Graphic:

Excerpt:

The rating-based mapping was partially altered in 2010, when the NAIC enacted a regulatory change that essentially allowed insurance companies to report CLO tranches that were purchased at a discount, or highly impaired, in a lower NAIC category than that implied by the rating-based mapping. The new capital regime for CLO investments likely increased insurance companies’ incentives to invest in higher-yielding CLO tranches.

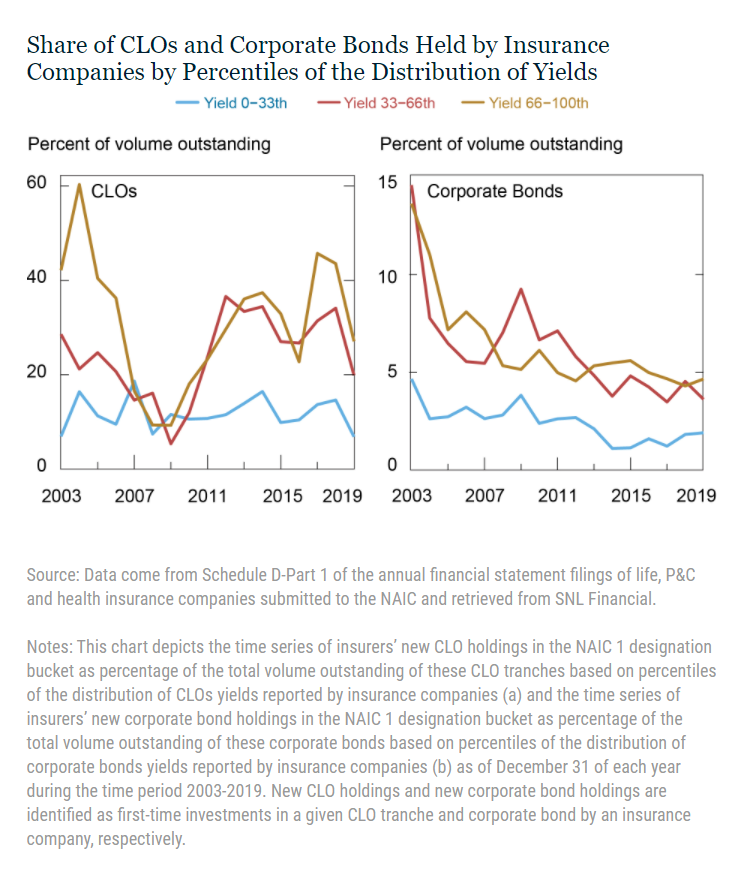

The following chart presents some evidence consistent with reach-for-yield behavior, particularly since the regulatory reforms of 2010. The left panel shows the time series of insurers’ new CLO holdings falling into the NAIC 1 designation as a percentage of the total volume outstanding of these tranches based on percentiles of the distribution of CLOs yields for each year. As expected, there is a clear preference for the riskiest tranches within NAIC 1 (those with yields above the 66th percentile) throughout the sample period, with the exception of the financial crisis, when all yields are squeezed at their minimum levels. Interestingly, the market shares of CLO tranches with yields above the 33rd percentile experience a sharp increase in the two years following the 2010 regulatory reform, then register a significant drop in 2019, when the reform was repealed. We do not find similar evidence in insurance companies’ corporate bond investments (right panel).

Author(s): Fulvia Fringuellotti, João A. C. Santos

Publication Date: 13 Oct 2021

Publication Site: Federal Reserve Bank of New York