Link: https://content.naic.org/sites/default/files/capital-markets-special-reports-bank-loans-2021.pdf

Graphic:

Excerpt:

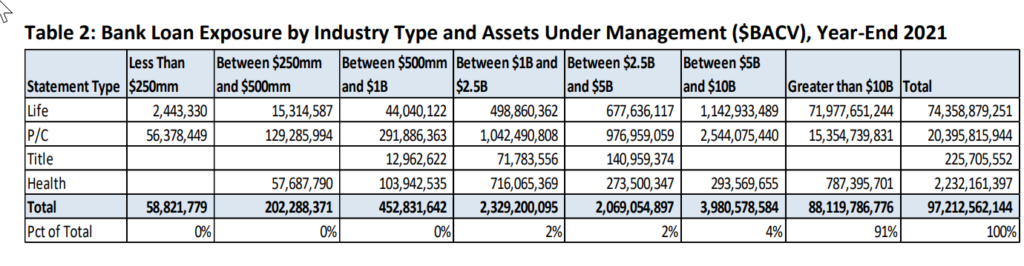

U.S. insurers’ exposure to bank loans increased by about 32% to $97.2 billion in book/adjusted

carrying value (BACV) at year-end 2021, from $73.9 billion at year-end 2020; they make up less

than 2% of the industry’s total cash and invested assets.

About 80% of U.S. insurers’ bank loans were acquired in market transactions; the remainder was

issued by the reporting entities.

About 74% of bank loans were held by large life companies, or those with more than $10 billion

in assets under management; 10 life insurance companies accounted for 54% of U.S. insurers’

total bank loan exposure at year-end 2021.

There was a small improvement in credit quality of U.S. insurer bank loans, with those carrying

NAIC 3 and NAIC 4 designations—i.e., BB and B credit rating categories—accounting for 53% of

the total at year-end 2021, compared to 57% at year-end 2020. Bank loans carrying CCC credit

ratings also decreased year-over-year (YOY) to 8% from 12%.

New leveraged loan market issuance in 2021 reached $615 billion, surpassing a previous record

set in 2017 of $503 billion, with collateralized loan obligations (CLOs) for the most part driving

demand.

Author(s): Jennifer Johnson, Jean-Baptiste Carelus

Publication Date: 1 June 2022

Publication Site: NAIC Capital Markets Special Report