Excerpt:

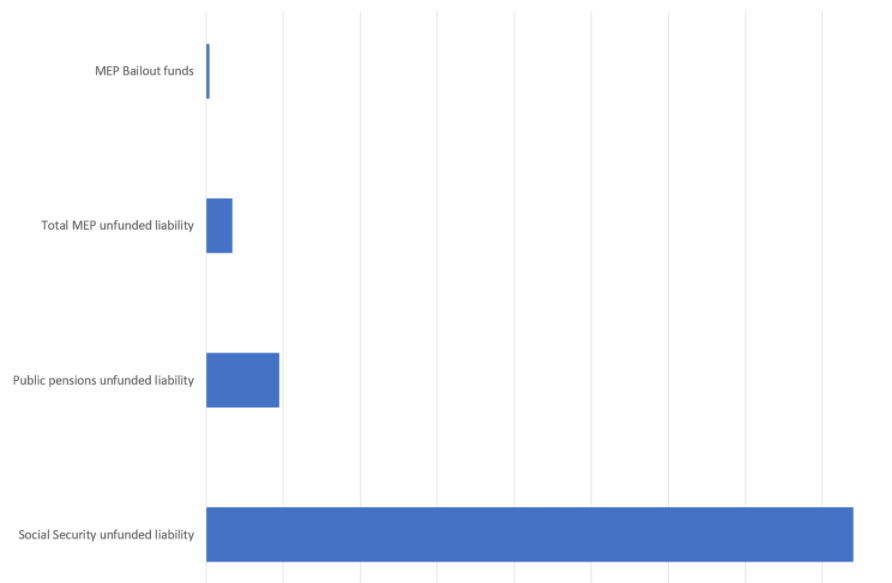

This year, Social Security’s deficit is unusually high due to lower revenues and higher benefits: 1.75%. In 2040, the deficit climbs to 3.70% rather than 3.54%. In 2080, the deficit stands at 4.87% rather than 4.59%.

Put another way, if there were no Trust Fund accounting mechanism now, the OASI program would have been able to pay 93% of benefits. This would drop to 76% in 2035 – 2040 – 2045, then drop further to being able to pay 70% of benefits.

What’s more, this year, the actuaries changed several assumptions. They assume that by the year 2036, fertility rates will increase to 2.00 children per woman, an increase from the 2020 report’s assumption of 1.95. They also assume a long-term unemployment rate of 4.5% rather than 5%. At the same time, they calculate alternate projections with more pessimistic assumptions, including a continuingly low fertility rate (1.69), a higher rate of mortality improvement (that is, longer-lived recipients), a higher rate of unemployment (5.5%), and others. In these alternate calculations, the 2040 deficit becomes 6.47% rather than 3.7% (benefits 64% payable), and the 2080 deficit becomes 12.39% rather than 4.87% (benefits 50% payable).

Also consider that, at the moment, there are 2.7 workers for each Social Security recipient (2.8 in 2020). This is forecast to drop to 2.2 in 2040 and ultimately down to 2.1. But if the population trends are those of the pessimistic scenario, then that 2.1 would drop to 1.5 by the year 2080.

Author(s): Elizabeth Bauer

Publication Date: 1 September 2021

Publication Site: Forbes