Graphic:

Excerpt:

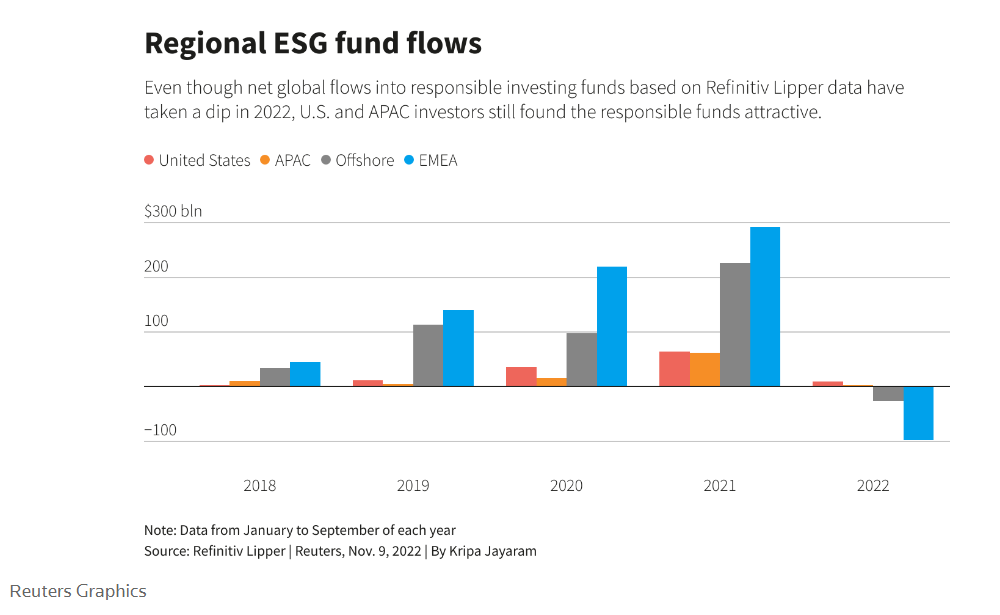

Funds adhering to environmental, social, and corporate governance (ESG) principles have been hit by unprecedented outflows in the market downturn, as investors prioritize capital preservation over goals such as tackling climate change.

ESG, a classification applied to fund assets currently worth an estimated $6.5 trillion, is being tested by a drop in market values fuelled by concerns that central banks hiking interest rates to fight rampant inflation will trigger an economic recession.

Investors souring on ESG funds could pose a challenge to governments seeking to enlist them in the fight against climate change. Policymakers at the COP27 climate talks in Egypt are trying this week to secure more financing from the private sector to help lower carbon emissions.

Data from research service Refinitiv Lipper shows that funds of equities, debt and other asset types dedicated to responsible investing posted net outflows globally of $108 billion this year to the end of September, the first time investors withdrew money from them over such a long period since Refinitiv started tracking them in late 2017.

Author(s): Isla Bennie, Ross Kerber

Publication Date: 11 Nov 2022

Publication Site: Reuters