Graphic:

Excerpt:

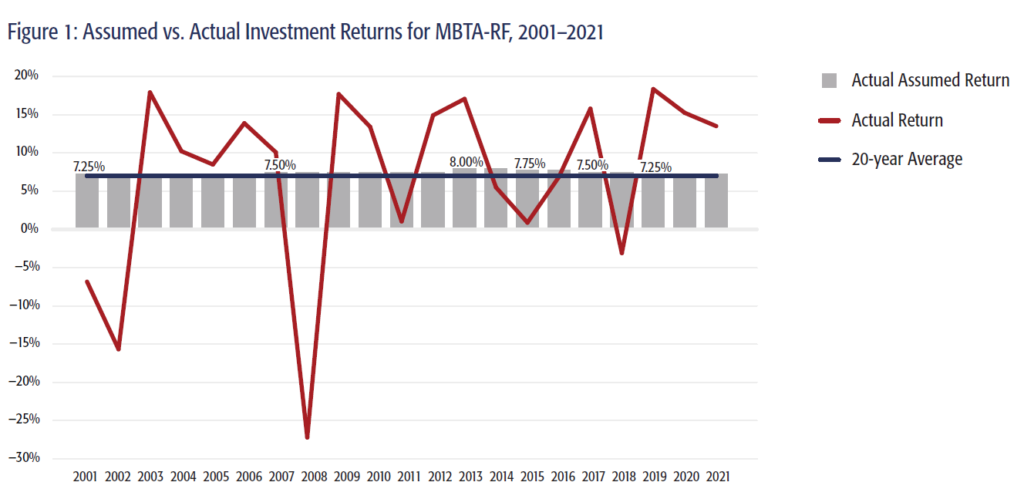

A new study published by Pioneer Institute finds that issuing pension obligation bonds (POBs) to refinance $360 million of the MBTA Retirement Fund’s (MBTARF’s) $1.3 billion unfunded pension liability would only compound the T’s already serious financial risks.

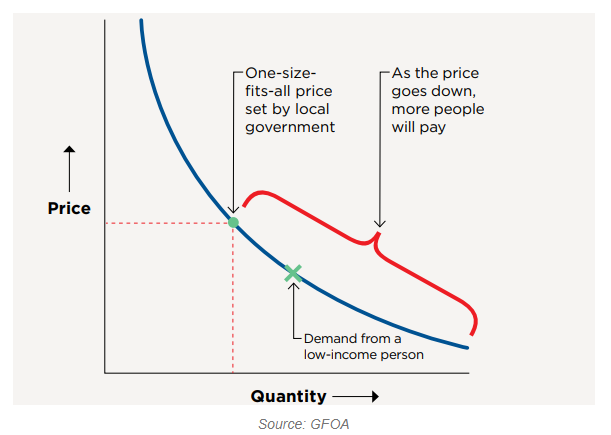

With POBs, government entities deposit revenues from bond sales into their pension funds and use the money to make investments they hope will deliver returns that outpace borrowing costs.

“Virtually every study of POBs finds that timing and duration of the bond issues are critical,” said E.J. McMahon, author of “Rolling the Retirement Dice.” “Bonds floated at the end of a bull market are the most likely to lose money, and that makes this idea a wrong turn at the worst possible time.”

If investments don’t meet a pension fund’s assumed rate of return, it could be left with debt service costs in addition to the pre-existing unfunded liability. In 2015, the Government Finance Officers Association bluntly warned that “State and local governments should not issue POBs.” It reaffirmed its guidance last year.

Author(s): E.J. McMahon

Publication Date: 21 Jun 2022

Publication Site: Pioneer Institute