Graphic:

Excerpt:

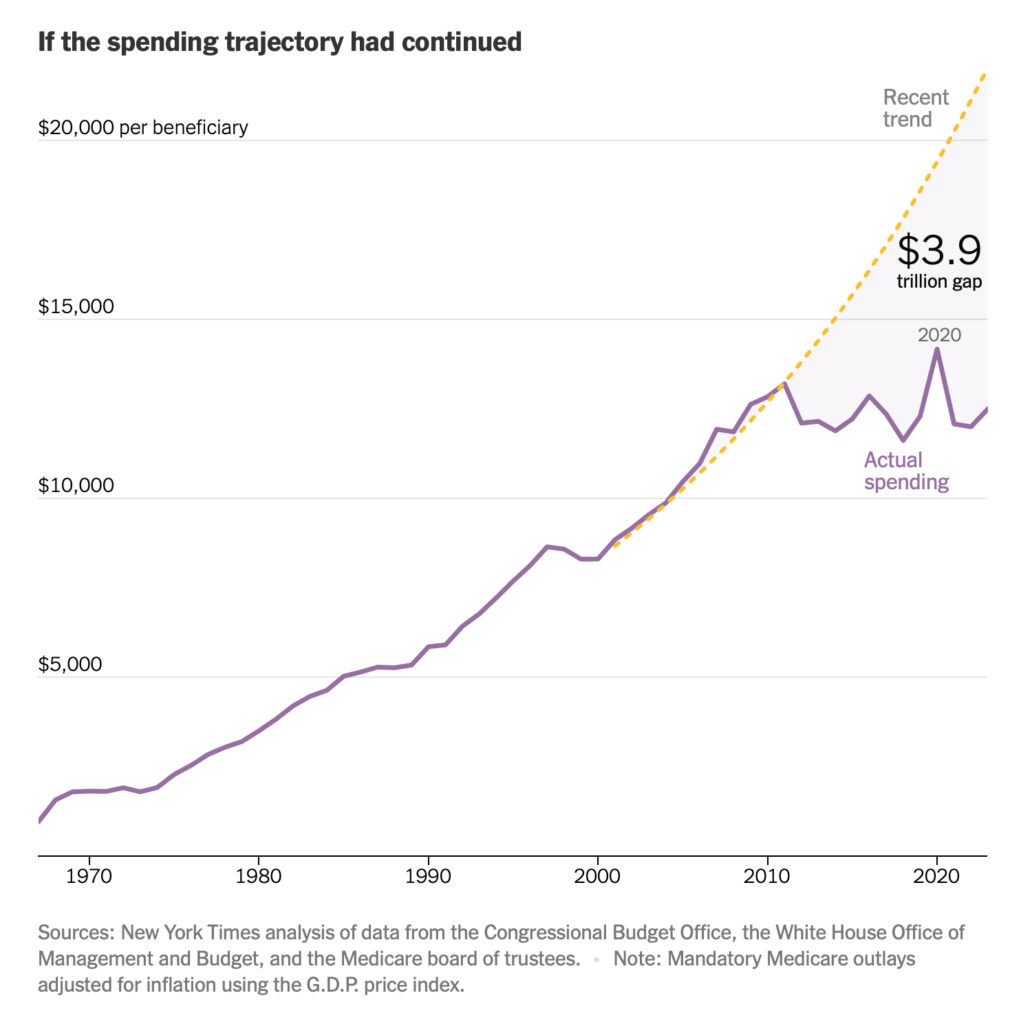

For decades, runaway Medicare spending was the story of the federal budget.

Now, flat Medicare spending might be a bigger one.

Something strange has been happening in this giant federal program. Instead of growing and growing, as it always had before, spending per Medicare beneficiary has nearly leveled off over more than a decade.

The trend can be a little hard to see because, as baby boomers have aged, the number of people using Medicare has grown. But it has had enormous consequences for federal spending. Budget news often sounds apocalyptic, but the Medicare trend has been unexpectedly good for federal spending, saving taxpayers a huge amount relative to projections.

….

Some of the reductions are easy to explain. Congress changed Medicare policy. The biggest such shift came with the Affordable Care Act in 2010, which reduced Medicare‘s payments to hospitals and to health insurers that offered private Medicare Advantage plans. Congress also cut Medicare payments as part of a budget deal in 2011.

But most of the savings can’t be attributed to any obvious policy shift. In a recent letter to the Senate Budget Committee, economists at the Congressional Budget Office described the huge reductions in its Medicare forecasts between 2010 and 2020. Most of those reductions came from a category the budget office calls “technical adjustments,” which it uses to describe changes to public health and the practice of medicine itself.

Older Americans appear to be having fewer heart attacks and strokes, the likely result of effective cholesterol and blood pressure medicines that became cheap and widely used in recent years, according to research from Professor Cutler and colleagues. And drug makers and surgeons haven’t developed as many new blockbuster treatments recently — there has been no new Prozac or angioplasty to drive up spending. (Medicare is currently barred by statute from covering the new class of expensive anti-obesity drugs.)

….

Medicare may even wind up saving money because of Covid-19 — because the older Americans who died from the disease tended to have other illnesses that would have been expensive to treat if they had survived, according to an analysis from the Medicare actuary.

Author(s): Sanger-Katz, Margot; Parlapiano, Alicia

Publication Date: 5 Sept 2023

Publication Site: NY Times