Link: https://finance.yahoo.com/news/hong-kong-stocks-sink-evergrande-023055601.html

Graphic:

Excerpt:

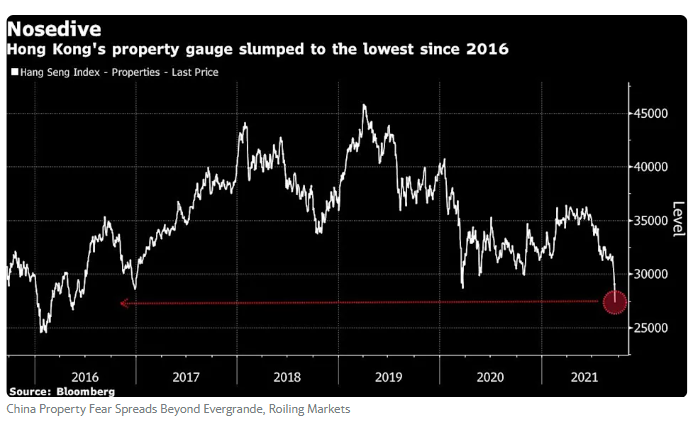

Growing investor angst about China’s real estate crackdown rippled through markets on Monday, adding pressure on Xi Jinping’s government to prevent financial contagion from destabilizing the world’s second-largest economy.

Hong Kong real estate giants including Henderson Land Development Co. suffered the biggest selloff in more than a year as traders speculated China will extend its property clampdown to the financial hub. Intensifying concerns about China Evergrande Group’s debt crisis dragged down everything from bank stocks to Ping An Insurance Group Co. and high-yield dollar bonds. One little-known Chinese property developer plunged 87% before shares were halted.

Hong Kong’s benchmark Hang Seng Index slumped 3.3%, its biggest loss since late July. The selling also spilled over into the Hong Kong dollar, offshore yuan and S&P 500 Index futures. Holiday closures in much of Asia may have exacerbated the volatility, traders said.

…..

“The repercussions from Evergrande’s prospective collapse will likely contribute to China’s ongoing economic deceleration, which in turn anchors global growth and inflation, and casts a pall over commodity prices,” wrote analysts led by Phoenix Kalen, head of emerging-market strategy in London.

Author(s): Catherine Ngai and Ishika Mookerjee

Publication Date: 20 September 2021

Publication Site: Yahoo Finance