Excerpt:

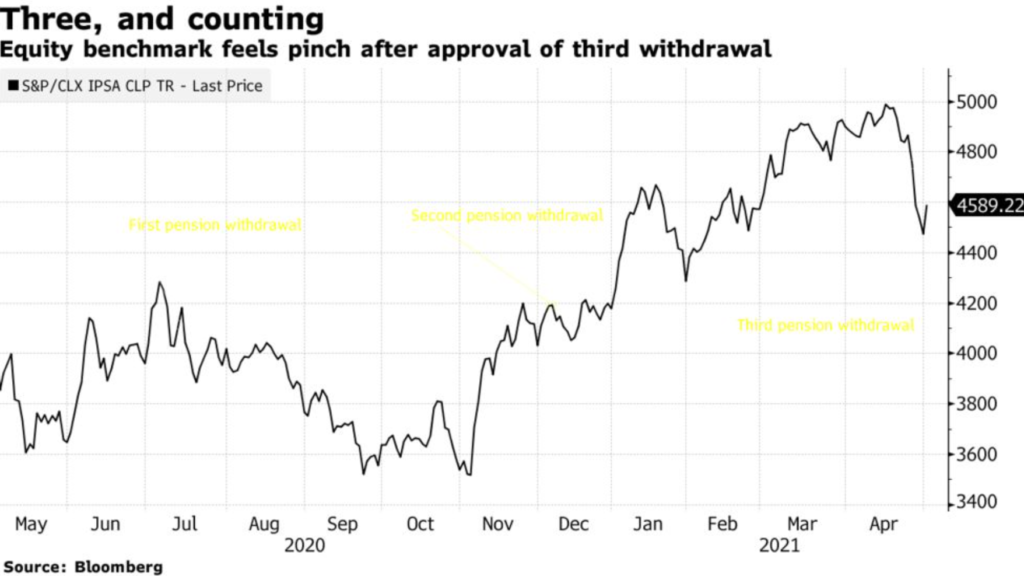

Peru, Chile and Bolivia have allowed early withdrawals from their funds as a source of relief for households and to support recoveries during the pandemic and the global price shock. But these have had negative financial and confidence ramifications, contributing to downgrades of Peru in 2021 and Chile in 2020. Longstanding private pension funds have been important supports for sovereign creditworthiness where they exist in Latin America.

….

Peru’s Congress approved a sixth withdrawal from private pension funds in May. Prior rounds due to the pandemic led to withdrawals of USD17.8 billion or 8% of 2021 GDP. In Chile, a fourth withdrawal proposal failed in April 2022, but Chileans have already withdrawn about USD50 billion (16% of 2021 GDP) in 2020-2021. Bolivia allowed early withdrawals once in 2021 for more limited amounts (0.4% of 2021 GDP).

Publication Date: 1 June 2022

Publication Site: Fitch Ratings