Link: https://www.youtube.com/watch?v=IPYSSZkP-Oo&ab_channel=RStreetInstitute

Video:

Description:

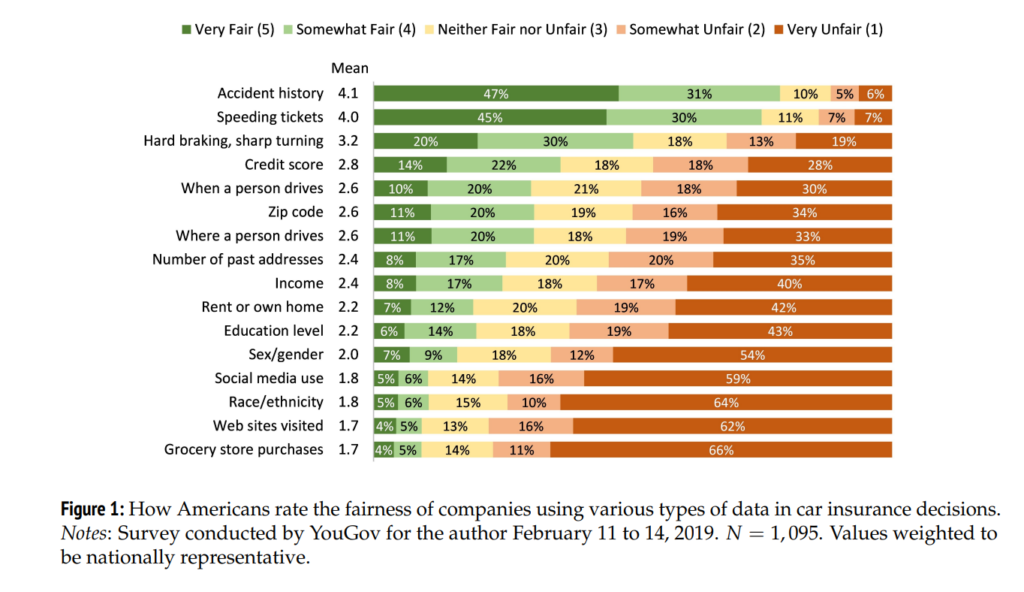

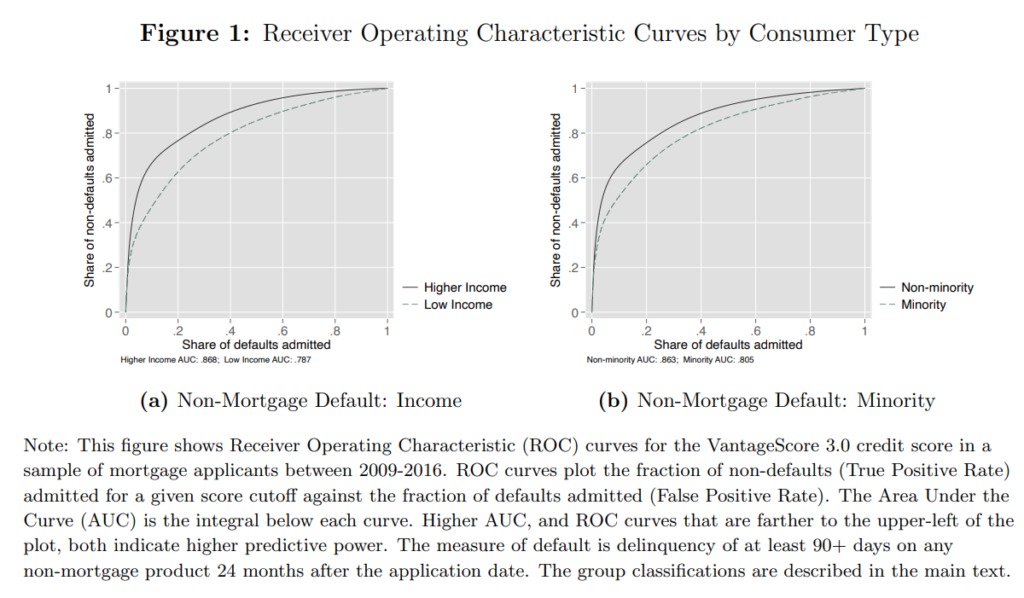

The insurance industry is unique in that the cost of its products—insurance policies—is unknown at the time of sale. Insurers calculate the price of their policies with “risk-based rating,” wherein risk factors known to be correlated with the probability of future loss are incorporated into premium calculations. One of these risk factors employed in the rating process for personal automobile and homeowner’s insurance is a credit-based insurance score.

Credit-based insurance scores draw on some elements of the insurance buyer’s credit history. Actuaries have found this score to be strongly correlated with the potential for an insurance claim. The use of credit-based insurance scores by insurers has generated controversy, as some consumer organizations claim incorporating such scores into rating models is inherently discriminatory. R Street’s webinar explores the facts and the history of this issue with two of the most knowledgeable experts on the topic.

Featuring:

[Moderator] Jerry Theodorou, Director, Finance, Insurance & Trade Program, R Street Institute

Roosevelt Mosley, Principal and Consulting Actuary, Pinnacle Actuarial Services

Mory Katz, Legacy Practice Leader, BMS GroupR Street Institute is a nonprofit, nonpartisan, public policy research organization. Our mission is to engage in policy research and outreach to promote free markets and limited, effective government.

We believe free markets work better than the alternatives. We also recognize that the legislative process calls for practical responses to current problems. To that end, our motto is “Free markets. Real solutions.”

We offer research and analysis that advance the goals of a more market-oriented society and an effective, efficient government, with the full realization that progress on the ground tends to be made one inch at a time. In other words, we look for free-market victories on the margin.

Learn more at https://www.rstreet.org/

Follow us on Twitter at @RSI

Author(s): Jerry Theodorou, Roosevelt Mosley, Mory Katz

Publication Date: 4 April 2022

Publication Site: R Street at YouTube