Link: https://content.naic.org/sites/default/files/capital-markets-special-reports-hy-ye2021_0.pdf

Graphic:

Excerpt:

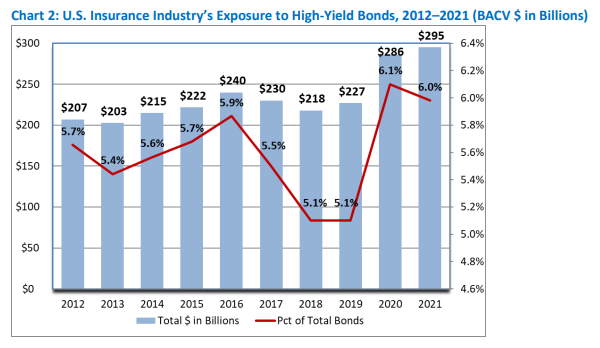

The U.S. insurance industry’s high-yield bond exposure of almost $300 billion at year-end 2021 is the

highest BACV reported over the last decade. (See Chart 2.) From 2012 to 2021 , high-yield bond

exposure increased approximately 42% while total bond exposure grew approximately 34% as insurance

companies sought higher relative yields offered by high-yield bonds, among other asset classes, amid

the low interest rate environment of the past decade. In addition, most recently, credit quality

deterioration from the impact of the COVID-19 pandemic resulted in some migration of the industry’s

investment grade bond exposure into high-yield territory, particularly in 2020.

On a percentage basis, high-yield exposure accounted for 6% of total bonds at year-end 2021, the

second highest point over the 10 years ending 2021. While exposure declined modestly from 6.1% at

year-end 2020, as a percentage of total bonds, it remains elevated relative to the last 10 years. The most

recent period when U.S. insurers’ high-yield-bond exposure exceeded 6% of total bonds was in 2009

during the financial crisis when it reached 6.3%

Author(s): Michele Wong

Publication Date: 13 Oct 2022

Publication Site: NAIC Capital Markets Special Report