Graphic:

Excerpt:

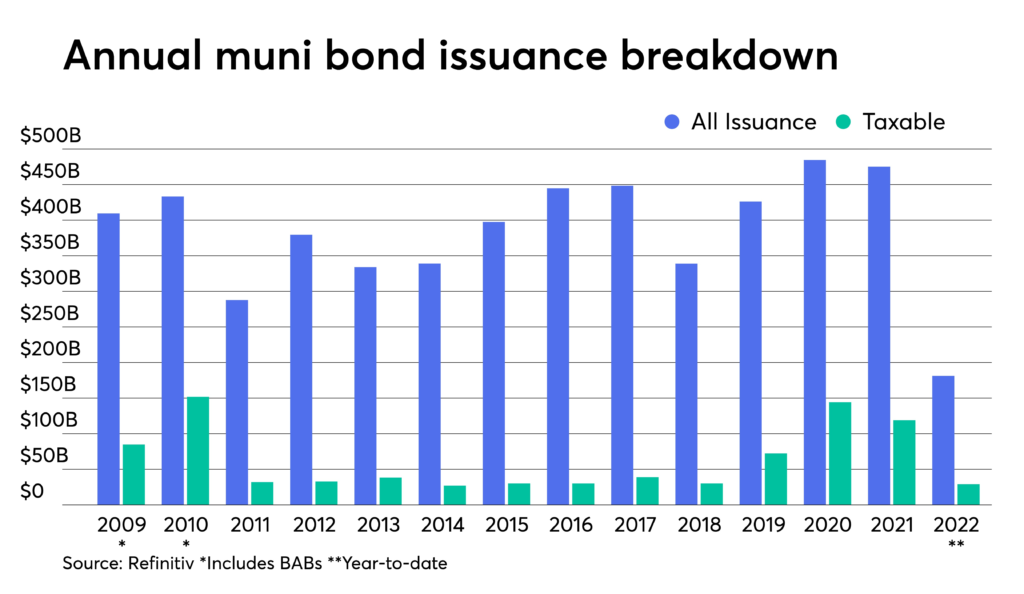

Market participants are revising their supply projections downward as rising interest rates have stymied refunding and taxable volumes and overall market volatility has held some issuers to the sidelines.

The pace of issuance so far in 2022 makes it less likely the market will hit previous records seen in 2020 and 2021.

BofA Securities was the latest shop to revise expectations downward because of the dearth of refundings, with strategists Yingchen Li and Ian Rogow forecasting total volume in 2022 to be $50 billion less than the $550 billion assumption they made at the end of 2021.

Author(s): Gabriel Rivera

Publication Date: 10 June 2022

Publication Site: Fidelity Fixed Income