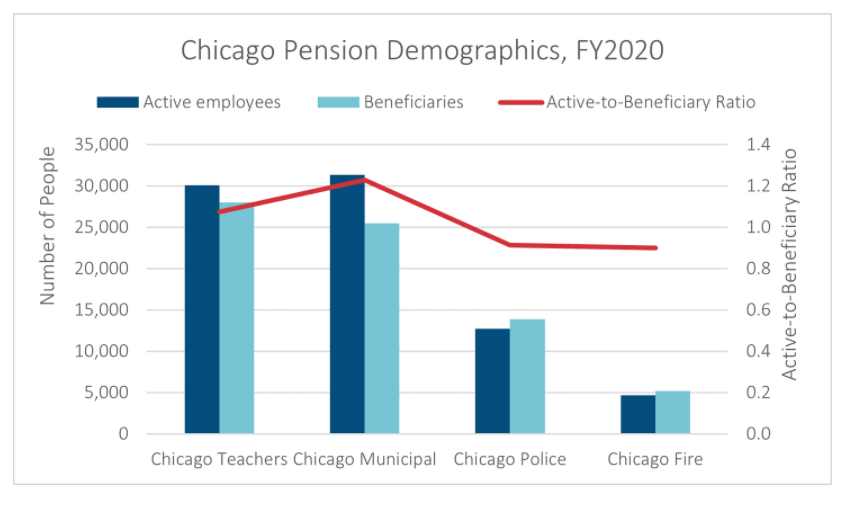

Chicago’s police and firefighter pensions already are in utterly abysmal shape, having just 18% and 23%, respectively, of the assets their actuaries say they should have. Together with two other pensions sponsored by the city, Chicago officially reports about $33 billion of unfunded pension liabilities. But using more realistic assumptions, Moody’s estimates the total unfunded liability at $60 billion. Moody’s also reports the city of Chicago’s total debts as a percentage of annual revenues are at 735%, the highest of any major city in the country.

….

It’s as if Martwick is saying, “We rob banks routinely so you might as well make it legal for us to rob banks.”

Author(s): Mark Glennon

Publication Date: 28 Jan 2022

Publication Site: Wirepoints