Link: https://protectpensions.org/2022/09/07/know-nfl-players-earn-pension-repost/

Excerpt:

In honor of the NFL season officially starting tomorrow, NPPC is re-sharing this blog originally posted on February 8, 2016, and written by Tyler Bond.

Last night the Denver Broncos won Super Bowl 50. For Denver’s starting quarterback Peyton Manning, this was almost certainly his last game before retirement. Once Manning enters retirement, there is one thing he can count on: his defined benefit pension.

NFL players participate in the Bert Bell/Pete Rozelle NFL Player Retirement Plan. NFL players are fully vested in the plan after three years on active roster or injured reserve status. The benefit amount is then based on the number of credited seasons played. In 2014 the average annual NFL player’s pension benefit was $43,000.

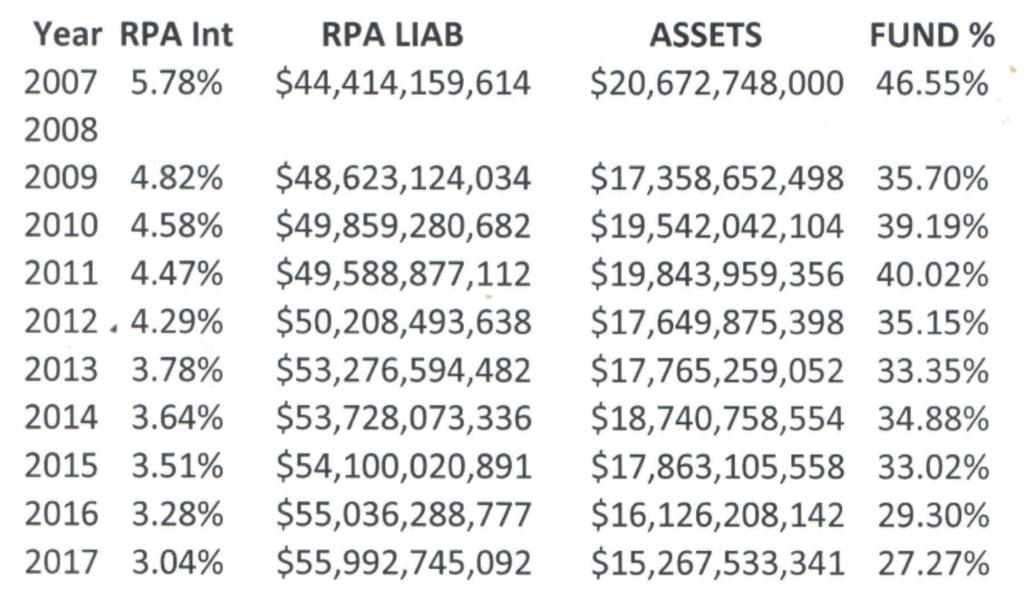

The NFL pension plan was funded at 55.9 percent in April 2014. This is a low funding ratio, but there’s a good reason for it. Following the lock-out in 2011 and the negotiation of a new collective bargaining agreement (CBA), the NFL Players’ Association fought for an increase in pension benefits for retired players. This took the plan down to a funded status of 48 percent in 2013, but the NFL has agreed to commit $620 million over ten years to reach full funding by 2021. The latest available data indicates the plan is funded at 89 percent as of 2018.

Author(s): Tyler Bond, reposted by ARIEL MCCONNELL

Publication Date: 7 Sept 2022

Publication Site: National Public Pension Coalition