Link: https://www.banking.senate.gov/hearings/current-issues-in-insurance

Excerpt: https://www.banking.senate.gov/imo/media/doc/Brown%20Statement%209-8-22.pdf

Statement from Chair Sherrod Brown (D-OH)

Every American needs insurance – whether it’s auto insurance to protect us when we’re on the

road, or homeowners’ insurance to protect the biggest investment for most families, or life

insurance to cement your family’s financial security in the event of a tragedy.

It’s our job to make sure that the industry is protecting Americans’ hard-earned money – not

putting it at risk.

American insurance companies are regulated by state insurance commissioners. The state-based

system of insurance regulation is historic, and ensures local markets and needs are taken into

consideration.

The National Association of Insurance Commissioners coordinates state commissioners across

all jurisdictions, to identify and address risks to the entire system.

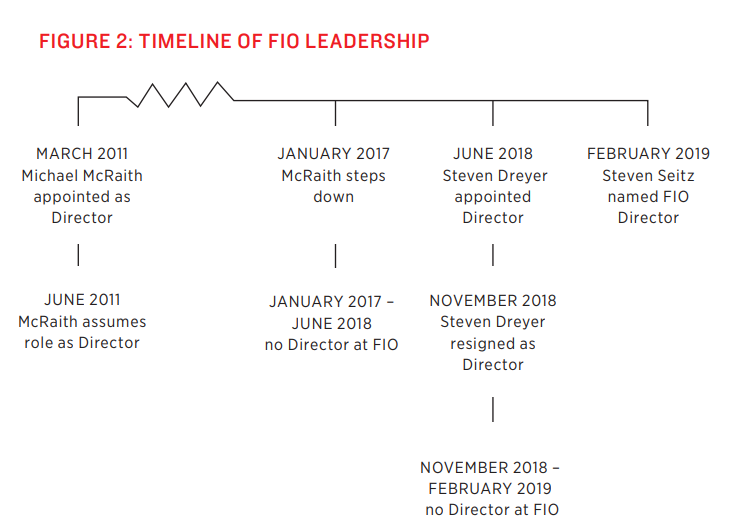

In the Wall Street Reform Act, Congress created the Federal Insurance Office within the

Treasury Department to promote national coordination in the insurance sector. It’s common

sense – insurers operate across all state jurisdictions and internationally.

I’m pleased to have both the Maryland Commissioner Kathleen Birrane on behalf of the NAIC,

and Director Seitz of FIO testify today.

If we’re going to keep Americans’ hard-earned money safe, it is more important than ever that

they work together.

Today we’ll explore many important topics.

For example, three months ago, Lockheed Martin transferred $4.3 billion of its pensions to

Athene Holding – an insurance holding company specializing in life insurance and owned by the

private equity firm, Apollo Global Management.

Overnight, Lockheed Martin employees and retirees were notified that their pensions would be

managed by Athene and no longer governed by ERISA or the Pension Benefit Guaranty

Corporation.

This is just one recent example of private equity giants’ expansion into people’s pensions and the

insurance industry.

We know that workers end up worse off when Wall Street private equity firms get involved.

We’ve seen it over and over, in industry after industry.

In March, I asked the NAIC and FIO to look into private equity’s expansion into similar pensionrisk transfer transactions. We need to understand the risks to workers whose financial security

depends on pension and retirement programs.

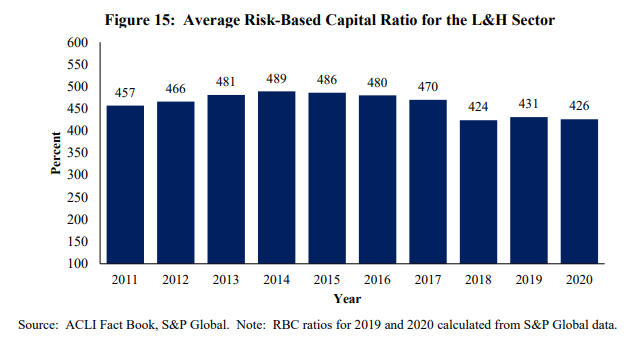

The NAIC and FIO provided thoughtful responses to my letter. The NAIC has been monitoring

the risk-taking behavior of private equity-owned insurers.

FIO has done similar work, and also looked at the wider interconnectedness of insurance and

reinsurance markets across the world. Those connections have added to systemic risk concerns,

because U.S. insurance companies depend even more on the financial health of insurance

companies outside the U.S.

Taken together, our insurance authorities are focused on these emerging and complex risks to

safeguard our economy.

Our communities and families rely on insurance companies to protect their loved ones, their

homes, small business, and so many parts of our lives. We can’t ignore when risks build up, or

firms behave irresponsibly.

And we know who always pays the price when they do. It’s not insurance executives. It’s not

private equity executives. It’s not Wall Street.

It’s workers and their families. And it’s taxpayers, who were forced to bail out AIG 15 years ago.

That should never happen again.

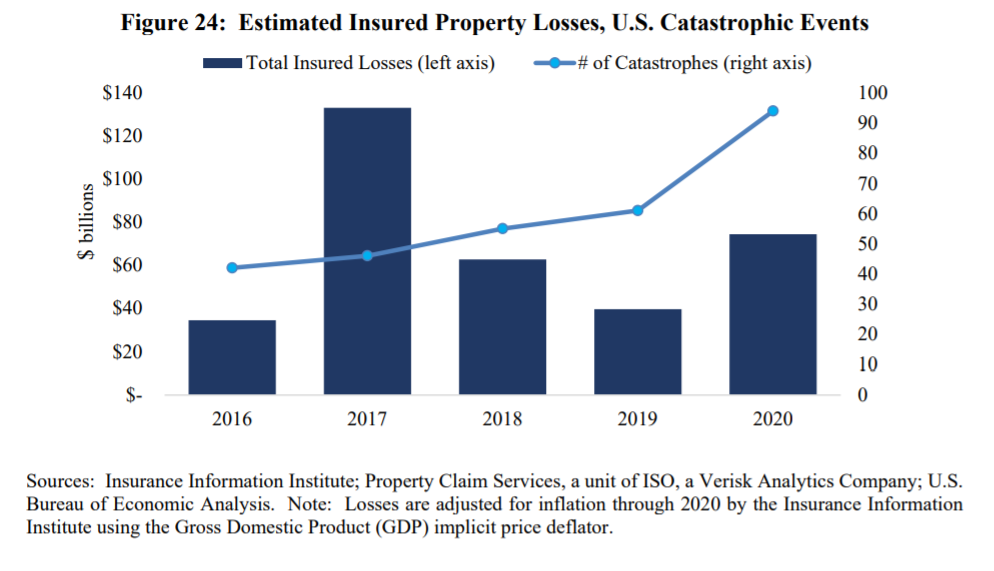

That also means looking around the corner to make sure the industry and agencies are prepared

for risks as they develop. As more Americans face increasingly severe climate catastrophes like

wildfires and hurricanes each year, we need to help communities prepare – and we need to

ensure insurance watchdogs and the companies they oversee are prepared.

In the aftermath of some of these natural disasters, we have seen instances where insurers either

raise prices or stop offering insurance altogether, leaving families and businesses struggling to

find affordable coverage as they rebuild their lives and communities.

We also know this industry has a long history of racial discrimination, just like so many big

industries.

Black and brown families face more difficulty in getting insurance across the board. We’ve seen

this happen in auto insurance.

Earlier this year, The New York Times also reported that customers, insurance agents, and

employees sued State Farm for discrimination in the workplace and in paying out claims.

My colleague Chairwoman Waters has been working on learning more about this as well. Her

committee recently requested information about large life and P&C insurers’ involvement in

financing chattel slavery.

And I’m glad FIO and NAIC are also working on this. NAIC is investigating through its Special

Committee on Race and Insurance.

And I look forward to reviewing FIO’s upcoming report on availability and affordability of auto

insurance, and hope it will shed more light on racial equity in accessing this insurance.

Finally, later this year, the International Association of Insurance Supervisors will meet to

consider whether the U.S. insurance system’s review of capital adequacy standards meets

international criteria.

Because we regulate insurance differently here in the U.S., where state and local markets and

international markets are served by the same companies, it’s important that representatives of the

U.S. system like FIO and the NAIC advocate for fair treatment by the international regulators.

And now that the Fed Vice Chair for Supervision has been confirmed, Michael Barr and the

offices testifying here today will get to work with our international counterparts in this process.

All of these issues show how critical the work of FIO and NAIC is to our economy’s health and

stability. I expect FIO and NAIC to prioritize monitoring these risks in their ongoing work.

Publication Date: 8 Sept 2022

Publication Site: COMMITTEE ON BANKING, HOUSING, AND URBAN AFFAIRS of the U.S. Senate