Link: https://elements.visualcapitalist.com/ranked-the-u-s-banks-with-the-most-uninsured-deposits/

Graphic:

Excerpt:

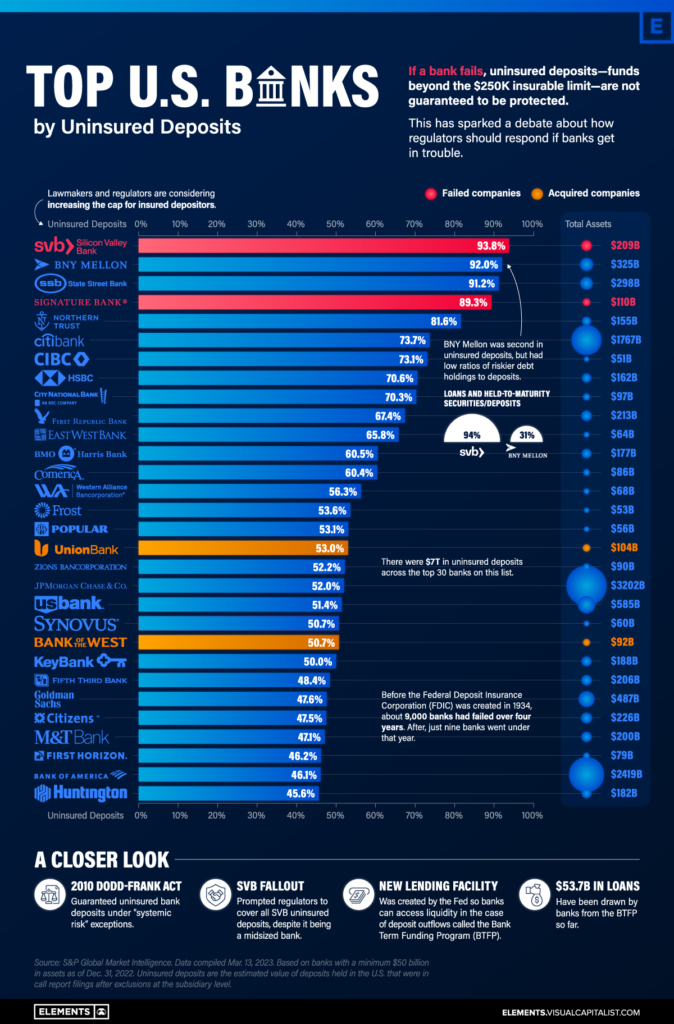

Today, there is at least $7 trillion in uninsured bank deposits in America.

This dollar value is roughly three times that of Apple’s market capitalization, or about equal to 30% of U.S. GDP. Uninsured deposits are ones that exceed the $250,000 limit insured by the Federal Deposit Insurance Corporation (FDIC), which was actually increased from $100,000 after the Global Financial Crisis. They account for roughly 40% of all bank deposits.

In the wake of the Silicon Valley Bank (SVB) fallout, we look at the 30 U.S. banks with the highest percentage of uninsured deposits, using data from S&P Global.

Author(s): Dorothy Neufeld, Sabrina Lam

Publication Date: 4 April 2023

Publication Site: Visual Capitalist