Link: https://thehill.com/homenews/senate/591378-salt-change-likely-to-be-cut-from-bill-say-senate-democrats

Graphic:

Excerpt:

Senate Democrats say a proposal to raise the cap on state and local tax (SALT) deductions, a top priority of Senate Majority Leader Charles Schumer (D-N.Y.), is likely to be cut from the revised Build Back Better Act.

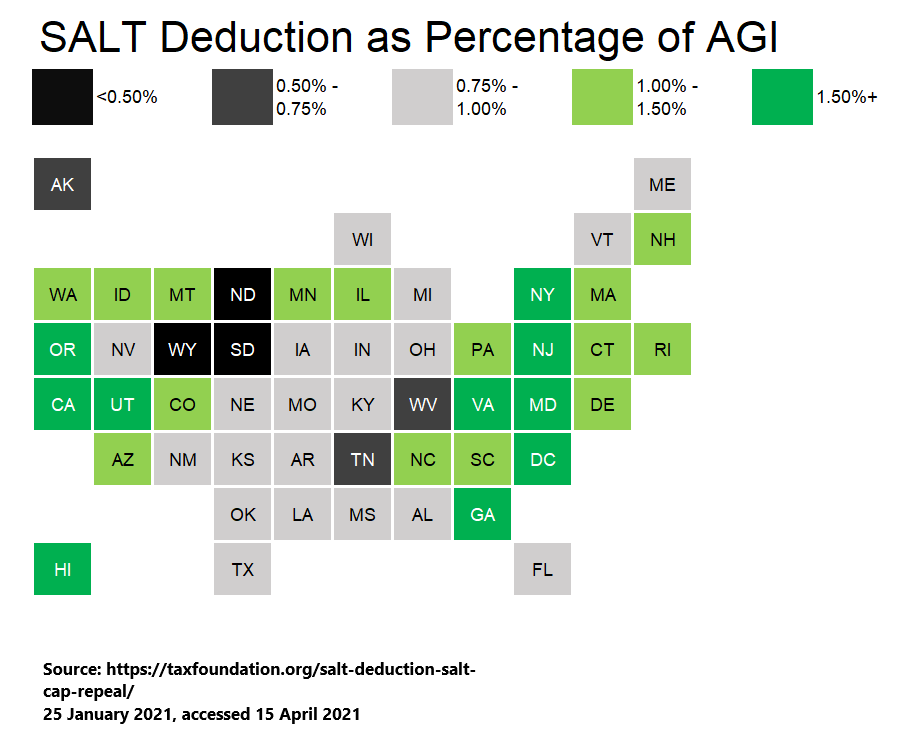

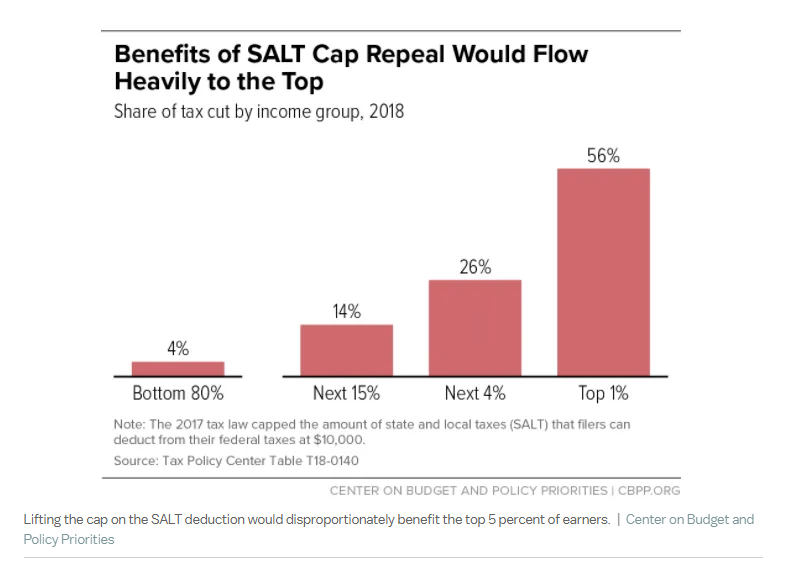

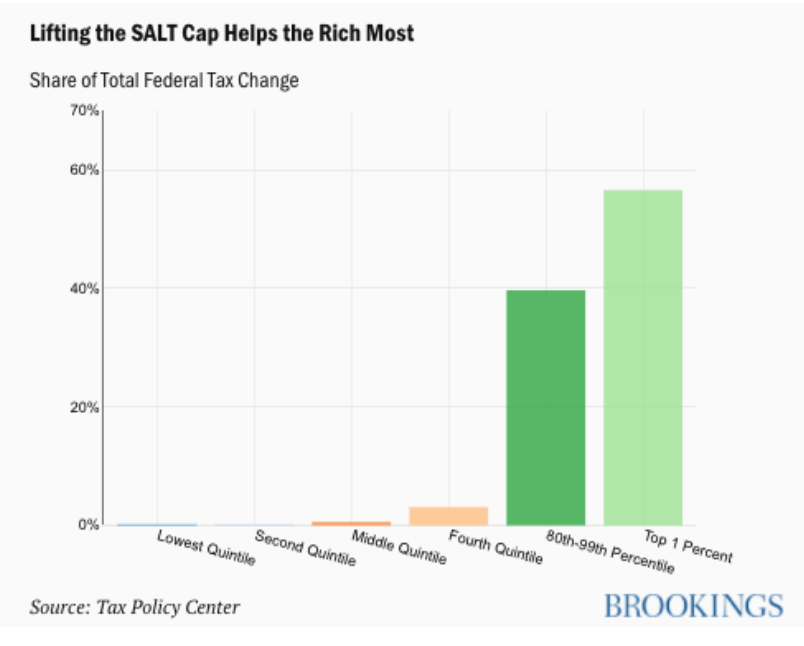

Senate Democrats who were involved in negotiations over the bill before Sen. Joe Manchin (D-W.Va.) blew it up last month say there’s simply not enough room for the expensive tax change, which Republicans argue would benefit wealthy suburban households in blue states.

….

Pulling the SALT fix out of the legislation also will make it tougher to pass the legislation through the House, where last week three Democrats from New York and New Jersey insisted they won’t support any bill that doesn’t raise the $10,000 cap former President Trump imposed on SALT deductions in 2017.

….

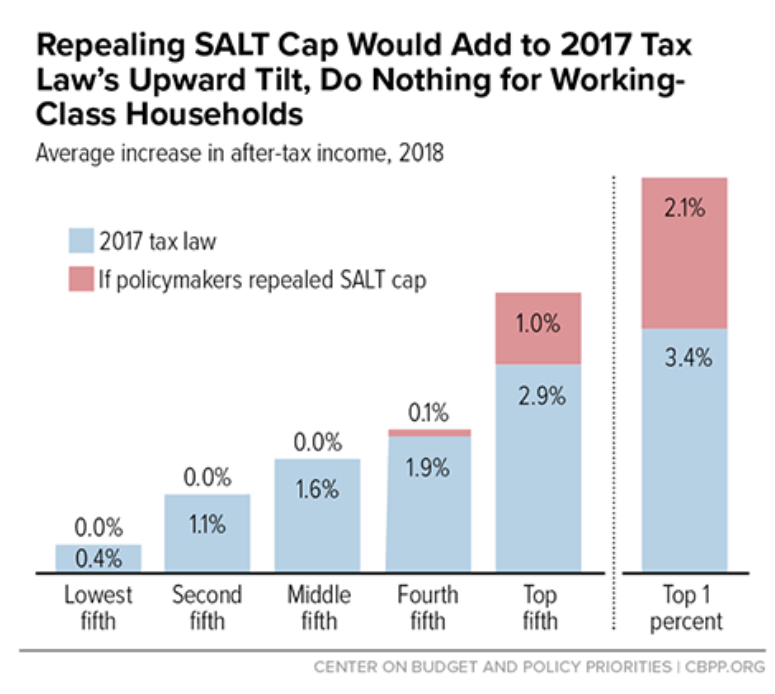

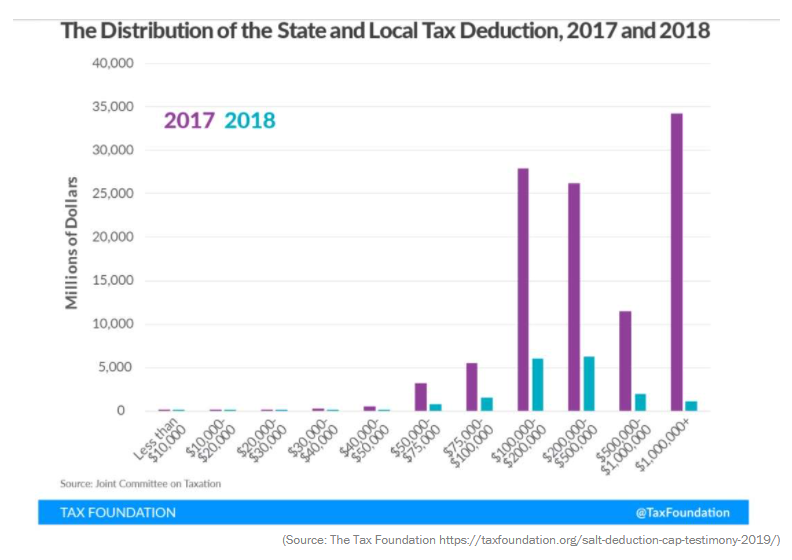

“The problem that the Democrats have here is not only does SALT relief cost a lot of money, but it is extremely regressive,” Gleckman said. “We looked at a number of versions of this. We looked at an $80,000 cap, we looked at a $25,000 cap, we looked at a $400,000 phaseout … and there are real significant differences, but all of them are extremely distributionally regressive. All of them largely benefit the highest-income people, no matter how you do it.”

Middle-income individuals and families hardly see any benefit because the vast majority of them do not itemize deductions.

Author(s): Alexander Bolton

Publication Date: 26 Jan 2022

Publication Site: The Hill