Excerpt:

Connecticut has made history as the first state to implement a baby bonds program — fully funded for 12 years of babies.

The state will invest $3,200 for each baby covered by HUSKY, the state’s Medicaid program – that’s about 15,000 babies a year and a whopping 36% of the state’s children. Kids are automatically enrolled; no action is required. Upon reaching adulthood (18-30), participants can claim funds for specific wealth-and-opportunity-building purposes like higher education, a home purchase, or starting a business in the state. To receive the funds, they have to be Connecticut residents and need to complete a financial literacy course (hopefully not one funded by self-serving Wall Street firms). The initial $3,200 investment is anticipated to grow to $11,000 – $24,000, depending on when claims are filed.

Turning the idea of baby bonds into reality was a rocky road: the Democratic-led Connecticut General Assembly passed the bill in 2021, championed by former Democratic Treasurer Shawn Wooden. However, Governor Lamont and his team initially opposed the program’s funding, citing concerns over borrowing more than $50 million annually. Internal conflict heated up, as revealed in a January 2023 investigation by the Connecticut Mirror, exposing tensions between Wooden and the governor’s staff. Yet, following the publication, the situation took an unexpected turn. The program became a reality.

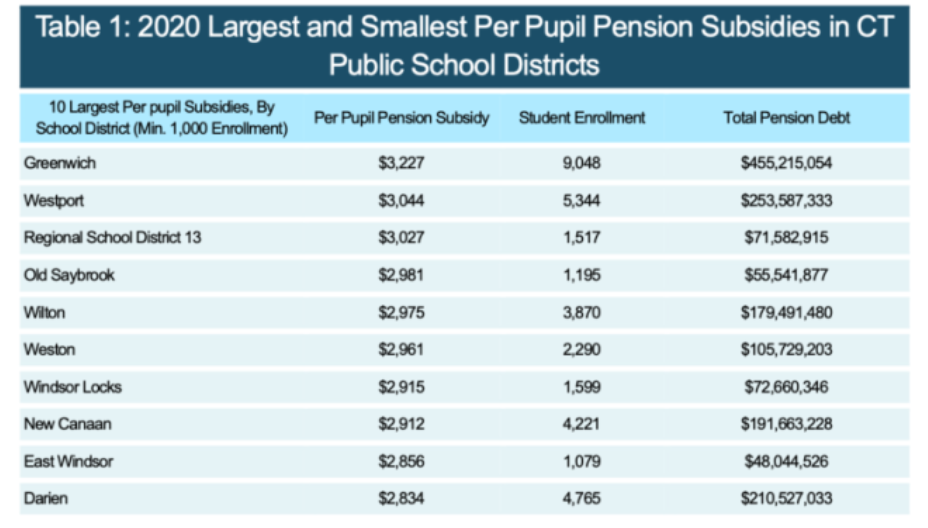

The sticking point of funding was solved by a plan to use a $393 million reserve fund established in 2019 during the restructuring of the state’s cash-strapped pension fund for municipal teachers. Originally designed to cover shortfalls in pension fund contributions, this reserve could be repurposed. To safeguard the pension system and meet ratings agencies’ requirements, a $12 million insurance policy was necessary, leaving approximately $381 million available for investment in the baby bonds program.

Author(s): Lynn Parramore

Publication Date: 27 Feb 2024

Publication Site: Institute for New Economic Thinking