Graphic:

Excerpt:

* The pension fund holds much more of its money in cash than other comparable state pension funds and more than its allocation policy suggests. State Treasurer Dale Folwell routinely overrides the policy to prevent “rebalancing.”

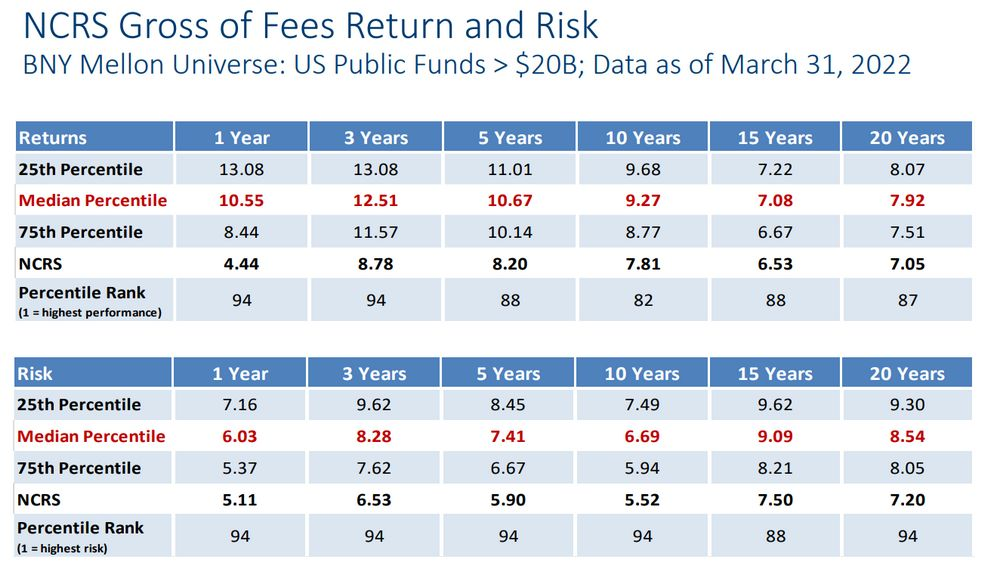

* Folwell emphasizes steeling the pension plan against stock market downturns. That’s led to the plan missing out on the big stock market gains of the last few years. Returns for the state pension fund are far lower than comparable public pension funds.

* Folwell repeatedly liquidated stock to shift money to bonds and cash.

*He has lowered the pension fund’s assumed rate of return in stages, which means the state and local governments have had to increase their contributions.

Author(s): Lynn Bonner

Publication Date: 5 August 2022

Publication Site: NC Policy Watch