Excerpt:

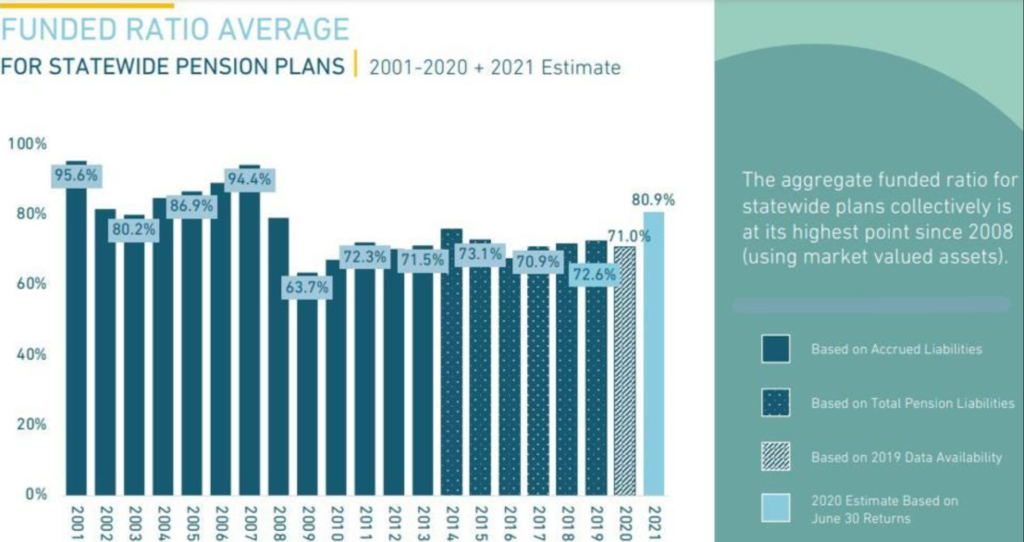

Back on July 18, the Equable Institute released the 2023 version of its annual State of Pensions report, which means that, yes, it’s time for another check-in on these infamously-poorly-funded pension plans. Among the wealth of tables is a list of the best and worst-funded of the 58 local pension plans studied, and, yes, you guessed it, the bottom five spots are Chicago plans, with the bottom three at levels far below all others:

- Municipal employees, 21% funded,

- Chicago police, 21.8% funded, and

- Chicago fire, 18.8% funded.

Combined with the Chicago Laborers’ pension fund, with a 41% funded status, the pensions for which the city bears a direct responsibility have a total pension debt on a market value of assets basis of $35 billion. (This data is from the actual reports*, released in May, which doesn’t match the Equable report precisely.) Spot fifth-worst is taken up by the Chicago Teachers, at 42.4% funded, and the first non-Chicago system in their list, Dallas Police & Fire at 45.2%, is twice as well funded, percentage-point-wise, as the Terrible Trio.

…..

What’s more, Ralph Martire and his Center for Tax and Budget Accountability continue to promote what he calls “reamortization” as a solution to the problem, both through an April Chicago Sun Times commentary and through the release of a report, “Understanding – and Resolving Illinois’ Pension Funding Challenges” (which is an update of a prior proposal). This proposal, which is directed at Illinois pensions but is clearly meant based on other comments to be an all-purpose fix, sounds innocuous, as merely a sort of “refinancing” as one might with a mortgage, but it’s really much more as he proposes to

- Reduce the funded status target from 90% to 80%, based on the claim that the GAO deems this funded status to be the right target for a “healthy” plan (whether he deliberately misleads or not, he is wrong here, the National Association of State Retirement Administrators or NASRA clearly explained more than a decade ago that 100% funding is always the right target and the only significance of an 80% level is that private sector pension law requires plans funded less than 80% to take immediate corrective action rather than have a long-term funding schedule, and the American Academy of Actuaries more explicitly calls this a “myth”);

- Issue large sums of Pension Obligation Bonds, which were questionable already when they first began promoting this but are now a terrible idea with our current high bond rates, all the more so for a low-credit-rating city such as Chicago; and

- Move contributions from last day of the fiscal year to the first day, which he argues would be a gain of a year’s investment return while forgetting that it requires the city to have this money on Day 1 and forgo the other uses it would have.

Author(s): Elizabeth Bauer

Publication Date: 1 Aug 2023

Publication Site: Forbes