Link: https://www.wsj.com/articles/populists-may-kill-chiles-pension-success-11622670275

Excerpt:

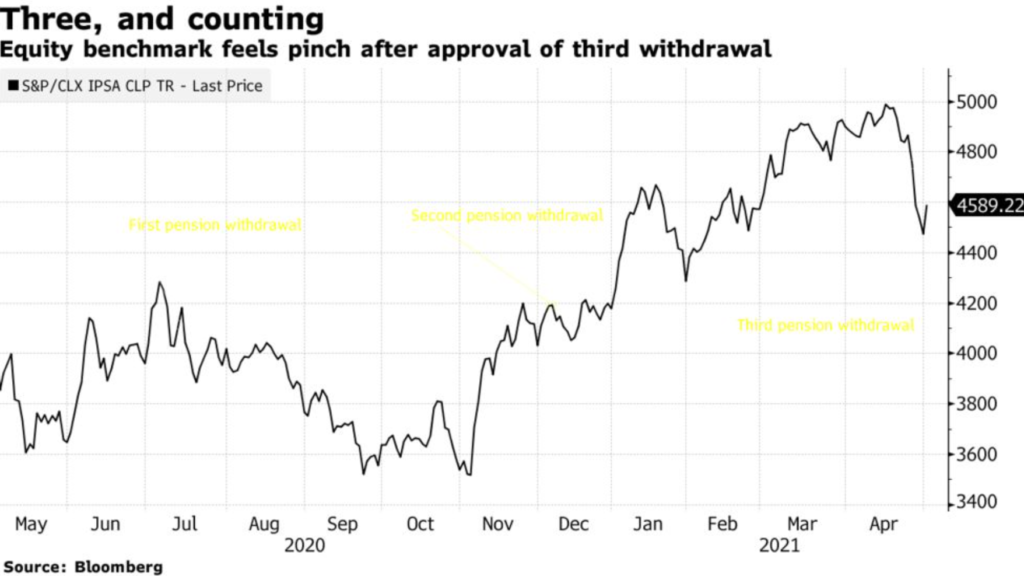

Populist politicians are destroying Chile’s revolutionary pension system. In 1981 Chile became the first country to privatize social security, ending the pay-as-you-go system that had been in place since 1924 and had collapsed. Now Chile’s left wants to resurrect it.

The state-run pension system was plagued by corruption and rent-seeking since its earliest days. Among the 11,395 laws passed by the Chilean Congress between 1926 and 1963, 10,532 granted pension privileges to special-interest groups, many of them politically connected. In 1968, Chilean President Eduardo Frei, a center-left Christian Democrat, described the cronyism that plagued social security as an “absurd monstrosity” that the government couldn’t afford.

Pension privatization reversed this perverse dynamic. Instead of taxing active workers to pay pensioners through the bureaucracy, the new system, created by former Labor Minister Jose Pinera, established that 10% of the employee’s salary is transferred automatically to an account under his name at one of the Administradoras de Fondos de Pensiones, or AFP. These private pension funds compete to attract workers and invest their pensions for a fee.

This has restored the link between contributions and pension benefits by making workers responsible for saving the funds that will support them once they retire. This novel system also limited corruption and rent-seeking, and Chilean taxpayers are no longer on the hook for pension deficits, which in 1981 represented 3% of gross domestic product.

….

Longer life expectancy is also a problem. When the AFP system was created, men retired at 65 with an average life expectancy around 67. Women retired at the age of 60 with a life expectancy around 74. Today, the retirement ages are unchanged but life expectancy has increased to 77 for men and 83 for women. This means more years of retirement have to be funded by the same years of saving.

Author(s): Axel Kaiser

Publication Date: 2 June 2021

Publication Site: WSJ