Excerpt:

The big players are overleveraged because the Fed encouraged them. The whole thing is propped up by stimulus and bailouts of consumers and companies alike.

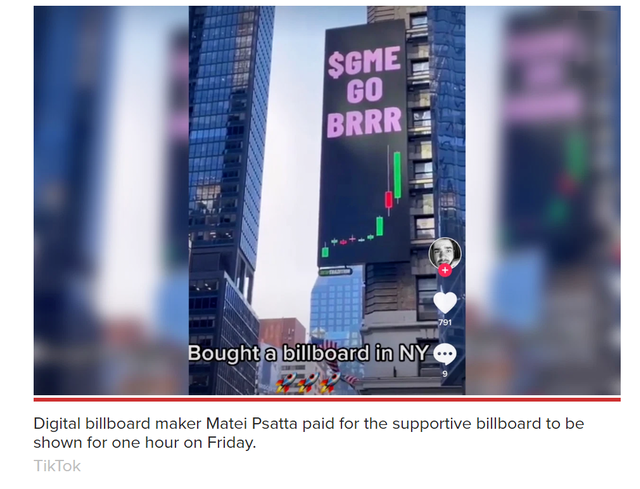

This coordinated short squeeze pushed two hedge funds and Robinhood to the brink. It revealed for all to see how broken the stock market has been..

You know it’s serious when the New York Times puts a stock chart at the top of the page in a Saturday morning edition.

Traders who follow prudent strategies are ridiculed and have zero returns. The Fed is the biggest manipulator out there.

Those traders on Reddit have succeeded in showing how completely broken the stock market is.

The Fed is a big proponent of this through its monetary policy for the wealth effect. It is responsible for reckless leverage, crazy trading strategies, and the huge incentive to manipulate.

Author(s): Mish

Publication Date: 1 February 2021

Publication Site: Mish Talk Global Economics Trend Analysis