Link: https://www.wsj.com/articles/fitch-downgrades-u-s-credit-rating-56c73b89?mod=hp_lead_pos1

Excerpt:

Fitch Ratings downgraded the U.S. government’s credit rating weeks after President Biden and congressional Republicans came to the brink of a historic default, warning about the growing debt burden and political dysfunction in Washington.

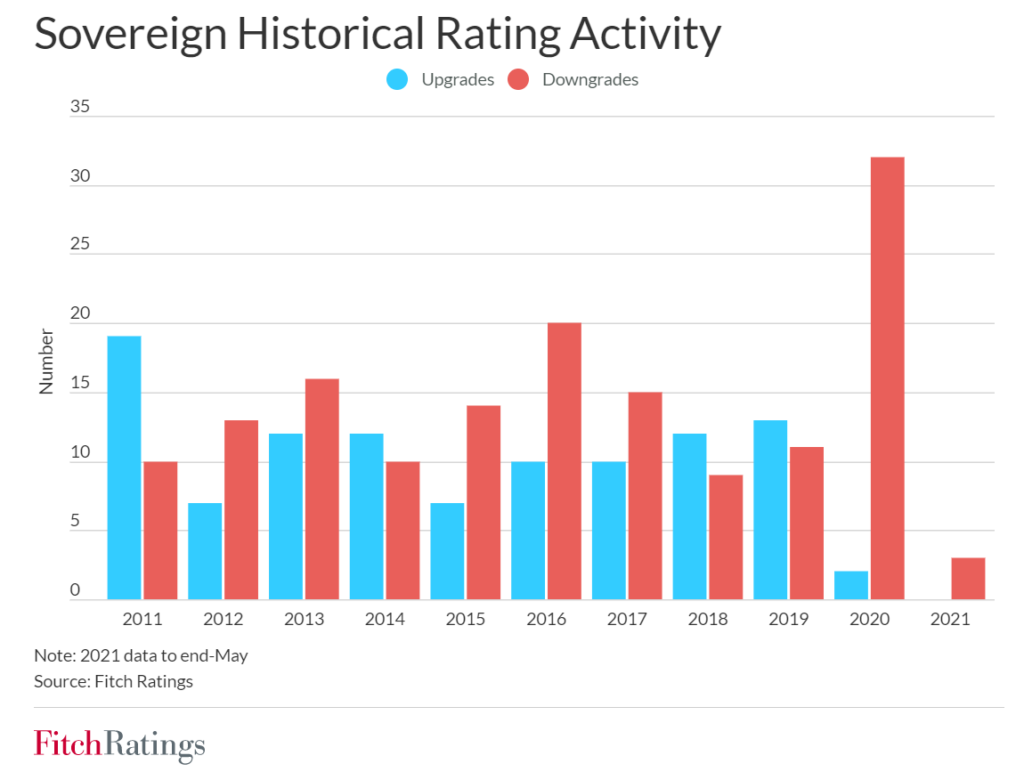

The downgrade, the first by a major ratings firm in more than a decade, is evidence that increasingly frequent political skirmishes over the U.S. government’s finances are clouding the outlook for the $25 trillion global market for Treasurys. Fitch’s rating on the U.S. now stands at “AA+”, or one notch below the top “AAA” grade.

….

Few investors believe that Fitch’s downgrade will immediately challenge that role. Still, it is the first time a ratings firm lowered its headline assessment of the U.S. government’s propensity to pay its bills on time since Standard & Poor’s in 2011 lowered its rating one notch below the top grade. That decision followed another tense debt-ceiling standoff in Congress.

Moody’s, the other member of the three big U.S. ratings firms, continues to give the U.S. its strongest assessment.

Fitch said Tuesday that the downgrade reflects an “erosion of governance” in the U.S. relative to other top-tier economies over the last two decades.

“The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management,” Fitch said.

Author(s): Matt Grossman and Andrew Duehren

Publication Date: 1 Aug 2023

Publication Site: WSJ