Link: https://www.casact.org/sites/default/files/2021-03/9_Panning.pdf

Graphic:

Excerpt:

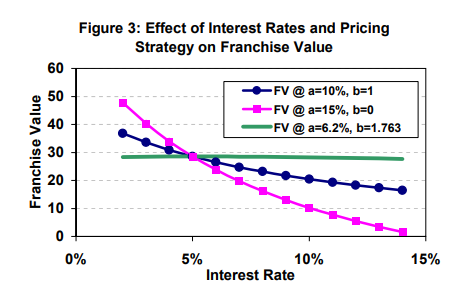

Fortunately, there is a solution to the dilemma just posed. It

consists in adopting a pricing strategy that substantially alters the

sensitivity of a firm’s total economic value to changes in interest

rates. In the example give earlier, where

a = 15% and

b = 0, the

duration of the firm’s franchise value and total economic value are

17.62 and 6.70, respectively. But suppose we alter the firm’s

pricing policy by changing these parameters to

a = 10% and

b = 1.

In this case the target return on surplus remains at 15% (given that

the risk-free yield remains at 5%), but the durations change from

17.62 to 7.62 for franchise value, and from 6.70 to 3.27 for total

economic value. The key insight here is that a firm’s pricing

strategy can significantly affect the duration of its franchise

value and, consequently, the duration of its total economic

value.This insight suggests a more systematic approach to managing the

duration of total economic value: find a combination of the

strategy parameters

a and

b such that the return on surplus and the

duration of total economic value are both acceptable. This can be done either by systematic numerical search or by constrained optimization procedures. For example, if the firm in our example

wanted a target return on equity of 15% but a total economic value with a duration of zero, it should implement a pricing strategy with the parameters

a = 6.2% and

b = 1.763 to achieve

those objectives. The consequences of this and the two previously

mentioned pricing strategies are shown in Figure 3 for the three

different pricing strategies just described.

Author(s): William H. Panning

Publication Date: 2006

Publication Site: Casualty Actuarial Society (for exams)