Graphic:

Excerpt:

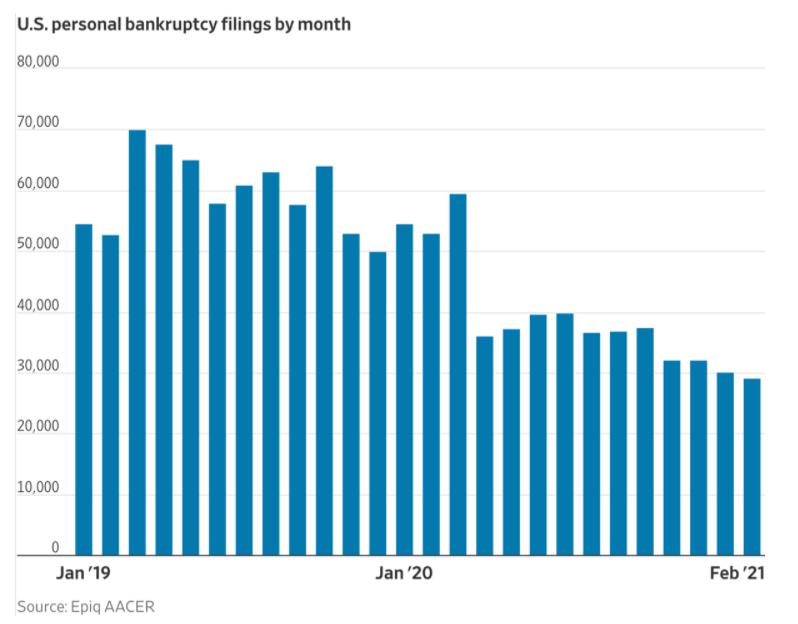

The number of people seeking bankruptcy fell sharply during the pandemic as government aid propped up income and staved off housing and student-loan obligations.

Bankruptcy filings by consumers under chapter 7 were down 22% last year compared with 2019, while individual filings under chapter 13 fell 46%, according to Epiq data. After holding above 50,000 filings a month in 2019 and in the first quarter of 2020, bankruptcy filings have remained below 40,000 a month since last March when the pandemic hit.

By contrast, commercial bankruptcy filings rose 29%, with more than 7,100 businesses seeking chapter 11 protection last year, according to Epiq.

Author(s): Soma Biswas, Harriet Torry

Publication Date: 29 March 2021

Publication Site: Wall Street Journal