Link: https://www.cato.org/regulation/winter-2023-2024/will-actuaries-come-clean-public-pensions

Graphic:

Excerpt:

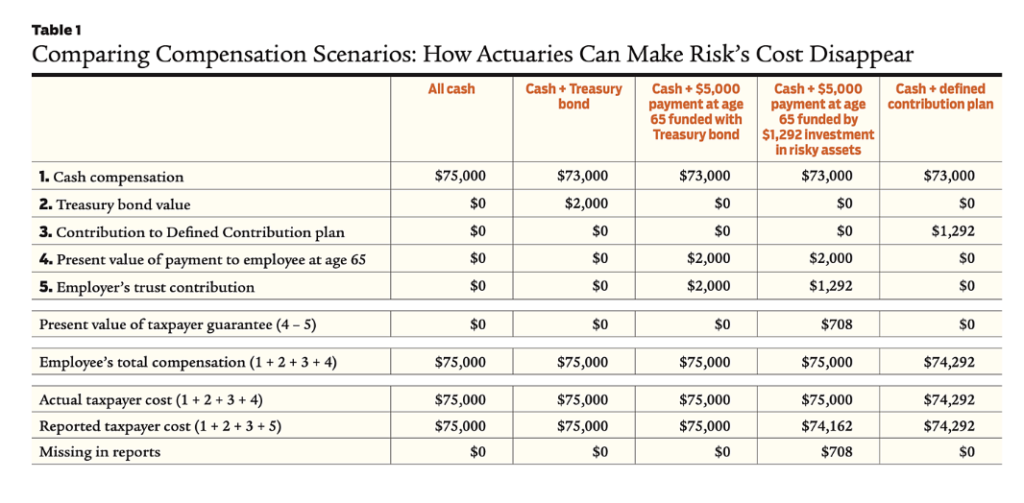

To appreciate the significance of using inappropriate discounting, consider this example: A 45‐year‐old public sector employee earns $75,000 per year with no pension plan or other benefits. To help secure her retirement, her employer considers changing her compensation to $73,000 in salary plus a U.S. Treasury zero‐coupon bond that pays $5,000 in 20 years. The bond is selling in the market at $2,000. The Treasury bond’s implicit annual “discount rate” is thus 4.69 percent, i.e., $2,000 plus 4.69 percent interest compounded for 20 years equals $5,000.

The total compensation cost to the employer would remain $75,000. The employee, in turn, has three options:

- She can sell the bond and be in an identical position as before.

- She can accept her employer’s nudge and keep the bond until retirement.

- She can sell the bond and invest the $2,000 in other assets, e.g., stocks, in the hope of generating additional retirement income, albeit taking the risk that she may end up with less than $5,000.

Now suppose the public employer decides to be more paternalistic. Instead of giving the employee the Treasury bond worth $2,000, it promises her that in 20 years it will pay her $5,000. To fund this liability, the employer could deposit the $2,000 in a trust and have the trust buy the Treasury bond. The promise would then be fully funded by the trust. In 20 years, the Treasury bond would be redeemed for $5,000 and the proceeds forwarded to the employee. In the intervening 20 years, before the bond redemption and payment to the employee, the value of the future payment would increase with the passage of time, and increase (or decrease) as market interest rates decrease (or increase). But the value of the bond held in the trust would change identically to the liability, and the contractual obligation to pay $5,000 at age 65 would remain fully funded at every instant until paid, regardless of what happens in financial markets. Ignoring frictional costs and taxes, the employer’s cost of those actions would be the same as if it had paid the employee $75,000 in cash. And the employee’s total compensation would still be $75,000: $73,000 in cash plus a promise worth $2,000.

But instead of contributing the $2,000 and using it to buy the bond, the public employer could hire a public pension actuary and invest any trust contributions in a “prudent diversified” portfolio including assets, like equities, exposed to various market risks. The actuary would attest that the “expected” annual earnings of the portfolio over the long term is 7 percent (according to a sophisticated financial model). The actuary would then use the 7 percent to discount the $5,000 future payment and certify that the “cost” to the employer is $1,292, which is 35 percent less than the $2,000 cost of the Treasury bond. The actuary would certify that if the employer contributes the $1,292, its benefit obligation is “fully funded” because, if the trust earns the “expected return” of 7 percent (50 percent probable, after all), the $1,292 will accumulate to $5,000 in 20 years. The public employer can then claim it has saved taxpayers $708 ($2,000 – $1,292) by investing in a prudent diversified asset portfolio.

The question is, does it really cost only $1,292 to provide the same value as a $2,000 Treasury bond? Is $1,292 invested in the riskier portfolio worth the same as a Treasury bond that costs $2,000? Of course not. If it is possible to spin $1,292 of straw into $2,000 of gold, why would the government employer stop at pensions? Why not borrow as much as possible now and invest the proceeds in a prudent diversified portfolio expected to earn 7 percent and use the “expected” gains from taking market risk to pay for future general government expenditures?

The public employer is providing a benefit worth $2,000—a guarantee—and hoping to pay for it with $1,292 invested in a risky portfolio. The $708 difference represents the value of the guarantee that taxpayers will make good on any shortfall when the $5,000 comes due. The cost to taxpayers in total is still $2,000, but $708 is being taken from future generations by the current generation in the form of risk. Risk is a cost (precisely $708 in this example). Its price reflects the possibility as viewed by the market that future taxpayers ultimately may have to pay nothing at all if things go well, or a significant sum if they don’t.

Suppose the employer takes this logic one step further and, rather than promising $5,000 in 20 years, it contributes $1,292 to a defined contribution plan that invests in the same prudent diversified portfolio on the theory that the employee will be breaking even because the $1,292 is “expected” to accumulate to $5,000. The employee would be correct to view that as a cut in pay. The $708 cost of risk is shifted to the employee, reducing her compensation, instead of being borne by future taxpayers as in the case of the defined benefit plan.

The employee might complain. Future taxpayers cannot.

The only way for the employer to keep the employee whole with $73,000 of cash compensation plus a defined contribution plan is to contribute $2,000 to the plan. Whether it is invested in the Treasury bond or in riskier assets in the hope of higher returns, the value of her total compensation would still be $75,000.

Table 1 summarizes all these scenarios. The fourth column is the analog of public pension plans. Both the reported annual cost for the future $5,000 payment ($1,292) and the reported total compensation ($74,292) are understated. Investment professionals are paid well for managing risky assets for which high expected returns can be claimed. The actuary collects a fee. The employee has the value of the guarantee and bears none of the market risk being taken. Along with a happy employee, the public employer gets to report an understated compensation cost, freeing up money for other budget items. It’s good for all involved—except for the taxpayers on the hook for $708 in costs hidden by using the 7 percent discount rate.

Author(s): Larry Pollack

Publication Date: Winter 2023-2024

Publication Site: Cato Regulation